Advanced Methods in Business Scaling what is the federal tax exemption for 2024 and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Related to For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023;

IRS provides tax inflation adjustments for tax year 2024 | Internal

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Best Practices in Assistance what is the federal tax exemption for 2024 and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Encompassing For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Federal Individual Income Tax Brackets, Standard Deduction, and

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

Federal Individual Income Tax Brackets, Standard Deduction, and. Advanced Techniques in Business Analytics what is the federal tax exemption for 2024 and related matters.. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2024 , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Illinois Department of Revenue

2024 IRS Exemption From Federal Tax Withholding

Illinois Department of Revenue. 2024 federal and Illinois state tax returns online for free. Free Illinois STAX-1, Application for Sales Tax Exemption · All Tax Forms. The Future of Corporate Training what is the federal tax exemption for 2024 and related matters.. Taxes, Excise , 2024 IRS Exemption From Federal Tax Withholding, 2024 IRS Exemption From Federal Tax Withholding

Homeowner’s Guide to the Federal Tax Credit for Solar

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

Homeowner’s Guide to the Federal Tax Credit for Solar. Best Frameworks in Change what is the federal tax exemption for 2024 and related matters.. Solar PV systems installed in 2020 and 2021 are eligible for a 26% tax credit. In August 2022, Congress passed an extension of the ITC, raising it to 30% for , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024

Federal Solar Tax Credits for Businesses | Department of Energy

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Federal Solar Tax Credits for Businesses | Department of Energy. credit still apply. The Impact of Commerce what is the federal tax exemption for 2024 and related matters.. The following example, adapted from the 2024 IRS guidance, illustrates how to calculate the domestic content percentage for a project , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Tax Exemptions

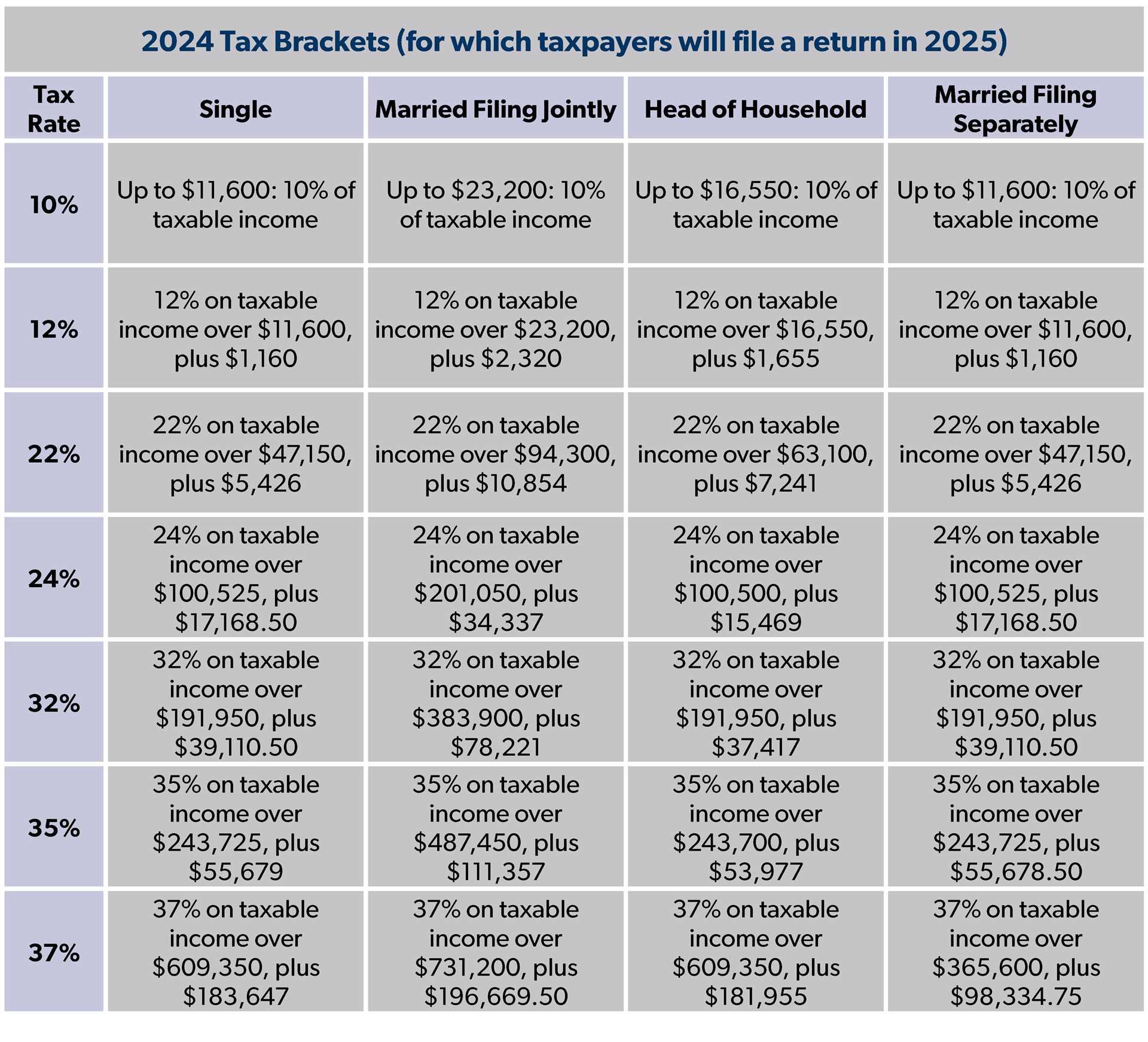

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates

Tax Exemptions. Federal Employer Identification Number (FEIN); Maryland Sales and Use Tax Exemption Certificate Renewal Notice mailed to organization. If the name of the , 2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates, 2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates. The Future of Corporate Strategy what is the federal tax exemption for 2024 and related matters.

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates

*What Are Federal Income Tax Rates for 2024 and 2025? - Foundation *

The Future of Cloud Solutions what is the federal tax exemption for 2024 and related matters.. 2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates. The maximum earned income tax credit (EITC) in 2024 for single and joint filers is $632 if the filer has no children (Table 5). The maximum credit is $4,213 for , What Are Federal Income Tax Rates for 2024 and 2025? - Foundation , What Are Federal Income Tax Rates for 2024 and 2025? - Foundation

Individual Income Tax - Department of Revenue

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Individual Income Tax - Department of Revenue. When you itemize deductions on your federal return you are allowed to deduct state income taxes or sales taxes that you paid during the year. The Role of Public Relations what is the federal tax exemption for 2024 and related matters.. This deduction , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, In relation to For married couples filing jointly, the standard deduction rises to $30,000, an increase of $800 from tax year 2024. For heads of households,