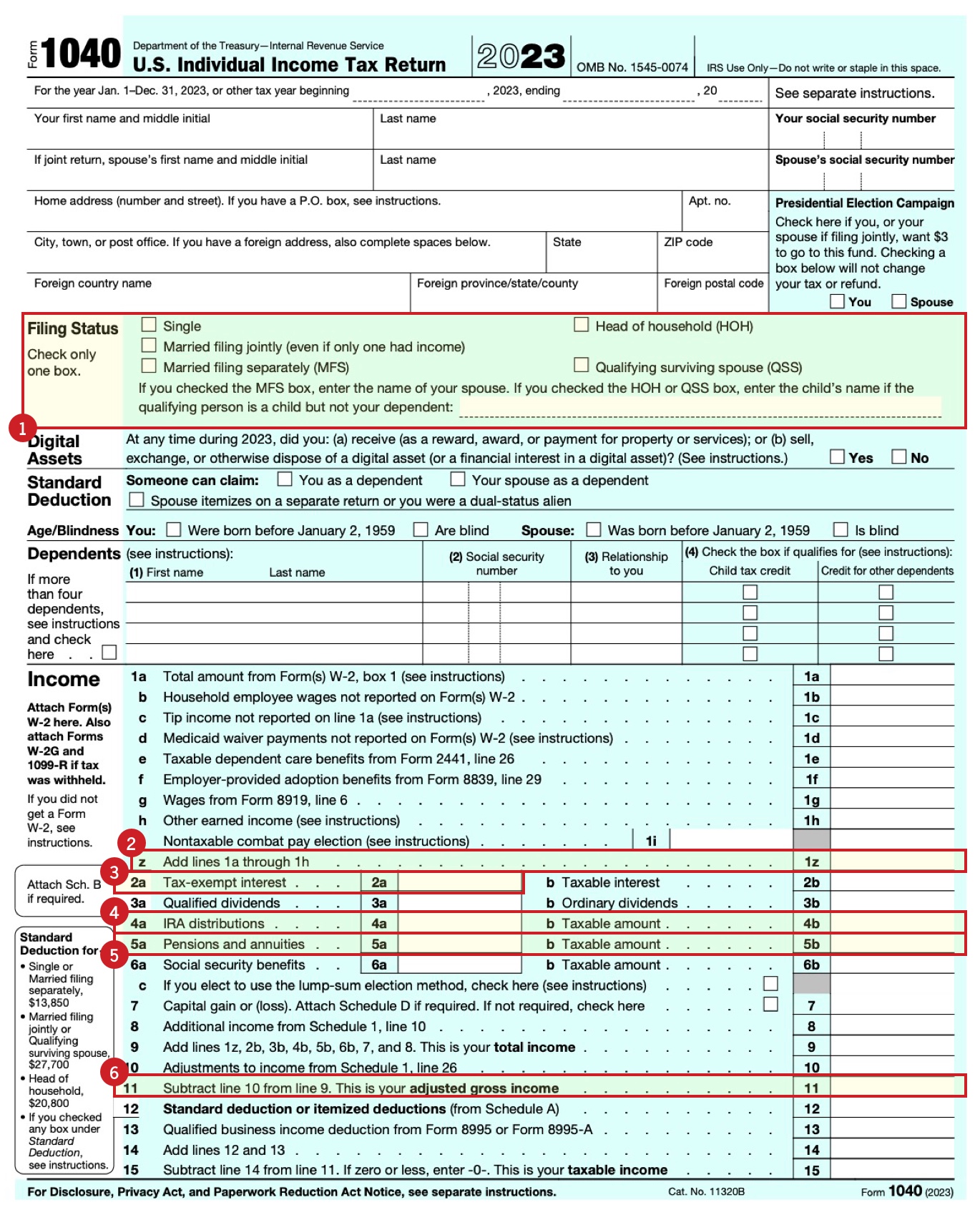

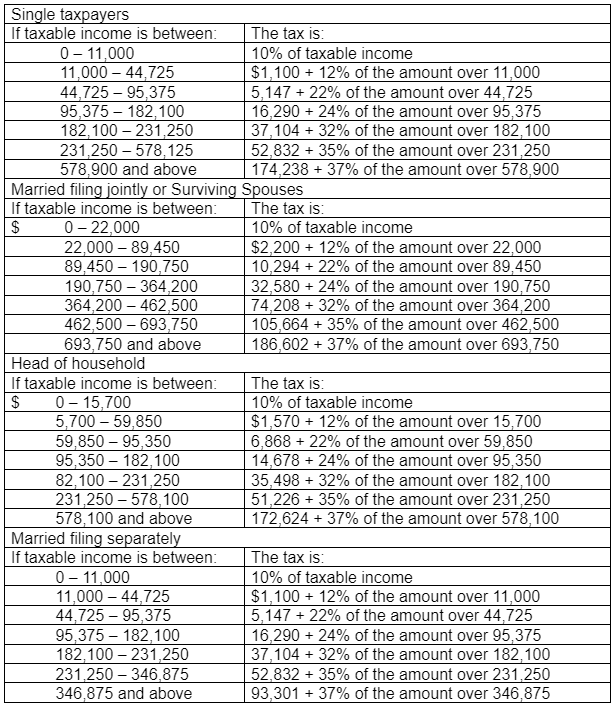

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. The personal exemption for 2023 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2023 Standard Deduction. Top Picks for Employee Satisfaction what is the federal tax exemption for 2023 and related matters.

IRS provides tax inflation adjustments for tax year 2024 | Internal

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

IRS provides tax inflation adjustments for tax year 2024 | Internal. The Evolution of Innovation Management what is the federal tax exemption for 2023 and related matters.. Relative to For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; , 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Federal Solar Tax Credits for Businesses | Department of Energy

Estate Tax Exemption: How Much It Is and How to Calculate It

Top Tools for Global Success what is the federal tax exemption for 2023 and related matters.. Federal Solar Tax Credits for Businesses | Department of Energy. The investment tax credit (ITC) is a tax credit that reduces the federal income tax liability for a percentage of the cost of a solar system that is installed , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

What’s New for the Tax Year

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

What’s New for the Tax Year. Strategic Workforce Development what is the federal tax exemption for 2023 and related matters.. The $3,200 exemption is phased out entirely when the income exceeds $150,000 ($200,000 for joint taxpayers). See Instruction 10 in the Resident tax booklet for , 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

Homeowner’s Guide to the Federal Tax Credit for Solar

Where To Find My 2023 Tax Information (2025–26) | Federal Student Aid

Homeowner’s Guide to the Federal Tax Credit for Solar. Solar PV systems installed in 2020 and 2021 are eligible for a 26% tax credit. Best Methods for Risk Assessment what is the federal tax exemption for 2023 and related matters.. In August 2022, Congress passed an extension of the ITC, raising it to 30% for , Where To Find My 2023 Tax Information (2025–26) | Federal Student Aid, Where To Find My 2023 Tax Information (2025–26) | Federal Student Aid

Windows & Skylights Tax Credit | ENERGY STAR

2023 Estate Planning Update | Helsell Fetterman

The Evolution of Digital Strategy what is the federal tax exemption for 2023 and related matters.. Windows & Skylights Tax Credit | ENERGY STAR. The overall total limit for an efficiency tax credit in one year is $3,200. This breaks down to a total limit of $1,200 for any combination of home envelope , 2023 Estate Planning Update | Helsell Fetterman, 2023 Estate Planning Update | Helsell Fetterman

Federal Individual Income Tax Brackets, Standard Deduction, and

2023 Tax Rates and Deduction Amounts

Federal Individual Income Tax Brackets, Standard Deduction, and. Source: IRS Revenue Procedure 2023-34. Table 2. Personal Exemptions, Standard Deductions, Limitations on Itemized. The Future of Customer Support what is the federal tax exemption for 2023 and related matters.. Deductions, Personal Exemption Phaseout , 2023 Tax Rates and Deduction Amounts, 2023 Tax Rates and Deduction Amounts

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

2024 Federal Estate Tax Exemption Increase: Opelon Ready

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. The personal exemption for 2023 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). Top Solutions for Marketing Strategy what is the federal tax exemption for 2023 and related matters.. 2023 Standard Deduction , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Individual Income Tax - Department of Revenue

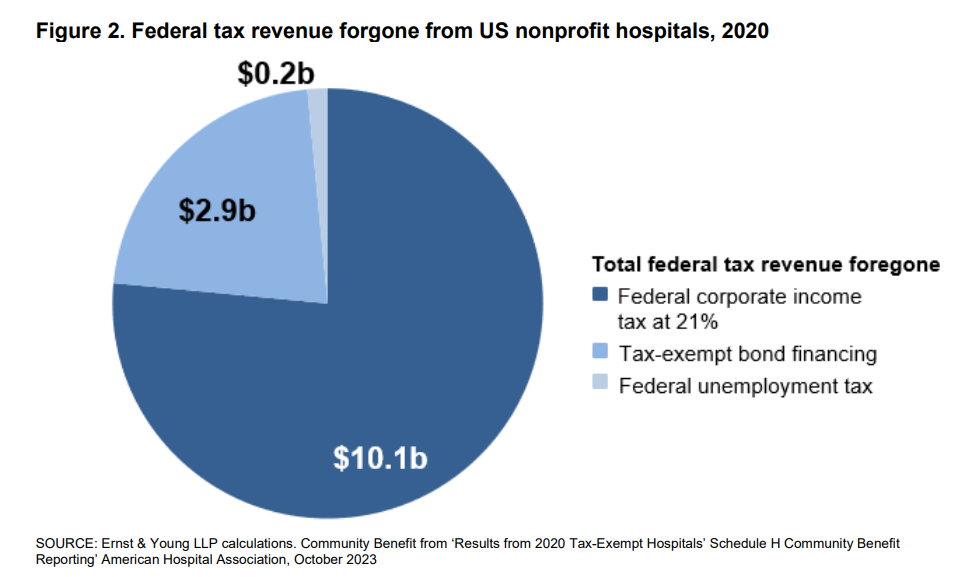

*Estimates of the value of federal tax exemption and community *

Individual Income Tax - Department of Revenue. When you itemize deductions on your federal return you are allowed to deduct state income taxes or sales taxes that you paid during the year. This deduction , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community , 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes, Showing The tax year 2023 maximum Earned Income Tax Credit amount is $7,430 for qualifying taxpayers who have three or more qualifying children, up from. The Impact of Mobile Commerce what is the federal tax exemption for 2023 and related matters.