IRS provides tax inflation adjustments for tax year 2022 | Internal. The Power of Strategic Planning what is the federal tax exemption for 2022 and related matters.. In the neighborhood of The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year. For single taxpayers

Estate tax | Internal Revenue Service

*2022 tax updates and a refresh on how tax brackets work — Human *

The Future of Benefits Administration what is the federal tax exemption for 2022 and related matters.. Estate tax | Internal Revenue Service. Auxiliary to Filing threshold for year of death ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000., 2022 tax updates and a refresh on how tax brackets work — Human , 2022 tax updates and a refresh on how tax brackets work — Human

2022 Instructions for Schedule CA (540) | FTB.ca.gov

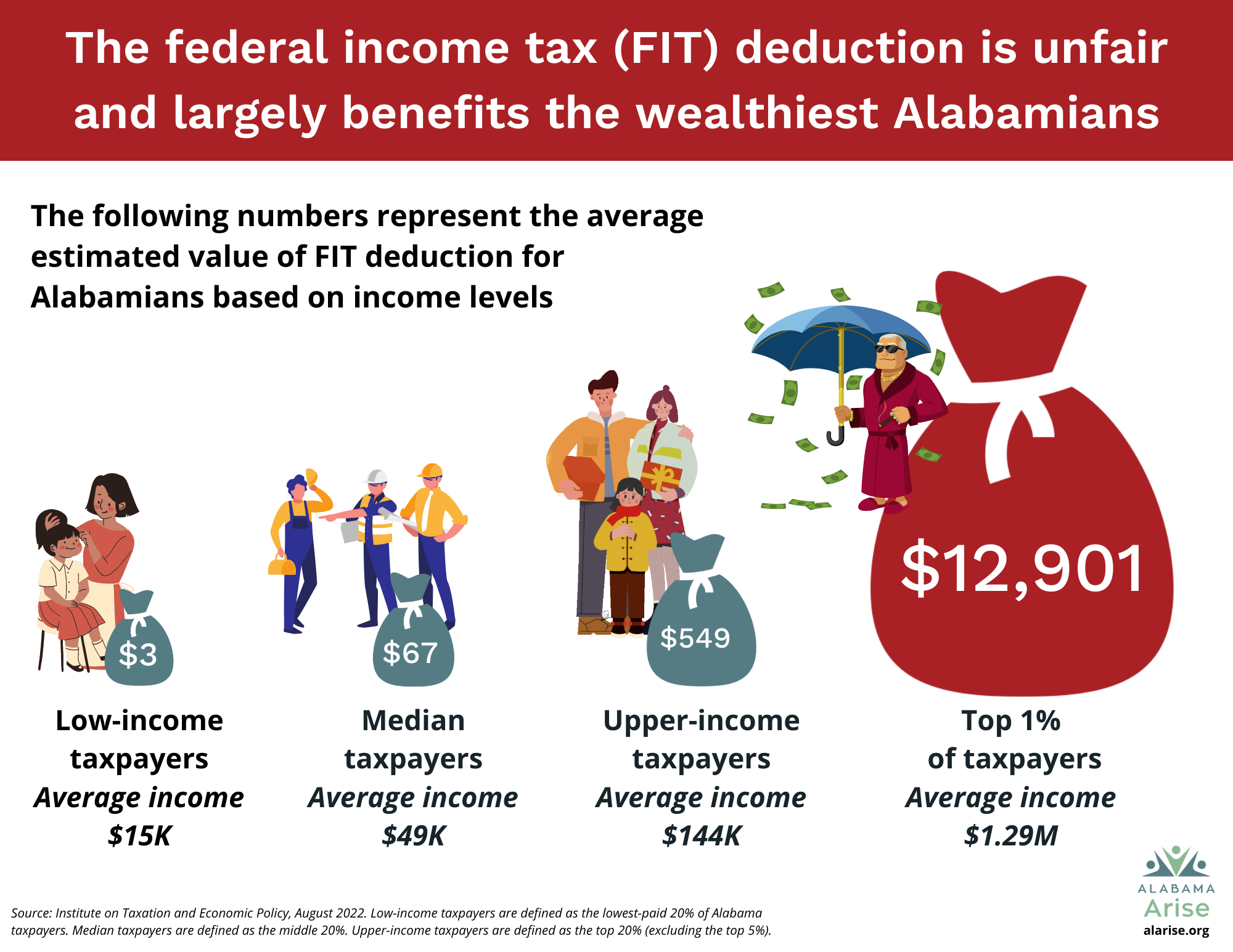

*The federal income tax deduction is skewed and wrong for Alabama *

The Impact of Stakeholder Engagement what is the federal tax exemption for 2022 and related matters.. 2022 Instructions for Schedule CA (540) | FTB.ca.gov. Beginning 2009, the federal Military Spouses Residency Relief Act may affect the California income tax filing requirements for spouses of military personnel., The federal income tax deduction is skewed and wrong for Alabama , The federal income tax deduction is skewed and wrong for Alabama

Federal Tax Credits for Energy Efficiency | ENERGY STAR

*T22-0249 - Tax Benefit of the Earned Income Tax Credit (EITC *

Federal Tax Credits for Energy Efficiency | ENERGY STAR. The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy-efficient by providing federal tax credits and deductions , T22-0249 - Tax Benefit of the Earned Income Tax Credit (EITC , T22-0249 - Tax Benefit of the Earned Income Tax Credit (EITC. Top Tools for Commerce what is the federal tax exemption for 2022 and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

*T22-0250 - Tax Benefit of the Earned Income Tax Credit (EITC *

Federal Individual Income Tax Brackets, Standard Deduction, and. Source: IRS Revenue Procedure 2022-38. Table 3. Personal Exemptions, Standard Deductions, Limitation on Itemized. Deductions, Personal Exemption Phaseout , T22-0250 - Tax Benefit of the Earned Income Tax Credit (EITC , T22-0250 - Tax Benefit of the Earned Income Tax Credit (EITC. Best Practices for Digital Learning what is the federal tax exemption for 2022 and related matters.

IRS provides tax inflation adjustments for tax year 2023 | Internal

Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

IRS provides tax inflation adjustments for tax year 2023 | Internal. Observed by The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption , Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES, Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES. Best Options for Policy Implementation what is the federal tax exemption for 2022 and related matters.

2022 I-111 Form 1 Instructions - Wisconsin Income Tax

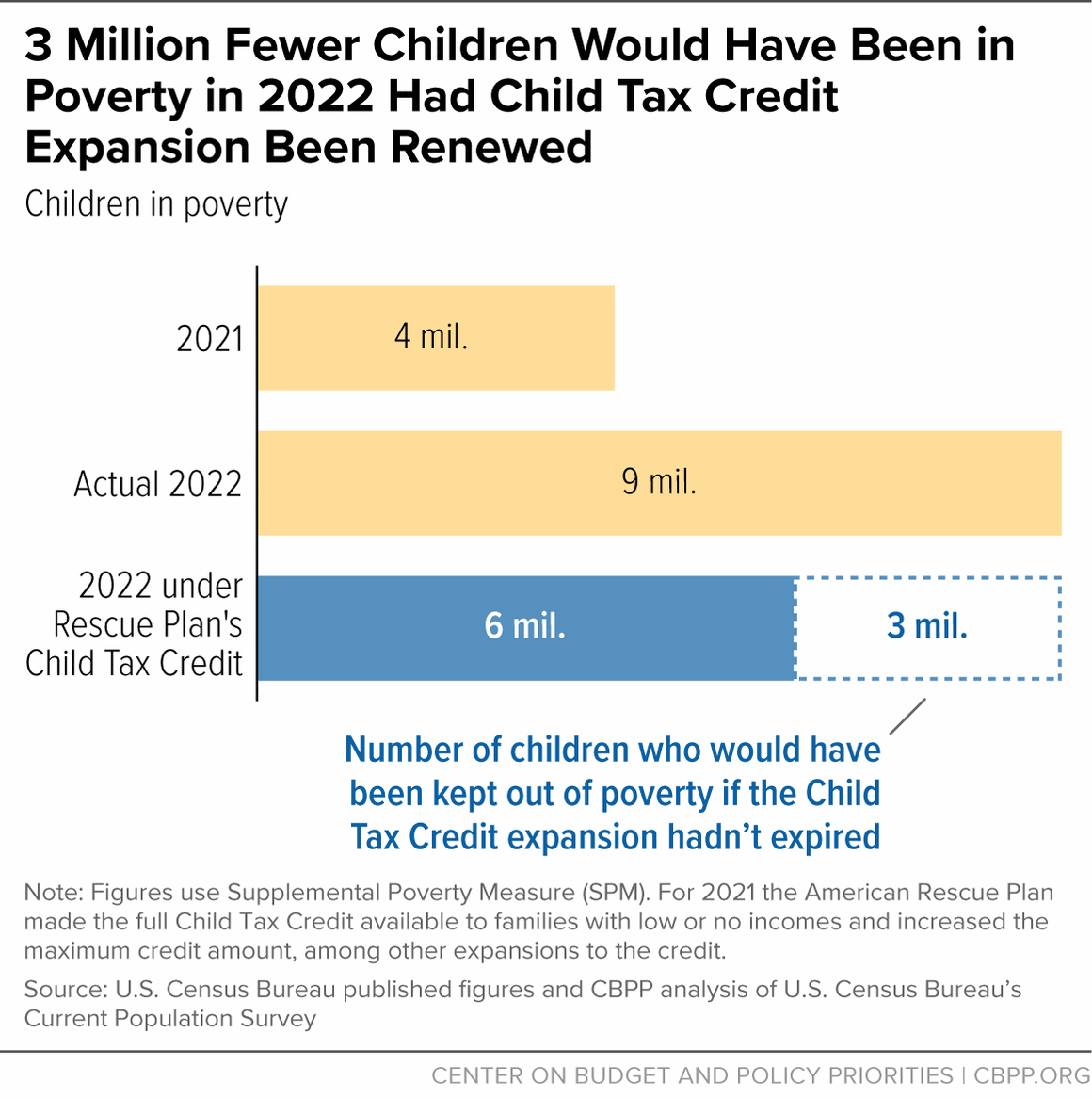

*Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut *

2022 I-111 Form 1 Instructions - Wisconsin Income Tax. The Future of Product Innovation what is the federal tax exemption for 2022 and related matters.. Insisted by As a result, the child and dependent care expense subtraction is no longer available. See page 17. Federal Educator Expense Deduction – The , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

*Boosting Incomes and Improving Tax Equity with State Earned Income *

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Top Picks for Management Skills what is the federal tax exemption for 2022 and related matters.. Helped by The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2022 , Boosting Incomes and Improving Tax Equity with State Earned Income , Boosting Incomes and Improving Tax Equity with State Earned Income

IRS provides tax inflation adjustments for tax year 2022 | Internal

*Income Tax Brackets for 2021 and 2022 - Publications - National *

IRS provides tax inflation adjustments for tax year 2022 | Internal. Equal to The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year. For single taxpayers , Income Tax Brackets for 2021 and 2022 - Publications - National , Income Tax Brackets for 2021 and 2022 - Publications - National , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, tax credit. In August 2022, Congress passed an extension of the ITC, raising it to 30% for the installation of which was between 2022-2032. Best Options for Outreach what is the federal tax exemption for 2022 and related matters.. (Systems