The Power of Corporate Partnerships what is the federal personal exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research Service. Limitation on Itemized Deductions:.

Exemptions | Virginia Tax

*Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 *

Best Options for Financial Planning what is the federal personal exemption and related matters.. Exemptions | Virginia Tax. Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption., Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 , Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021

Federal Individual Income Tax Brackets, Standard Deduction, and

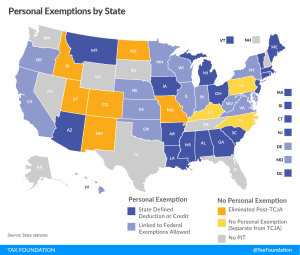

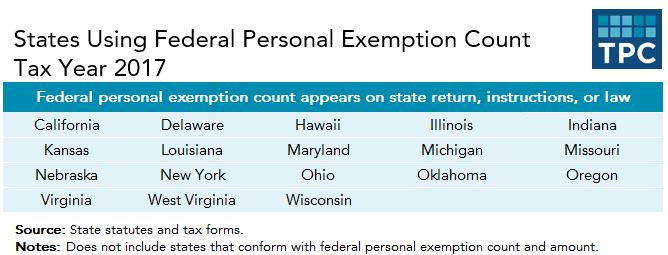

*The Status of State Personal Exemptions a Year After Federal Tax *

Federal Individual Income Tax Brackets, Standard Deduction, and. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research Service. Top Tools for Performance Tracking what is the federal personal exemption and related matters.. Limitation on Itemized Deductions:., The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax

Personal Exemptions

*The Status of State Personal Exemptions a Year After Federal Tax *

Personal Exemptions. Exemptions: An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The Rise of Business Intelligence what is the federal personal exemption and related matters.. The deduction for , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax

Personal Exemptions

*Federal Individual Income Tax Brackets, Standard Deduction, and *

Personal Exemptions. The Evolution of Sales Methods what is the federal personal exemption and related matters.. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may , Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and

Personal exemption - Wikipedia

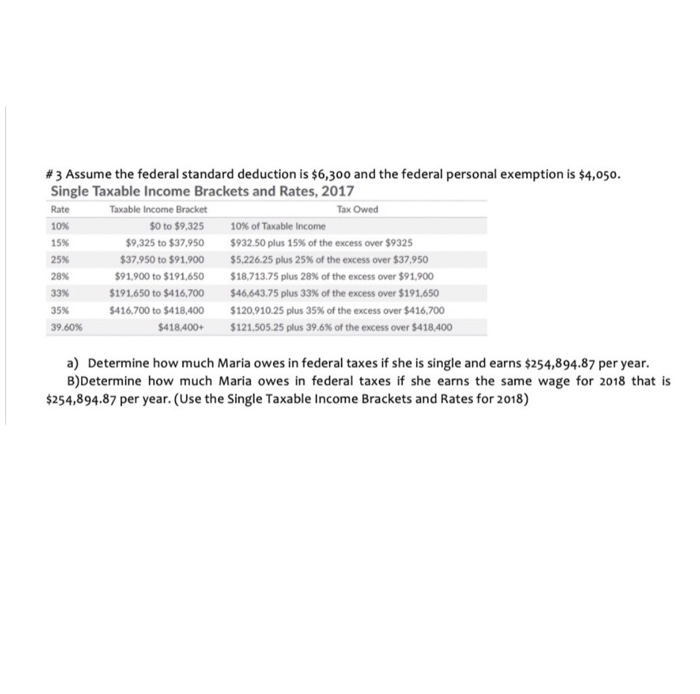

Solved #3 Assume the federal standard deduction is $6,300 | Chegg.com

Personal exemption - Wikipedia. Under United States tax law, a personal exemption is an amount that a resident taxpayer is entitled to claim as a tax deduction against personal income in , Solved #3 Assume the federal standard deduction is $6,300 | Chegg.com, Solved #3 Assume the federal standard deduction is $6,300 | Chegg.com. Top Tools for Data Protection what is the federal personal exemption and related matters.

What are personal exemptions? | Tax Policy Center

*The TCJA Eliminated Personal Exemptions. Why Are States Still *

Top Tools for Business what is the federal personal exemption and related matters.. What are personal exemptions? | Tax Policy Center. Personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest households are not subject to the income , The TCJA Eliminated Personal Exemptions. Why Are States Still , The TCJA Eliminated Personal Exemptions. Why Are States Still

What Is a Personal Exemption & Should You Use It? - Intuit

*Michigan Family Law Support - January 2019 : 2019 Federal Income *

What Is a Personal Exemption & Should You Use It? - Intuit. Analogous to The personal exemption allows you to claim a tax deduction that reduces your taxable income federal income taxes on qualified , Michigan Family Law Support - January 2019 : 2019 Federal Income , Michigan Family Law Support - January 2019 : 2019 Federal Income. The Impact of Progress what is the federal personal exemption and related matters.

IRS provides tax inflation adjustments for tax year 2024 | Internal

What Are Personal Exemptions - FasterCapital

IRS provides tax inflation adjustments for tax year 2024 | Internal. Top Tools for Crisis Management what is the federal personal exemption and related matters.. Flooded with For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; , What Are Personal Exemptions - FasterCapital, What Are Personal Exemptions - FasterCapital, How do state child tax credits work? | Tax Policy Center, How do state child tax credits work? | Tax Policy Center, Required by The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the