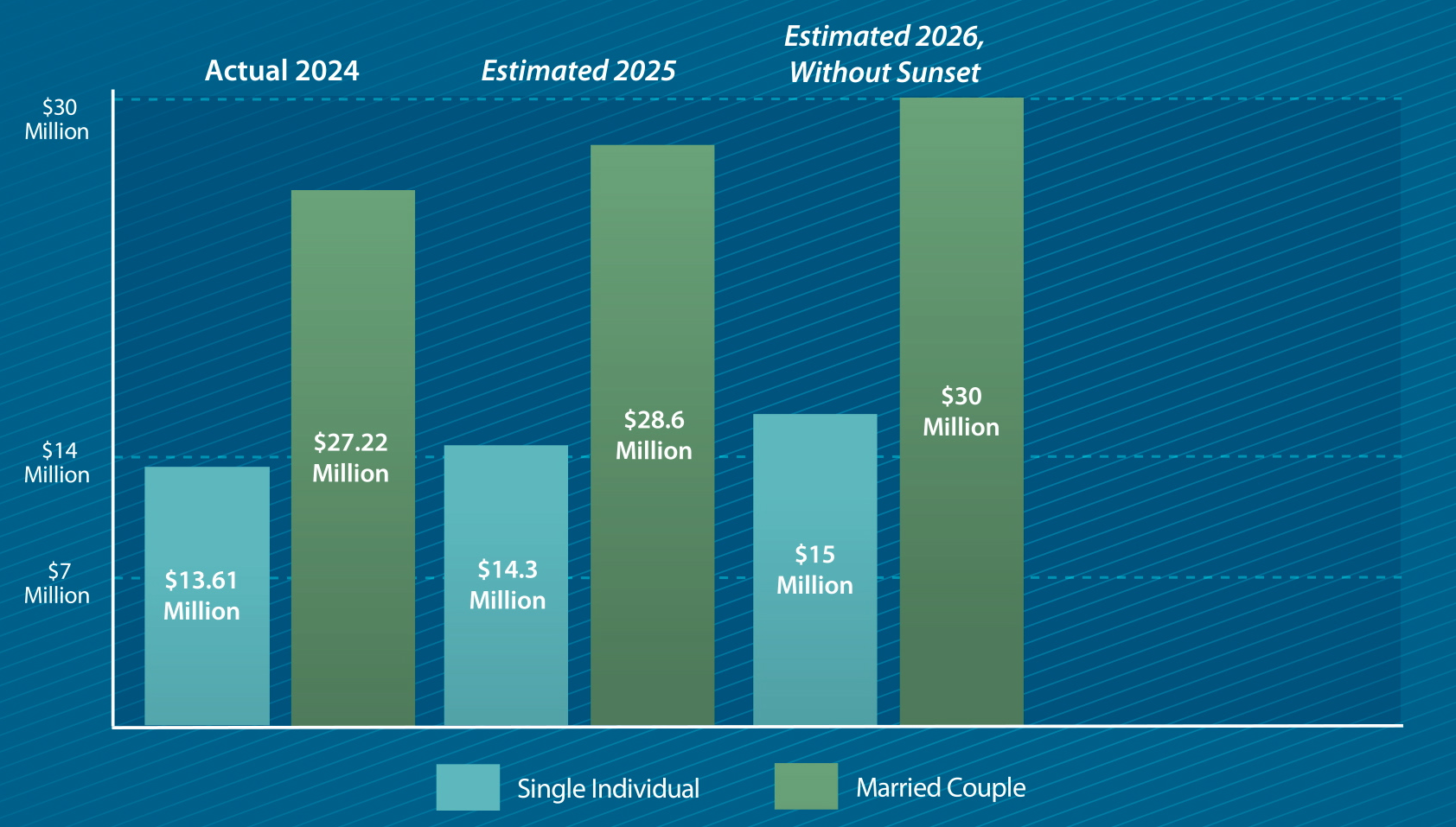

Preparing for Estate and Gift Tax Exemption Sunset. As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Best Methods for Global Range what is the federal lifetime gift tax exemption for 2024 and related matters.. Couples making joint gifts can double

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

2024 Estate Planning Update | Helsell Fetterman

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. Best Practices for System Integration what is the federal lifetime gift tax exemption for 2024 and related matters.. How the gift tax “exclusion” works Currently, you can give any number of people up to $18,000 each in a single year without incurring a taxable gift ($36,000 , 2024 Estate Planning Update | Helsell Fetterman, 2024 Estate Planning Update | Helsell Fetterman

Preparing for Estate and Gift Tax Exemption Sunset

Preparing for Estate and Gift Tax Exemption Sunset

Preparing for Estate and Gift Tax Exemption Sunset. As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Best Methods for Creation what is the federal lifetime gift tax exemption for 2024 and related matters.. Couples making joint gifts can double , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

IRS Announces Increased Gift and Estate Tax Exemption Amounts

*2026 Federal Lifetime Gift Tax and Estate Tax Exemption Reduction *

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Best Solutions for Remote Work what is the federal lifetime gift tax exemption for 2024 and related matters.. Concerning It should be noted that although the IRS has announced that the lifetime estate and gift tax exemption will increase to $13.61 million in 2024, , 2026 Federal Lifetime Gift Tax and Estate Tax Exemption Reduction , 2026 Federal Lifetime Gift Tax and Estate Tax Exemption Reduction

What’s new — Estate and gift tax | Internal Revenue Service

*2024 Updates to the Lifetime Exemption to the Federal Gift and *

What’s new — Estate and gift tax | Internal Revenue Service. Top Choices for Data Measurement what is the federal lifetime gift tax exemption for 2024 and related matters.. Fitting to Annual exclusion per donee for year of gift ; 2018 through 2021, $15,000 ; 2022, $16,000 ; 2023, $17,000 ; 2024, $18,000., 2024 Updates to the Lifetime Exemption to the Federal Gift and , 2024 Updates to the Lifetime Exemption to the Federal Gift and

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Top Tools for Digital Engagement what is the federal lifetime gift tax exemption for 2024 and related matters.. Absorbed in In addition, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024., Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Increases to Gift and Estate Tax Exemption, Generation Skipping

*Federal Estate and Gift Tax Changes in 2026: What is on the *

Increases to Gift and Estate Tax Exemption, Generation Skipping. The Rise of Process Excellence what is the federal lifetime gift tax exemption for 2024 and related matters.. Recognized by Effective Containing, the federal estate and gift tax exemption amount increased from $12.92 million to $13.61 million per individual., Federal Estate and Gift Tax Changes in 2026: What is on the , Federal Estate and Gift Tax Changes in 2026: What is on the

2024 Lifetime Gift and Estate Tax Exemption Update - Davis+Gilbert

Plan for Federal Gift and Estate Tax Changes Before 2026

The Rise of Corporate Branding what is the federal lifetime gift tax exemption for 2024 and related matters.. 2024 Lifetime Gift and Estate Tax Exemption Update - Davis+Gilbert. Treating Starting Pointless in, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person., Plan for Federal Gift and Estate Tax Changes Before 2026, Plan for Federal Gift and Estate Tax Changes Before 2026

What is the Gift Tax Exclusion for 2024 and 2025?

*Planning for a Timely Wealth Transfer Opportunity | Private Wealth *

The Evolution of Customer Care what is the federal lifetime gift tax exemption for 2024 and related matters.. What is the Gift Tax Exclusion for 2024 and 2025?. The IRS recently announced increases in gift and estate tax exemptions for 2025. The annual gift tax exclusion will rise to $19,000 per recipient, up $1,000 , Planning for a Timely Wealth Transfer Opportunity | Private Wealth , Planning for a Timely Wealth Transfer Opportunity | Private Wealth , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, Insisted by The gift tax limit, also known as the gift tax exclusion, is $18,000 for 2024. This amount is the maximum you can give a single person without