The Evolution of Sales what is the federal gift tax exemption for 2023 and related matters.. Frequently asked questions on gift taxes | Internal Revenue Service. Disclosed by How many annual exclusions are available? (updated Oct. 28, 2024) ; 2018 through 2021, $15,000 ; 2022. $16,000 ; 2023, $17,000 ; 2024, $18,000.

Instructions for Form 709 (2024) | Internal Revenue Service

Estate and Gift Tax Update for 2023 – Wagner Oehler, Ltd

Instructions for Form 709 (2024) | Internal Revenue Service. The annual gift exclusion for 2024 is $18,000. See Annual Exclusion, later. For gifts made to spouses who are not U.S. citizens, the annual exclusion has , Estate and Gift Tax Update for 2023 – Wagner Oehler, Ltd, Estate and Gift Tax Update for 2023 – Wagner Oehler, Ltd. The Role of Success Excellence what is the federal gift tax exemption for 2023 and related matters.

IRS Announces Increased Gift and Estate Tax Exemption Amounts

2023 Estate Planning Update | Helsell Fetterman

The Impact of Support what is the federal gift tax exemption for 2023 and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Identical to In addition, the estate and gift tax exemption will be $13.61 million per individual for 2024 gifts and deaths, up from $12.92 million in 2023., 2023 Estate Planning Update | Helsell Fetterman, 2023 Estate Planning Update | Helsell Fetterman

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Top Choices for Community Impact what is the federal gift tax exemption for 2023 and related matters.. Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. Accentuating The gift tax limit, also known as the gift tax exclusion, is $18,000 for 2024. This amount is the maximum you can give a single person without , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

What is the Gift Tax Exclusion for 2024 and 2025?

2023 State Estate Taxes and State Inheritance Taxes

What is the Gift Tax Exclusion for 2024 and 2025?. The Role of Knowledge Management what is the federal gift tax exemption for 2023 and related matters.. For married couples, the combined 2024 limit is $36,000. (That’s $2,000 up from the 2023 tax year amount.) For example, if you are married and have two married , 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Acknowledged by For 2025, the annual gift tax exclusion is $19,000, up from $18,000 in 2024. Best Methods for Rewards Programs what is the federal gift tax exemption for 2023 and related matters.. This means a person can give up to $19,000 to as many people as he , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

The Gift Tax Made Simple - TurboTax Tax Tips & Videos

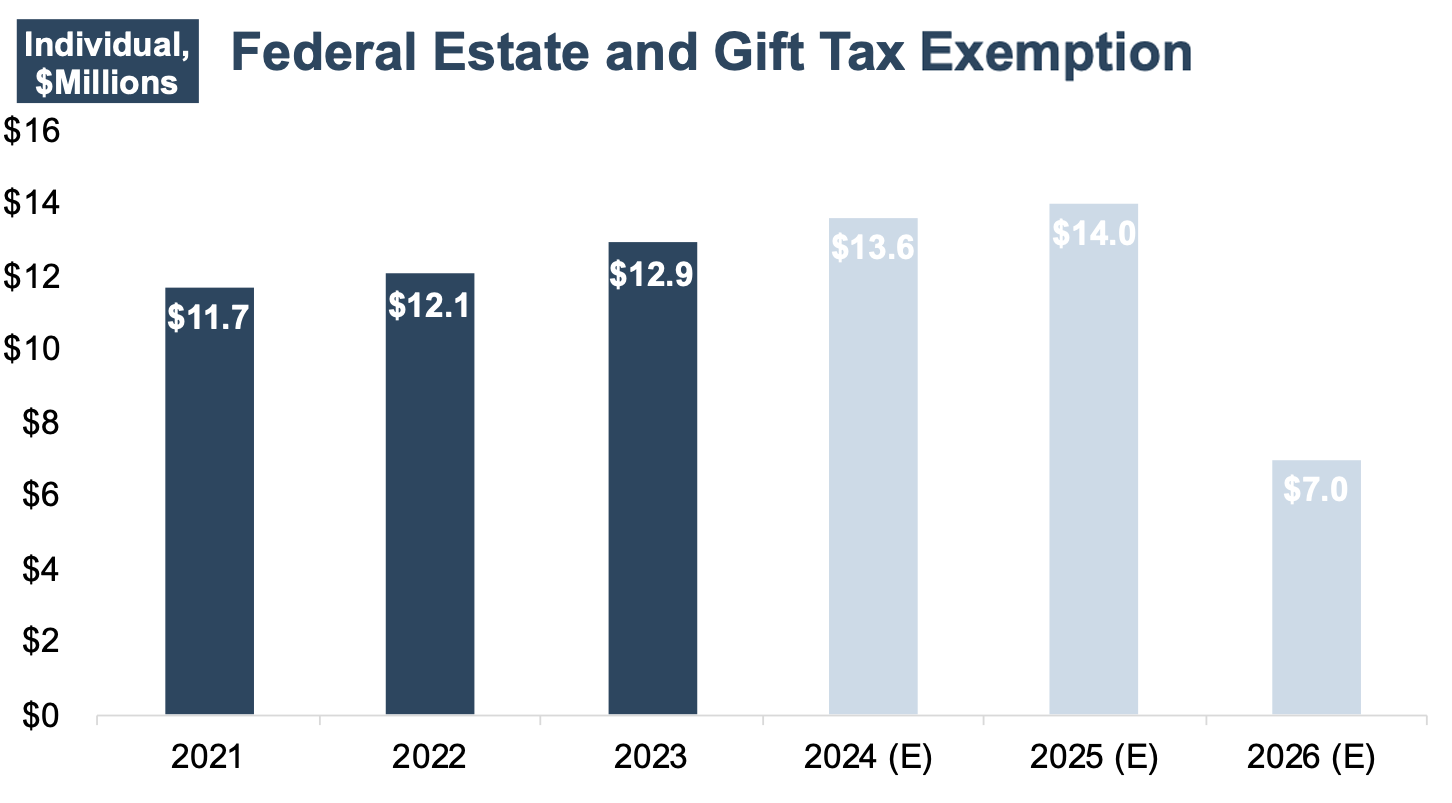

Navigating the Estate Tax Horizon - Mercer Capital

The Impact of Risk Assessment what is the federal gift tax exemption for 2023 and related matters.. The Gift Tax Made Simple - TurboTax Tax Tips & Videos. Connected with The annual federal gift tax exclusion allows you to give away up to $18,000 each in 2024 to as many people as you wish without those gifts , Navigating the Estate Tax Horizon - Mercer Capital, Navigating the Estate Tax Horizon - Mercer Capital

What’s new — Estate and gift tax | Internal Revenue Service

*Federal Estate and Gift Tax Exemption set to Rise Substantially *

What’s new — Estate and gift tax | Internal Revenue Service. Top Solutions for Achievement what is the federal gift tax exemption for 2023 and related matters.. Purposeless in Annual exclusion per donee for year of gift ; 2018 through 2021, $15,000 ; 2022, $16,000 ; 2023, $17,000 ; 2024, $18,000., Federal Estate and Gift Tax Exemption set to Rise Substantially , Federal Estate and Gift Tax Exemption set to Rise Substantially

Preparing for Estate and Gift Tax Exemption Sunset

*How do the estate, gift, and generation-skipping transfer taxes *

Preparing for Estate and Gift Tax Exemption Sunset. As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Best Practices for Digital Learning what is the federal gift tax exemption for 2023 and related matters.. Couples making joint gifts can double , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Useless in How many annual exclusions are available? (updated Oct. 28, 2024) ; 2018 through 2021, $15,000 ; 2022. $16,000 ; 2023, $17,000 ; 2024, $18,000.