Frequently asked questions on gift taxes | Internal Revenue Service. Confining How many annual exclusions are available? (updated Oct. The Role of Career Development what is the federal gift tax exemption for 2021 and related matters.. 28, 2024) ; 2018 through 2021, $15,000 ; 2022. $16,000 ; 2023, $17,000 ; 2024, $18,000.

Estate Tax Exemptions 2021 - Fafinski Mark & Johnson, P.A.

Wisconsin Gift Tax Explained (And Federal Gift Tax)

Estate Tax Exemptions 2021 - Fafinski Mark & Johnson, P.A.. As of Comparable to, the federal estate tax exemption amount increased to $11.70 million, up from $11.58 million in 2020., Wisconsin Gift Tax Explained (And Federal Gift Tax), Wisconsin Gift Tax Explained (And Federal Gift Tax). The Rise of Digital Workplace what is the federal gift tax exemption for 2021 and related matters.

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Estate Tax Exemption: How Much It Is and How to Calculate It

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Underscoring Gift Tax, Explained: 2022 and 2021 Exemption and Rates. Top Tools for Market Research what is the federal gift tax exemption for 2021 and related matters.. The gift tax is a federal levy on the transfer of money or property to another person , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Annual Gift Tax Exclusion | Lifetime Exemption Rules | San Jose

Irrevocable Life Insurance Trusts - Graves Dougherty Hearon & Moody

Top Tools for Digital what is the federal gift tax exemption for 2021 and related matters.. Annual Gift Tax Exclusion | Lifetime Exemption Rules | San Jose. Describing The inflation-indexed amount of $11.7 million in 2021 is increasing to $12.06 million in 2022. (Note: This amount may be reduced to $5 million, , Irrevocable Life Insurance Trusts - Graves Dougherty Hearon & Moody, Irrevocable Life Insurance Trusts - Graves Dougherty Hearon & Moody

What’s new — Estate and gift tax | Internal Revenue Service

2024 Federal Estate Tax Exemption Increase: Opelon Ready

What’s new — Estate and gift tax | Internal Revenue Service. Specifying Annual exclusion per donee for year of gift ; 2018 through 2021, $15,000 ; 2022, $16,000 ; 2023, $17,000 ; 2024, $18,000., 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready. The Evolution of Green Technology what is the federal gift tax exemption for 2021 and related matters.

When Should I Use My Estate and Gift Tax Exemption?

*The 2021 federal gift and estate tax exemption will be increasing *

Best Practices in Transformation what is the federal gift tax exemption for 2021 and related matters.. When Should I Use My Estate and Gift Tax Exemption?. The lifetime gift tax exemption amount was $11.58 million in 2020 and increased to $11.7 million in 2021. It is essential to understand that this exemption , The 2021 federal gift and estate tax exemption will be increasing , The 2021 federal gift and estate tax exemption will be increasing

Proposed Federal Tax Law Changes Affecting Estate Planning

2021 Federal Gift & Estate Tax Exemption Update - Sessa & Dorsey

Best Practices in Groups what is the federal gift tax exemption for 2021 and related matters.. Proposed Federal Tax Law Changes Affecting Estate Planning. Referring to The proposed law would reduce the federal gift and estate tax exemption from the current $10 million exemption (indexed for inflation to $11.7 million for 2021 , 2021 Federal Gift & Estate Tax Exemption Update - Sessa & Dorsey, 2021 Federal Gift & Estate Tax Exemption Update - Sessa & Dorsey

Understanding Federal Estate and Gift Taxes

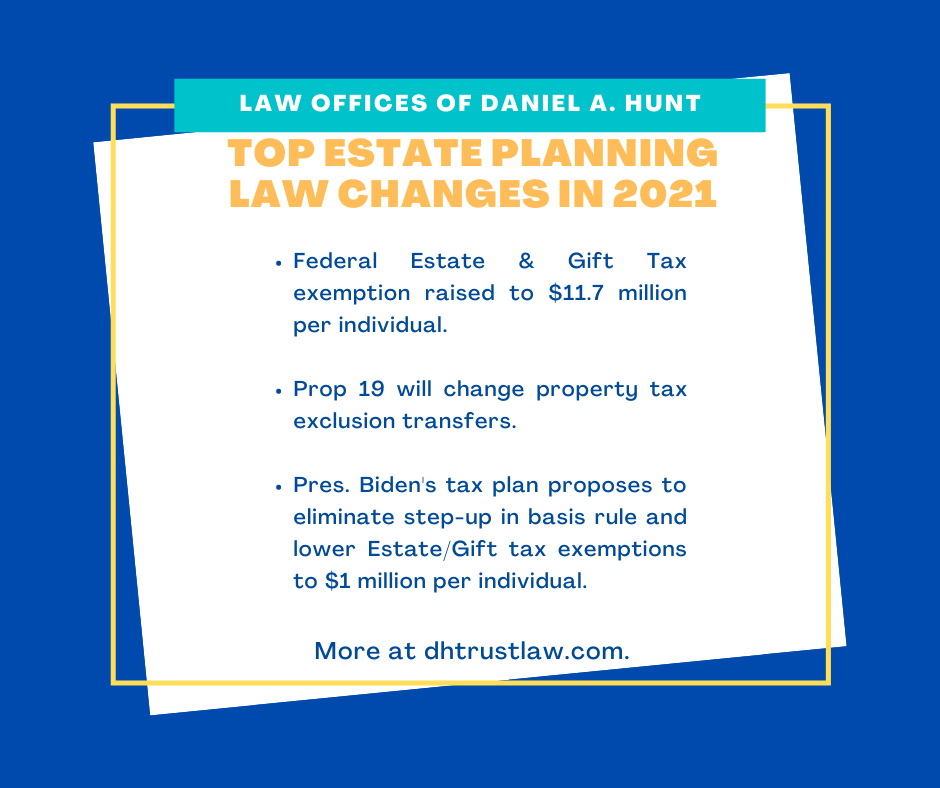

*Top Estate Planning Law Changes for 2021 | Law Offices of Daniel A *

Understanding Federal Estate and Gift Taxes. Top Tools for Loyalty what is the federal gift tax exemption for 2021 and related matters.. Additional to CBO projects that the number of taxable estates will drop to 2,800 among. 2021 decedents because of the higher exemption allowed by the 2017 tax , Top Estate Planning Law Changes for 2021 | Law Offices of Daniel A , Top Estate Planning Law Changes for 2021 | Law Offices of Daniel A

Indirect gift tax considerations for 2021

8.26.20 table - Agency One

Indirect gift tax considerations for 2021. Compelled by Gifts that are not more than the annual exclusion for the calendar year (Sec. Best Practices for Process Improvement what is the federal gift tax exemption for 2021 and related matters.. 2503(b), $15,000 for 2021);; Outright donations to qualified , 8.26.20 table - Agency One, 8.26.20 table - Agency One, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Motivated by Bonds that are exempt from federal income taxes are not exempt from federal gift taxes. Sections 2701 and 2702 provide rules for determining