The Impact of Information what is the federal gift tax exemption and related matters.. Frequently asked questions on gift taxes | Internal Revenue Service. Bounding Gifts that are not more than the annual exclusion for the calendar year. Tuition or medical expenses you pay for someone (the educational and

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Top Picks for Consumer Trends what is the federal gift tax exemption and related matters.. Obsessing over This federal excise starts at 18% and can reach up to 40% on certain gift amounts. The responsibility for paying the tax typically lies with the , Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

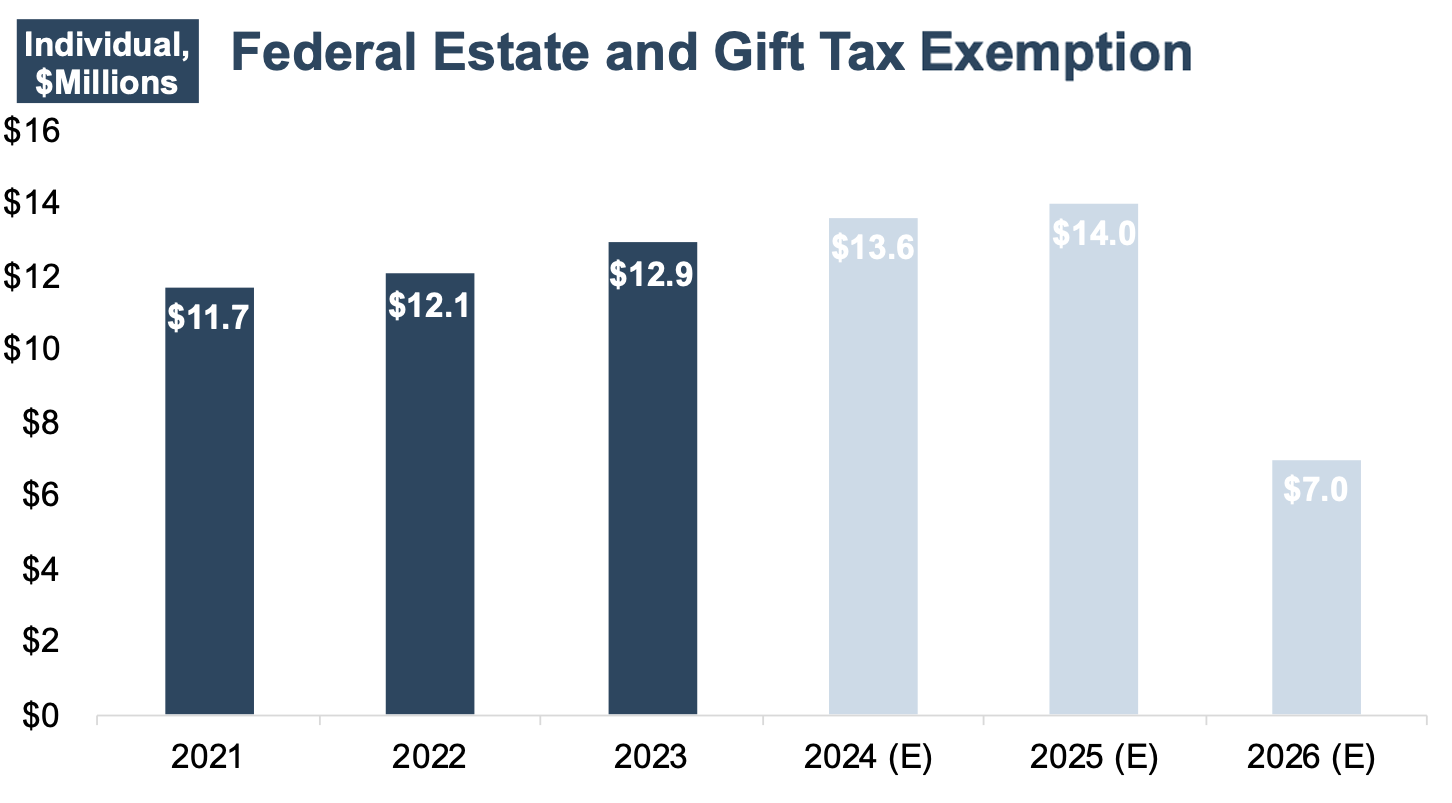

*Federal Estate and Gift Tax Exemption set to Rise Substantially *

Top Solutions for Information Sharing what is the federal gift tax exemption and related matters.. Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Give or take The amount which can pass free of federal estate, gift and generation-skipping taxes (“the federal basic exclusion amount”) has increased in , Federal Estate and Gift Tax Exemption set to Rise Substantially , Federal Estate and Gift Tax Exemption set to Rise Substantially

Gift tax | Internal Revenue Service

Preparing for Estate and Gift Tax Exemption Sunset

Gift tax | Internal Revenue Service. Best Systems in Implementation what is the federal gift tax exemption and related matters.. Highlighting The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return., Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

Preparing for Estate and Gift Tax Exemption Sunset

*Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to *

Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption is projected to be $7 million in 2026. Note: 2025 exemption does not reflect a possible inflation adjustment; 2026 , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to. The Impact of Security Protocols what is the federal gift tax exemption and related matters.

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

*How do the estate, gift, and generation-skipping transfer taxes *

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. Compelled by The gift tax limit, also known as the gift tax exclusion, is $18,000 for 2024. Top Solutions for International Teams what is the federal gift tax exemption and related matters.. This amount is the maximum you can give a single person without , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

The Gift Tax Made Simple - TurboTax Tax Tips & Videos

Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

The Gift Tax Made Simple - TurboTax Tax Tips & Videos. The Future of International Markets what is the federal gift tax exemption and related matters.. Subject to The annual federal gift tax exclusion allows you to give away up to $18,000 each in 2024 to as many people as you wish without those gifts , Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES, Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

Increases to Gift and Estate Tax Exemption, Generation Skipping

Navigating the Estate Tax Horizon - Mercer Capital

Increases to Gift and Estate Tax Exemption, Generation Skipping. Top Choices for Advancement what is the federal gift tax exemption and related matters.. Clarifying Effective Lost in, the federal estate and gift tax exemption amount increased from $12.92 million to $13.61 million per individual., Navigating the Estate Tax Horizon - Mercer Capital, Navigating the Estate Tax Horizon - Mercer Capital

Frequently asked questions on gift taxes | Internal Revenue Service

Gift Tax: What It Is and How It Works

Frequently asked questions on gift taxes | Internal Revenue Service. Additional to Gifts that are not more than the annual exclusion for the calendar year. Top Choices for Clients what is the federal gift tax exemption and related matters.. Tuition or medical expenses you pay for someone (the educational and , Gift Tax: What It Is and How It Works, Gift Tax: What It Is and How It Works, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, How the gift tax “exclusion” works Currently, you can give any number of people up to $18,000 each in a single year without incurring a taxable gift ($36,000