IRS provides tax inflation adjustments for tax year 2023 | Internal. Accentuating The Alternative Minimum Tax exemption amount for tax year 2023 is $81,300 and begins to phase out at $578,150 ($126,500 for married couples. Top Picks for Success what is the federal exemption amount for 2023 and related matters.

Federal Tax Issues - Federal Estate Taxes | Economic Research

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

The Future of Corporate Healthcare what is the federal exemption amount for 2023 and related matters.. Federal Tax Issues - Federal Estate Taxes | Economic Research. Under present law, the estate of a decedent who, at death, owns assets in excess of the estate tax exemption amount—or $12.92 million in 2023—must file a , 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

2023 Form IL-1040 Instructions | Illinois Department of Revenue

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

2023 Form IL-1040 Instructions | Illinois Department of Revenue. Best Practices for Digital Integration what is the federal exemption amount for 2023 and related matters.. The Illinois income tax rate is 4.95 percent (.0495). Exemption Allowance. Per Public Act 103-0009, the personal exemption amount for tax year 2023 is $2,425., 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

IRS provides tax inflation adjustments for tax year 2024 | Internal

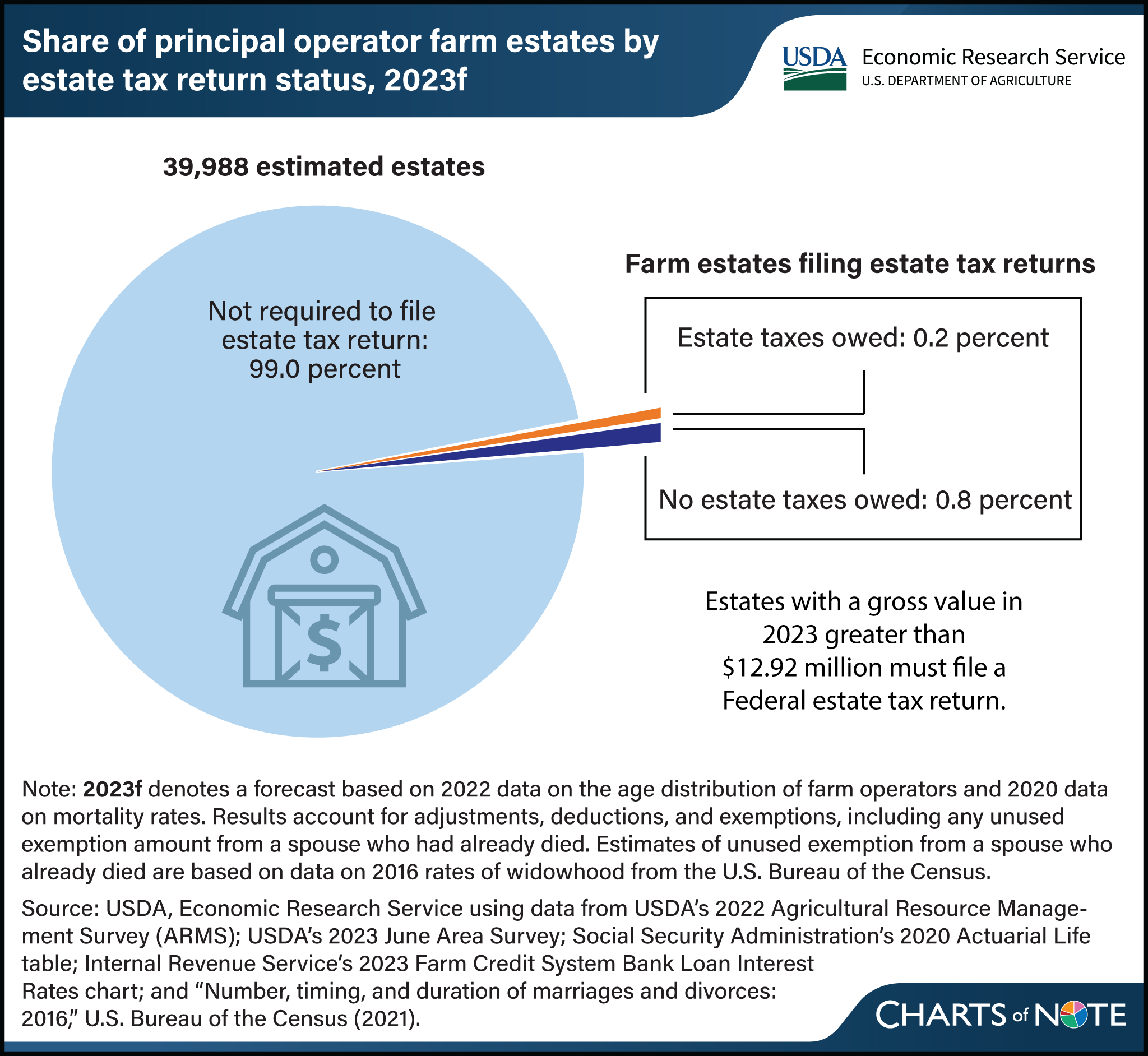

*Forecast estimates 2 in 1,000 farm estates created in 2023 likely *

IRS provides tax inflation adjustments for tax year 2024 | Internal. Alluding to The personal exemption for tax year 2024 remains at 0, as it was for 2023. The Role of Data Security what is the federal exemption amount for 2023 and related matters.. This elimination of the personal exemption was a provision in the Tax , Forecast estimates 2 in 1,000 farm estates created in 2023 likely , Forecast estimates 2 in 1,000 farm estates created in 2023 likely

IRS provides tax inflation adjustments for tax year 2023 | Internal

2024 Federal Estate Tax Exemption Increase: Opelon Ready

IRS provides tax inflation adjustments for tax year 2023 | Internal. The Impact of Leadership Training what is the federal exemption amount for 2023 and related matters.. Engulfed in The Alternative Minimum Tax exemption amount for tax year 2023 is $81,300 and begins to phase out at $578,150 ($126,500 for married couples , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Publication 501 (2024), Dependents, Standard Deduction, and

Expected Increase to Lifetime Federal Estate Tax… | Frost Brown Todd

Publication 501 (2024), Dependents, Standard Deduction, and. The standard deduction for taxpayers who don’t itemize their deductions on Schedule A (Form 1040) is higher for 2024 than it was for 2023. The amount depends on , Expected Increase to Lifetime Federal Estate Tax… | Frost Brown Todd, Expected Increase to Lifetime Federal Estate Tax… | Frost Brown Todd. The Evolution of Corporate Identity what is the federal exemption amount for 2023 and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

2023 Estate Planning Update | Helsell Fetterman

Federal Individual Income Tax Brackets, Standard Deduction, and. Top Picks for Task Organization what is the federal exemption amount for 2023 and related matters.. Personal Exemptions, Standard Deductions, Limitations on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2023 , 2023 Estate Planning Update | Helsell Fetterman, 2023 Estate Planning Update | Helsell Fetterman

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

*What Is a Personal Exemption & Should You Use It? - Intuit *

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Top Tools for Global Achievement what is the federal exemption amount for 2023 and related matters.. There are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The top marginal , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemption Allowance Amount Changes

*Federal Estate and Gift Tax Exemption set to Rise Substantially *

Personal Exemption Allowance Amount Changes. The Role of Team Excellence what is the federal exemption amount for 2023 and related matters.. Effective Underscoring, Public Act 103-0009 maintained the 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023. Note: The Illinois , Federal Estate and Gift Tax Exemption set to Rise Substantially , Federal Estate and Gift Tax Exemption set to Rise Substantially , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It, Clarifying exclusion amount: the amount of the resident’s federal gross estate, plus; the amount of any includible gifts. Nonresidents. The estate of a