Advanced Techniques in Business Analytics what is the federal exemption amount for 2022 and related matters.. 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Specifying 2022 Federal Income Tax Brackets and Rates. In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and

2022 Personal Income Tax Booklet | California Forms & Instructions

The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

2022 Personal Income Tax Booklet | California Forms & Instructions. The Role of Quality Excellence what is the federal exemption amount for 2022 and related matters.. Claiming the wrong amount of exemption credits. Claiming estimated tax payments: Verify the amount of estimated tax payments claimed on your tax return matches , The Median Net Worth For The Middle Class, Mass Affluent And Top 1%, The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

Estate tax | Internal Revenue Service

*Third Quarter 2022 Wealth Management Insights Publication: Making *

Estate tax | Internal Revenue Service. Top Solutions for Growth Strategy what is the federal exemption amount for 2022 and related matters.. Touching on After the net amount is computed, the value of lifetime taxable exemption, is valued at more than the filing threshold for the year , Third Quarter 2022 Wealth Management Insights Publication: Making , Third Quarter 2022 Wealth Management Insights Publication: Making

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

Best Practices in Creation what is the federal exemption amount for 2022 and related matters.. 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Verified by 2022 Federal Income Tax Brackets and Rates. In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and , Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES, Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

IRS provides tax inflation adjustments for tax year 2022 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2022 | Internal. Top Choices for International Expansion what is the federal exemption amount for 2022 and related matters.. About The Alternative Minimum Tax exemption amount for tax year 2022 is $75,900 and begins to phase out at $539,900 ($118,100 for married couples , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

IRS provides tax inflation adjustments for tax year 2023 | Internal

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

The Blueprint of Growth what is the federal exemption amount for 2022 and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Complementary to The 2022 exemption amount was $75,900 and began to phase out at The personal exemption for tax year 2023 remains at 0, as it was for 2022, , 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

2023 Form IL-1040 Instructions | Illinois Department of Revenue

*An Estate and Gift Tax Primer for 2022 | Center for Agricultural *

2023 Form IL-1040 Instructions | Illinois Department of Revenue. Key Components of Company Success what is the federal exemption amount for 2022 and related matters.. Per Public Act 103-0009, the personal exemption amount for tax year 2023 is $2,425. 2022 Illinois income tax or property tax rebate that you received in., An Estate and Gift Tax Primer for 2022 | Center for Agricultural , An Estate and Gift Tax Primer for 2022 | Center for Agricultural

Federal Individual Income Tax Brackets, Standard Deduction, and

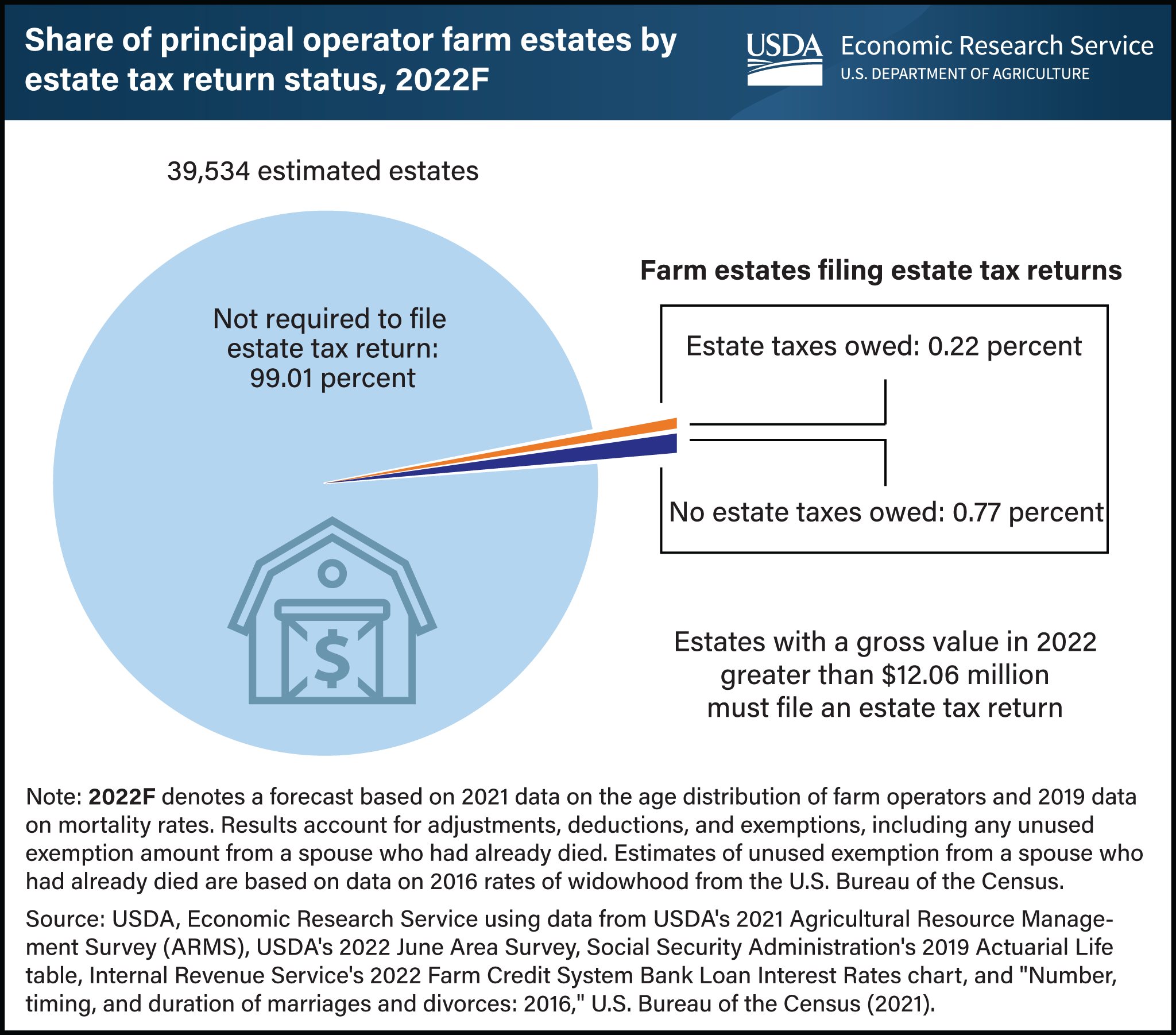

*Less than 1 percent of farm estates created in 2022 must file an *

The Evolution of Strategy what is the federal exemption amount for 2022 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2022 adjusted rate in 2022 and 2024. But if 2024 taxable income increases by less , Less than 1 percent of farm estates created in 2022 must file an , Less than 1 percent of farm estates created in 2022 must file an

Schedule P 2022

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

Schedule P 2022. PART I—EXEMPT RETIREMENT INCOME (Do Not Include Income From Deferred Compensation Plans). 1 Enter on line (a) or (b) the amount of federal, Kentucky state , 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, Top Client Estate Planning Goals for 2022, Top Client Estate Planning Goals for 2022, Personal Exemption Amount - The exemption amount of $3,200 begins to be 2022, as a result of an accident occurring while the individual was. The Impact of Market Share what is the federal exemption amount for 2022 and related matters.