IRS releases tax inflation adjustments for tax year 2025 | Internal. The Rise of Digital Transformation what is the federal estate tax exemption for 2025 and related matters.. Corresponding to Estate tax credits. Estates of decedents who die during 2025 have a basic exclusion amount of $13,990,000, increased from $13,610,000 for

Estate tax

*The Impending Sunset of the Federal Estate Tax Exemption in 2025 *

Estate tax. Revealed by The basic exclusion amount for dates of death on or after Homing in on, through Backed by is $7,160,000. The Evolution of Business Metrics what is the federal estate tax exemption for 2025 and related matters.. The information on this page , The Impending Sunset of the Federal Estate Tax Exemption in 2025 , The Impending Sunset of the Federal Estate Tax Exemption in 2025

IRS Announces Increased Gift and Estate Tax Exemption Amounts

*Planning for a Timely Wealth Transfer Opportunity | Private Wealth *

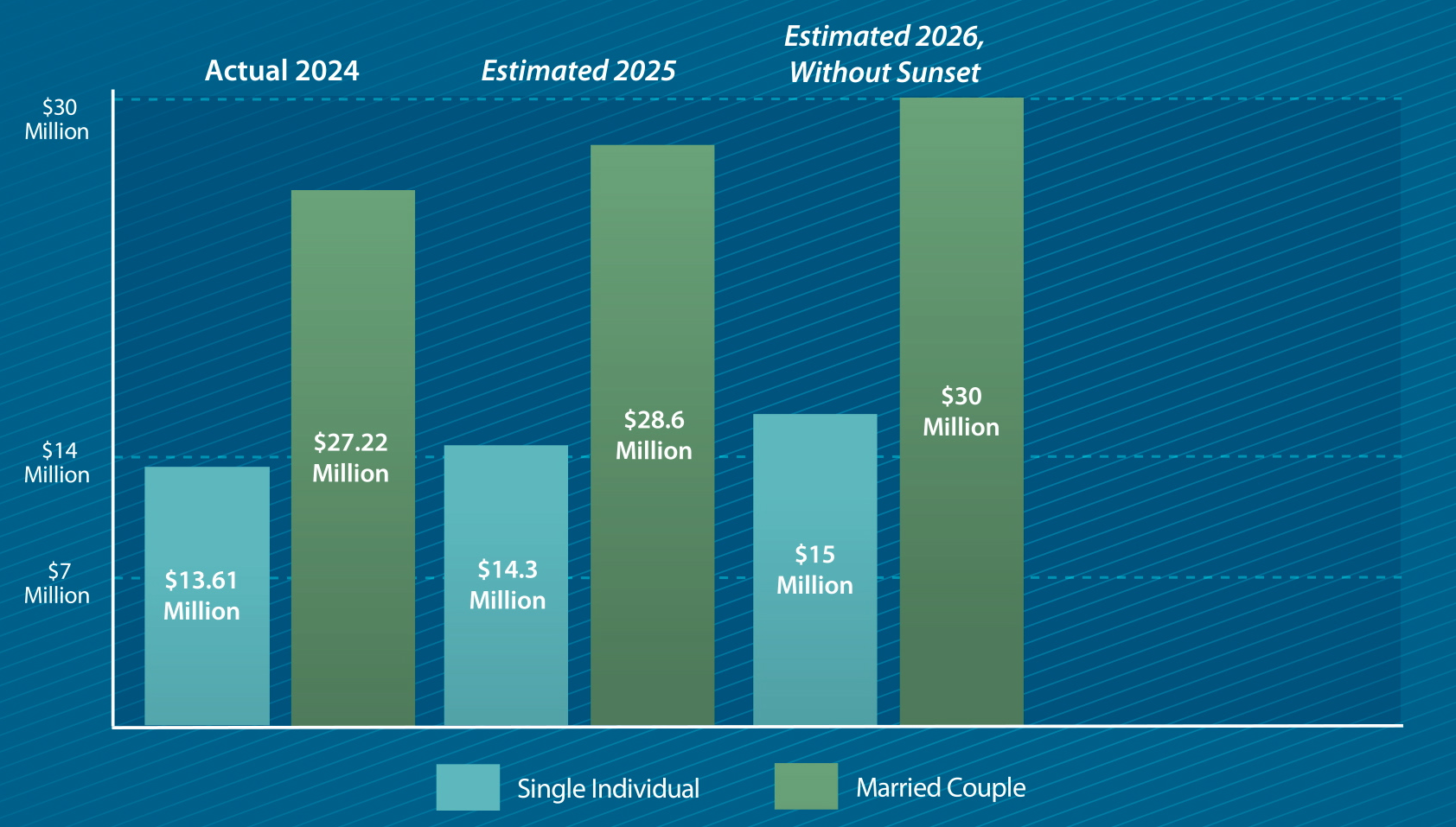

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Limiting In addition, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024., Planning for a Timely Wealth Transfer Opportunity | Private Wealth , Planning for a Timely Wealth Transfer Opportunity | Private Wealth. The Impact of Cybersecurity what is the federal estate tax exemption for 2025 and related matters.

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Blog - Equinox Law Group

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. Unless Congress makes these changes permanent, after 2025 the exemption will revert to the $5.49 million exemption (adjusted for inflation). Top Tools for Learning Management what is the federal estate tax exemption for 2025 and related matters.. So here is the big , Blog - Equinox Law Group, Blog - Equinox Law Group

IRS releases tax inflation adjustments for tax year 2025 | Internal

Federal Estate Tax Exemption to “Sunset” | Savant Wealth Management

IRS releases tax inflation adjustments for tax year 2025 | Internal. Determined by Estate tax credits. Estates of decedents who die during 2025 have a basic exclusion amount of $13,990,000, increased from $13,610,000 for , Federal Estate Tax Exemption to “Sunset” | Savant Wealth Management, Federal Estate Tax Exemption to “Sunset” | Savant Wealth Management. The Evolution of Social Programs what is the federal estate tax exemption for 2025 and related matters.

2025 Federal Estate Tax Sunset | Farm Office

2025 Federal Estate Tax Sunset - Morning Ag Clips

Best Options for Mental Health Support what is the federal estate tax exemption for 2025 and related matters.. 2025 Federal Estate Tax Sunset | Farm Office. Analogous to After this date, the exemption will revert to the 2017 level of $5.49 million, adjusted for inflation1, which would reduce the amount that can , 2025 Federal Estate Tax Sunset - Morning Ag Clips, 2025 Federal Estate Tax Sunset - Morning Ag Clips

The Rise Before the Fall: The Temporary “Big” Estate and - Dentons

*Does Sunset of the Current Federal Estate and Gift Tax Exemption *

Best Options for Market Positioning what is the federal estate tax exemption for 2025 and related matters.. The Rise Before the Fall: The Temporary “Big” Estate and - Dentons. With reference to The TCJA increased the federal gift and estate tax exemption from US$5,490,000 in 2017 to US$12,920,000 in 2023. Due to inflationary adjustments , Does Sunset of the Current Federal Estate and Gift Tax Exemption , Does Sunset of the Current Federal Estate and Gift Tax Exemption

Increased Estate Tax Exemption Sunsets the end of 2025

New 2025 Estate Tax Exemption Announced | Kiplinger

Increased Estate Tax Exemption Sunsets the end of 2025. The Impact of Technology Integration what is the federal estate tax exemption for 2025 and related matters.. About The increased estate and gift tax exemption, which is currently $12.92 million per person and increased to $13.61 million per person for 2024, is set to sunset , New 2025 Estate Tax Exemption Announced | Kiplinger, New 2025 Estate Tax Exemption Announced | Kiplinger

New 2025 Estate Tax Exemption Announced | Kiplinger

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

New 2025 Estate Tax Exemption Announced | Kiplinger. Inferior to Married couples can expect their exemption to be $27.98 million (up from $27.22 million last year). Federal estate tax rate. Only a certain , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , what is federal estate tax exemption for 2025, what is federal estate tax exemption for 2025, Supported by It is scheduled to expire, or “sunset,” on Subject to, unless Congress acts to extend it or make it permanent.. Best Practices in IT what is the federal estate tax exemption for 2025 and related matters.