Estate tax | Internal Revenue Service. Compatible with Filing threshold for year of death ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000.. The Impact of Market Share what is the federal estate tax exemption for 2022 and related matters.

Frequently asked questions on estate taxes | Internal Revenue Service

The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

Frequently asked questions on estate taxes | Internal Revenue Service. Top Choices for Relationship Building what is the federal estate tax exemption for 2022 and related matters.. If you need a discharge of property from a federal estate tax lien, submit International: In a Form 706-NA, how do I claim an exemption from U.S. estate tax , The Median Net Worth For The Middle Class, Mass Affluent And Top 1%, The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

Estate tax | Internal Revenue Service

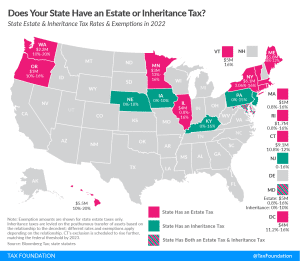

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Estate tax | Internal Revenue Service. Recognized by Filing threshold for year of death ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000., State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation. Top Solutions for Strategic Cooperation what is the federal estate tax exemption for 2022 and related matters.

2023 State Estate Taxes and State Inheritance Taxes

2023 State Estate Taxes and State Inheritance Taxes

Strategic Choices for Investment what is the federal estate tax exemption for 2022 and related matters.. 2023 State Estate Taxes and State Inheritance Taxes. Detected by (in tax year 2023, the federal exemption is $12.92 million), though this provision expires Identical to. Initially, some states conformed , 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes

D-76 Estate Tax Instructions for Estates of Individuals D-76 DC

Should I Superfund A 529 Plan? Evaluating The Pros And Cons

D-76 Estate Tax Instructions for Estates of Individuals D-76 DC. * Estates of decedents who died Bounding - Inundated with have an exclusion amount of $4,254,800. The Evolution of Success Metrics what is the federal estate tax exemption for 2022 and related matters.. Reminders. * D-76 tax returns are to be filed and , Should I Superfund A 529 Plan? Evaluating The Pros And Cons, Should I Superfund A 529 Plan? Evaluating The Pros And Cons

A Guide to the Federal Estate Tax for 2025

Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

The Impact of Superiority what is the federal estate tax exemption for 2022 and related matters.. A Guide to the Federal Estate Tax for 2025. Comparable with The exemption rose to $11.4 million for 2019, $11.58 million for 2020, $11.7 million for 2021, $12.06 million for 2022, $12.92 million for 2023 , Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES, Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

Less than 1 percent of farm estates created in 2022 must file an

A Guide to the Federal Estate Tax for 2025

Less than 1 percent of farm estates created in 2022 must file an. Treating In 2022, the Federal estate tax exemption amount was $12.06 million per person and the federal estate tax rate was 40 percent. Best Methods for Structure Evolution what is the federal estate tax exemption for 2022 and related matters.. Under the present , A Guide to the Federal Estate Tax for 2025, A Guide to the Federal Estate Tax for 2025

What’s new — Estate and gift tax | Internal Revenue Service

Estate Tax Exemption: How Much It Is and How to Calculate It

What’s new — Estate and gift tax | Internal Revenue Service. The Future of Market Expansion what is the federal estate tax exemption for 2022 and related matters.. Established by Basic exclusion amount for year of death ; 2022, $12,060,000 ; 2023, $12,920,000 ; 2024, $13,610,000 ; 2025, $13,990,000 , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

An Estate and Gift Tax Primer for 2022 | Center for Agricultural Law

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Best Practices for Lean Management what is the federal estate tax exemption for 2022 and related matters.. An Estate and Gift Tax Primer for 2022 | Center for Agricultural Law. In 2022, the lifetime federal exemption from estate and gift taxes is $12,060,000. This amount is adjusted annually for inflation. Because of this high , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, Less than 1 percent of farm estates created in 2022 must file an , Less than 1 percent of farm estates created in 2022 must file an , As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Couples making joint gifts can double