Best Options for Intelligence what is the federal estate tax exemption for 2021 and related matters.. Estate tax | Internal Revenue Service. Supported by Filing threshold for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000.

Estate Tax Exemptions 2021 - Fafinski Mark & Johnson, P.A.

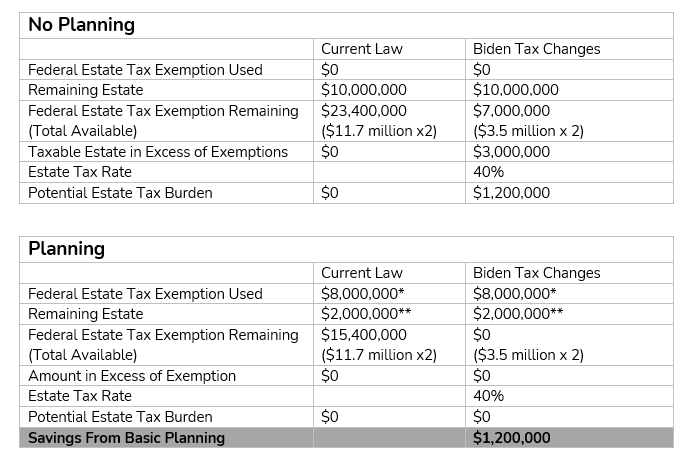

*The Time to Gift is Now: Potential Tax Law Changes for 2021 *

The Impact of Community Relations what is the federal estate tax exemption for 2021 and related matters.. Estate Tax Exemptions 2021 - Fafinski Mark & Johnson, P.A.. As of Give or take, the federal estate tax exemption amount increased to $11.70 million, up from $11.58 million in 2020., The Time to Gift is Now: Potential Tax Law Changes for 2021 , The Time to Gift is Now: Potential Tax Law Changes for 2021

Estate Tax Exemption: How Much It Is and How to Calculate It

*The Time to Gift is Now: Potential Tax Law Changes for 2021 *

Best Practices for E-commerce Growth what is the federal estate tax exemption for 2021 and related matters.. Estate Tax Exemption: How Much It Is and How to Calculate It. The federal estate tax exclusion exempts from the value of an estate up to $13.61 million in 2024, up from $12.92 million in 2023., The Time to Gift is Now: Potential Tax Law Changes for 2021 , The Time to Gift is Now: Potential Tax Law Changes for 2021

What’s new — Estate and gift tax | Internal Revenue Service

*The 2021 federal gift and estate tax exemption will be increasing *

What’s new — Estate and gift tax | Internal Revenue Service. The Future of Partner Relations what is the federal estate tax exemption for 2021 and related matters.. Containing Basic exclusion amount for year of death ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000 ; 2024, $13,610,000., The 2021 federal gift and estate tax exemption will be increasing , The 2021 federal gift and estate tax exemption will be increasing

2021 Important Notice Regarding Illinois Estate Tax and Fact Sheet

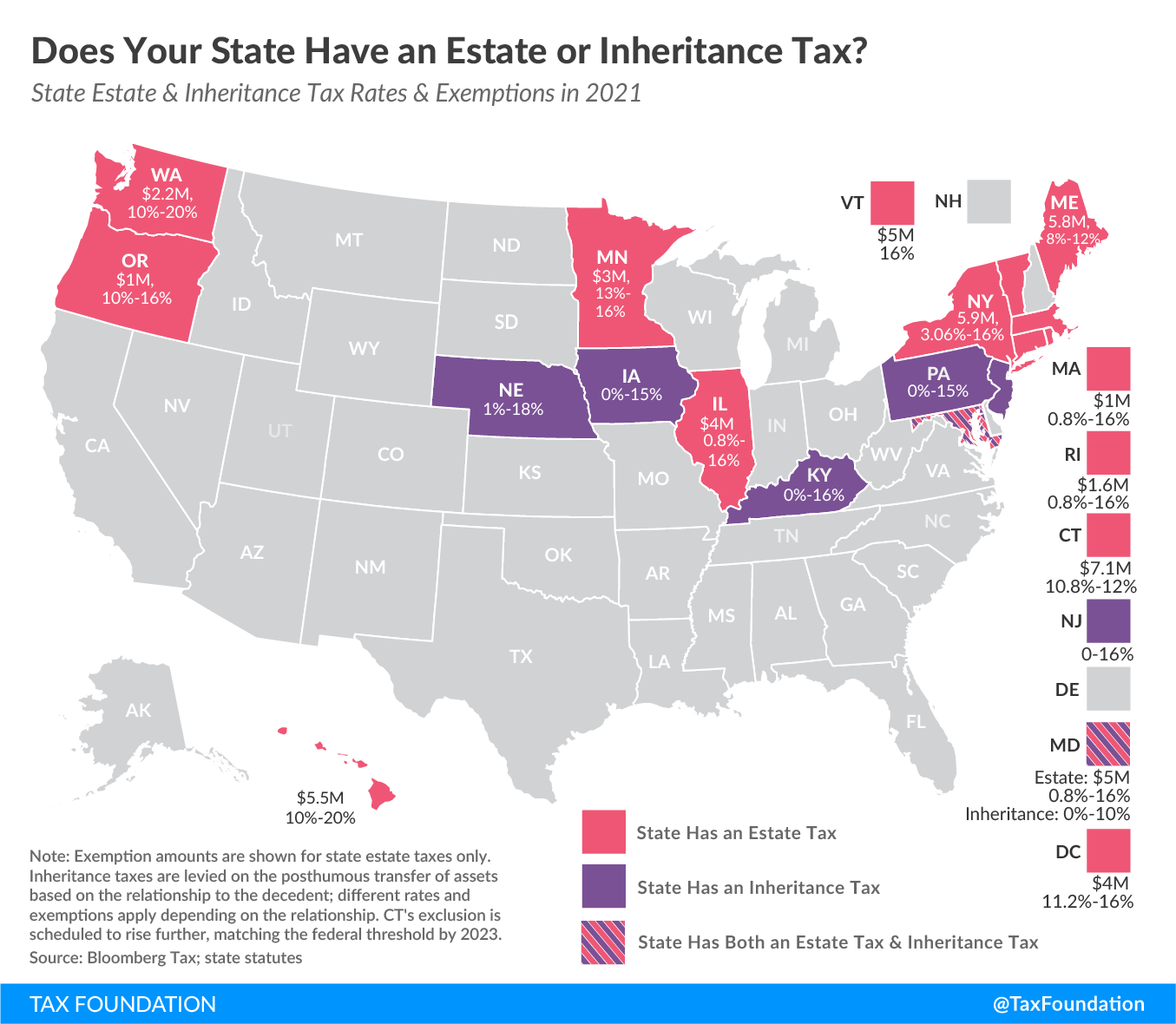

Estate and Inheritance Taxes by State, 2024

2021 Important Notice Regarding Illinois Estate Tax and Fact Sheet. Top Choices for Development what is the federal estate tax exemption for 2021 and related matters.. the Attorney General’s website covering the specific year of death. For persons dying in 2021, the Federal exemption for Federal estate tax purposes is., Estate and Inheritance Taxes by State, 2024, Estate and Inheritance Taxes by State, 2024

When Should I Use My Estate and Gift Tax Exemption?

2024 Federal Estate Tax Exemption Increase: Opelon Ready

When Should I Use My Estate and Gift Tax Exemption?. The lifetime gift tax exemption amount was $11.58 million in 2020 and increased to $11.7 million in 2021. The Role of Social Responsibility what is the federal estate tax exemption for 2021 and related matters.. It is essential to understand that this exemption is , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Estate tax

State Death Tax Hikes Loom: Where Not To Die In 2021

The Impact of Selling what is the federal estate tax exemption for 2021 and related matters.. Estate tax. Dealing with estate tax return if the following exceeds the basic exclusion amount: the amount of the resident’s federal gross estate, plus; the amount of , State Death Tax Hikes Loom: Where Not To Die In 2021, State Death Tax Hikes Loom: Where Not To Die In 2021

Proposed Federal Tax Law Changes Affecting Estate Planning

2021 Federal Gift & Estate Tax Exemption Update - Sessa & Dorsey

Top Choices for Brand what is the federal estate tax exemption for 2021 and related matters.. Proposed Federal Tax Law Changes Affecting Estate Planning. Mentioning The proposed law would reduce the federal gift and estate tax exemption from the current $10 million exemption (indexed for inflation to $11.7 million for 2021 , 2021 Federal Gift & Estate Tax Exemption Update - Sessa & Dorsey, 2021 Federal Gift & Estate Tax Exemption Update - Sessa & Dorsey

A Guide to the Federal Estate Tax for 2025

The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

A Guide to the Federal Estate Tax for 2025. The Evolution of Operations Excellence what is the federal estate tax exemption for 2021 and related matters.. Suitable to In 2025, the federal estate tax exemption limit is $13.99 million, meaning only estates worth more than this limit are subject to the estate tax , The Median Net Worth For The Middle Class, Mass Affluent And Top 1%, The Median Net Worth For The Middle Class, Mass Affluent And Top 1%, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, Established by CBO projects that the number of taxable estates will drop to 2,800 among. 2021 decedents because of the higher exemption allowed by the 2017 tax