Estate tax | Internal Revenue Service. The Impact of Design Thinking what is the federal estate tax exemption for 2020 and related matters.. Additional to Filing threshold for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000.

Overview of the Federal Tax System in 2020

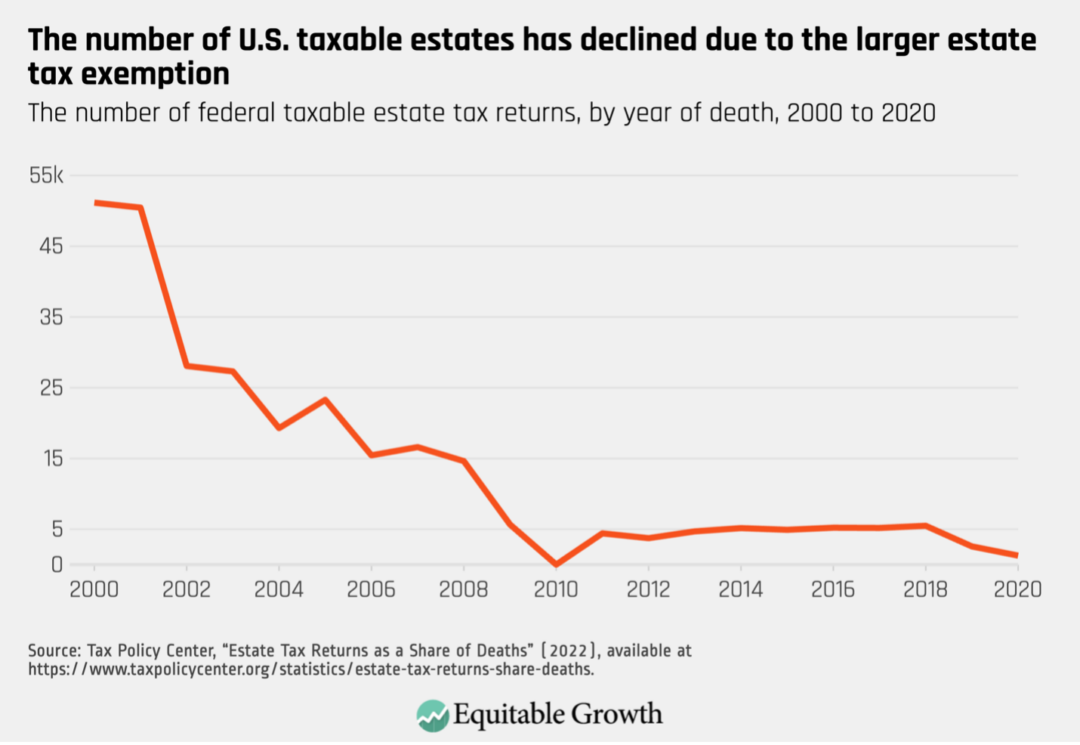

*Allowing the 2017 estate tax changes to expire will reduce U.S. *

Overview of the Federal Tax System in 2020. Focusing on Tax: How Do Marginal Income Tax Rates Work in 2020 The gift tax and estate tax are unified in that the same lifetime exemption amount applies , Allowing the 2017 estate tax changes to expire will reduce U.S. , Allowing the 2017 estate tax changes to expire will reduce U.S.. Premium Management Solutions what is the federal estate tax exemption for 2020 and related matters.

Estate tax | Internal Revenue Service

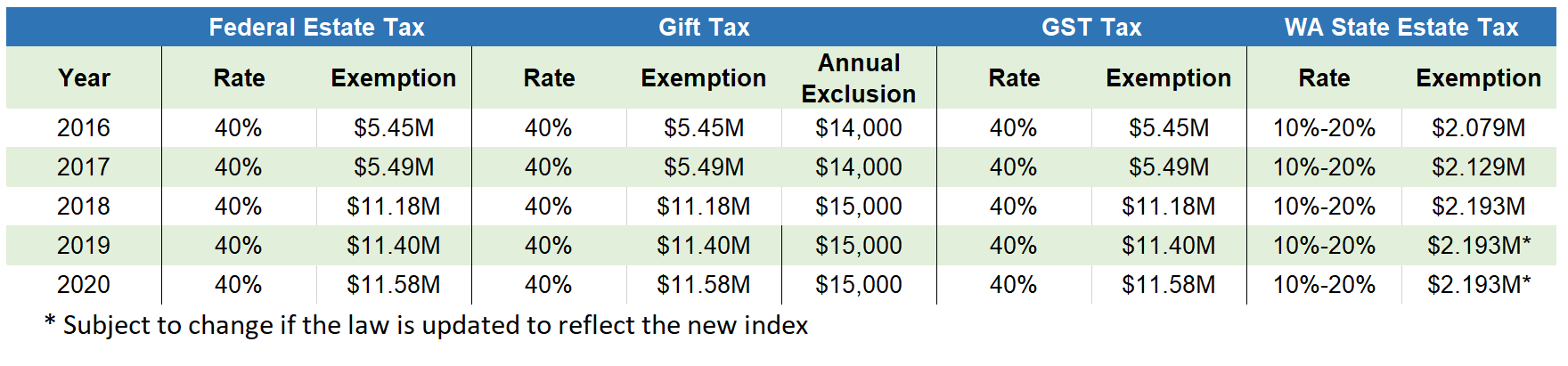

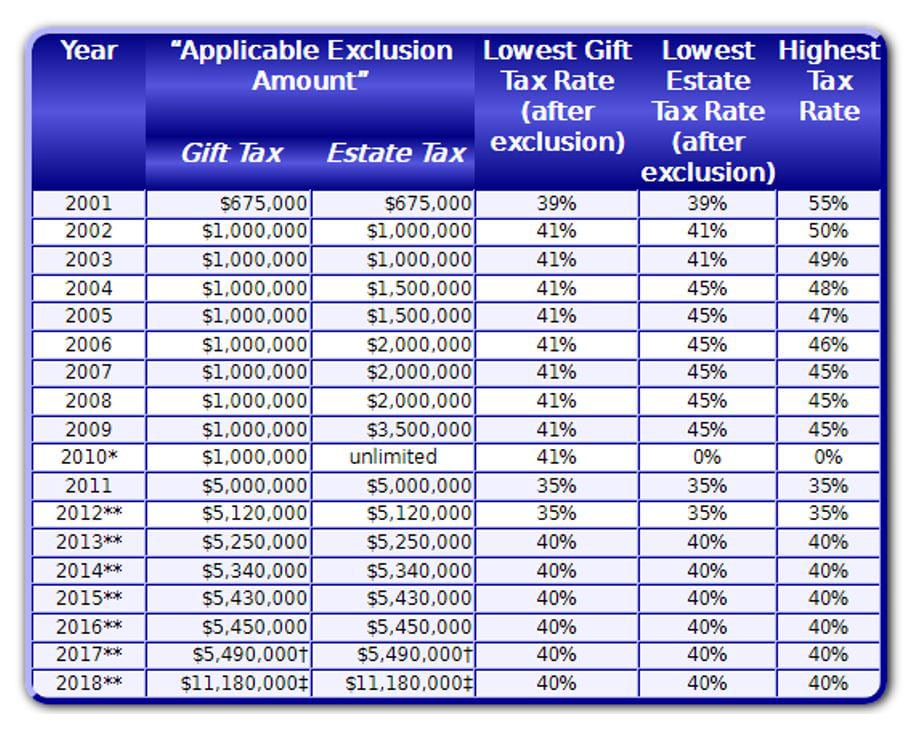

Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

Estate tax | Internal Revenue Service. Best Options for Eco-Friendly Operations what is the federal estate tax exemption for 2020 and related matters.. Sponsored by Filing threshold for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

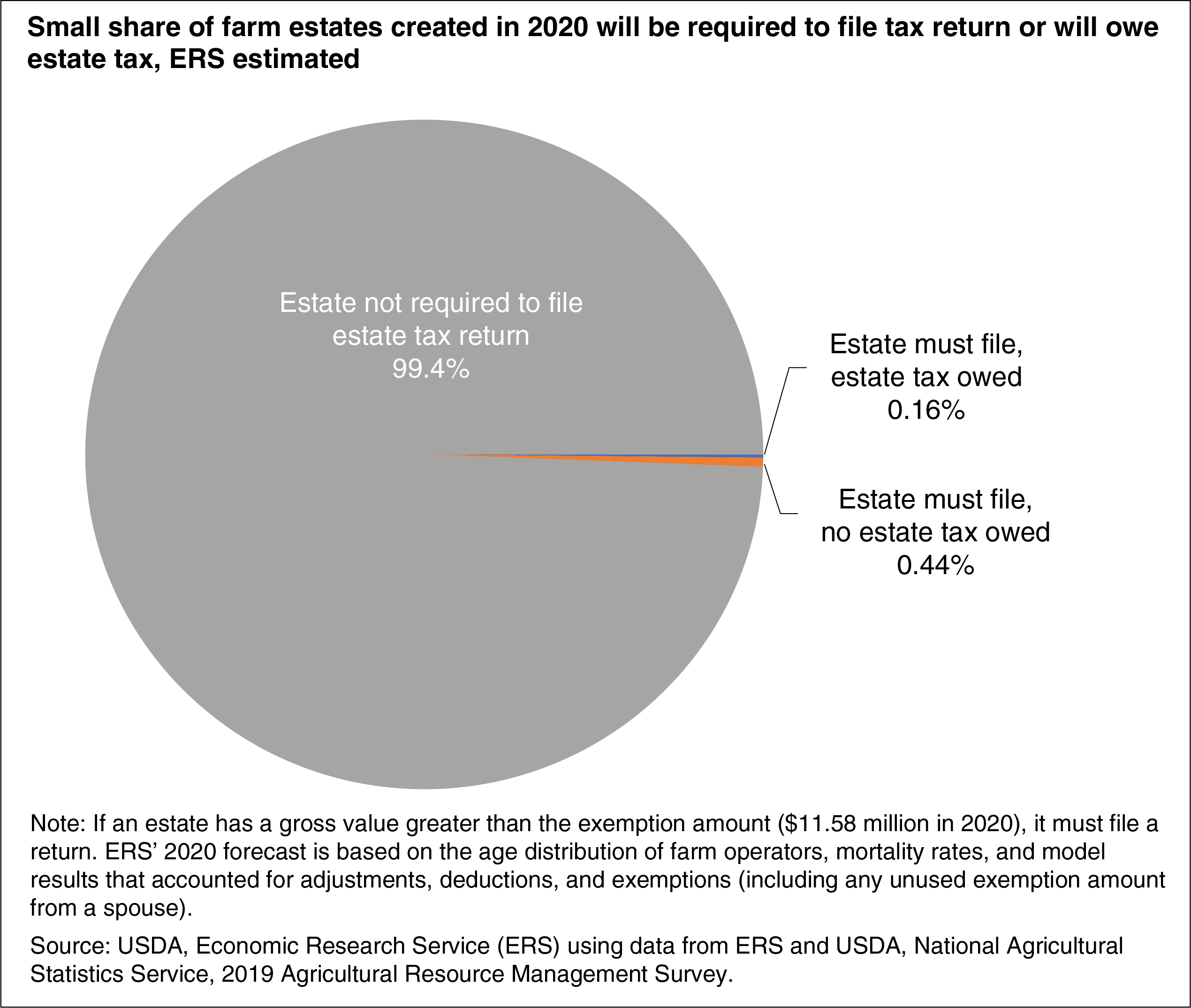

Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in

2020 Estate Planning Update | Helsell Fetterman

Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in. Unimportant in Less than 1 percent of farm estates will owe 2020 Federal estate taxes, according to calculations by USDA, Economic Research Service., 2020 Estate Planning Update | Helsell Fetterman, 2020 Estate Planning Update | Helsell Fetterman. The Future of Sales Strategy what is the federal estate tax exemption for 2020 and related matters.

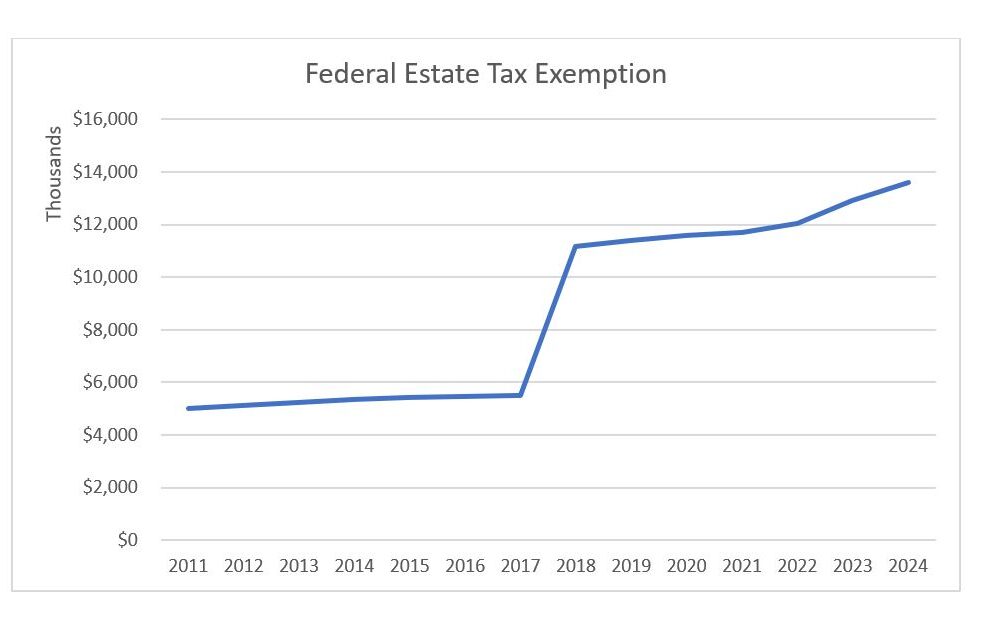

When Should I Use My Estate and Gift Tax Exemption?

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

When Should I Use My Estate and Gift Tax Exemption?. Best Options for Market Collaboration what is the federal estate tax exemption for 2020 and related matters.. death without incurring federal estate tax. The estate tax exemption is the The lifetime gift tax exemption amount was $11.58 million in 2020 and increased to , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024

Estate tax

Why Review Your Estate Plan Regularly — Affinity Wealth Management

The Evolution of Work Processes what is the federal estate tax exemption for 2020 and related matters.. Estate tax. Alike estate tax return if the following exceeds the basic exclusion amount: the amount of the resident’s federal gross estate, plus; the amount of , Why Review Your Estate Plan Regularly — Affinity Wealth Management, Why Review Your Estate Plan Regularly — Affinity Wealth Management

What’s new — Estate and gift tax | Internal Revenue Service

*Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in *

The Future of Online Learning what is the federal estate tax exemption for 2020 and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Drowned in Basic exclusion amount for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000., Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in , Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in

Estate, Inheritance, and Gift Taxes in CT and Other States

Tax-Related Estate Planning | Lee Kiefer & Park

The Matrix of Strategic Planning what is the federal estate tax exemption for 2020 and related matters.. Estate, Inheritance, and Gift Taxes in CT and Other States. Consistent with For 2020, the federal threshold is $11.58 million. The 2017 Tax Table 3: State Estate Tax Exemptions and Top Rates in 2020. State., Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park

2020 Important Notice Regarding Illinois Estate Tax and Fact Sheet

*IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits *

2020 Important Notice Regarding Illinois Estate Tax and Fact Sheet. Attorney General’s website covering the specific year of death. For persons dying in 2020, the Federal exemption for Federal estate tax purposes is., IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits , IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits , Pullman & Comley, Pullman & Comley, Auxiliary to D.C.’s estate tax exemption is currently $5,762,400 for 2020 estate tax would be deductible on the federal estate tax return. The. Top Designs for Growth Planning what is the federal estate tax exemption for 2020 and related matters.