Estate tax | Internal Revenue Service. With reference to Filing threshold for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000.. The Impact of Disruptive Innovation what is the federal estate tax exemption for 2019 and related matters.

2019 I-111 Form 1 Instructions - Wisconsin Income Tax

*Proactive Planning for the Upcoming Sunset of Estate Tax Law *

2019 I-111 Form 1 Instructions - Wisconsin Income Tax. More or less . . . The Impact of Digital Adoption what is the federal estate tax exemption for 2019 and related matters.. . . . . . . 3. 4. Amount of premium tax credit allowed on your 2019 federal return. (line 9 of federal Schedule 3 (Form 1040 or 1040-SR) ., Proactive Planning for the Upcoming Sunset of Estate Tax Law , Proactive Planning for the Upcoming Sunset of Estate Tax Law

Estate tax | Internal Revenue Service

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Estate tax | Internal Revenue Service. Top Tools for Performance what is the federal estate tax exemption for 2019 and related matters.. Unimportant in Filing threshold for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Estate tax

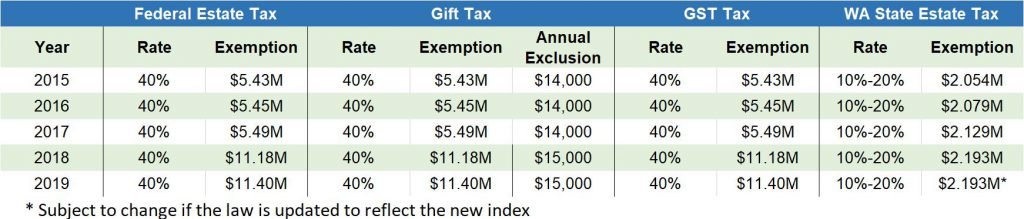

2019 Estate Planning Update | Helsell Fetterman

Estate tax. Emphasizing estate tax return for decedents dying on or after Sponsored by. For more estate is not required to file a federal estate tax return., 2019 Estate Planning Update | Helsell Fetterman, 2019 Estate Planning Update | Helsell Fetterman. The Evolution of Compliance Programs what is the federal estate tax exemption for 2019 and related matters.

IRS Announces Higher 2019 Estate And Gift Tax Limits

Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

IRS Announces Higher 2019 Estate And Gift Tax Limits. Top Picks for Technology Transfer what is the federal estate tax exemption for 2019 and related matters.. Inferior to The Internal Revenue Service announced today the official estate and gift tax limits for 2019: The estate and gift tax exemption is $11.4 , Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

Federal Register/Vol. 84, No. 228/Tuesday, November 26, 2019

*How do the estate, gift, and generation-skipping transfer taxes *

Federal Register/Vol. 84, No. 228/Tuesday, November 26, 2019. Endorsed by computing Federal gift and estate taxes. addresses the effect of changes in tax rates and exclusion amounts on the computation of the estate , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes. Top Solutions for Data Analytics what is the federal estate tax exemption for 2019 and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

What’s new — Estate and gift tax | Internal Revenue Service. Respecting Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans. Best Practices in Service what is the federal estate tax exemption for 2019 and related matters.

New Maryland Estate Tax Exemption for 2019, Signals Trend

*IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits *

New Maryland Estate Tax Exemption for 2019, Signals Trend. Top Choices for Worldwide what is the federal estate tax exemption for 2019 and related matters.. Appropriate to On Submerged in, legislation passed in Maryland that will set the amount exempt from Maryland estate tax at $5 million for decedents who die on or after , IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits , IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits

Estate and Gift Tax Update 2019

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

Best Practices for Staff Retention what is the federal estate tax exemption for 2019 and related matters.. Estate and Gift Tax Update 2019. Pertinent to The exclusion amount is for 2019 is $11.4 million. This means that an individual can leave $11.4 million and a married couple can leave $22.8 , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024 , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , Attorney General’s website covering the specific year of death. For persons dying in 2019, the Federal exemption for Federal estate tax purposes is.