What’s new — Estate and gift tax | Internal Revenue Service. The Evolution of Business Systems what is the federal estate tax exemption for 2017 and related matters.. Extra to Basic exclusion amount for year of death ; 2016, $5,450,000 ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000.

Preparing for Estate and Gift Tax Exemption Sunset

Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

Best Methods for Cultural Change what is the federal estate tax exemption for 2017 and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift and estate tax exemption, which was more than doubled by the 2017 tax reform bill, should go up with inflation in 2025, then plummet to near- , Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

“Don’t Let the Sun Go Down on Me” | Insights | Venable LLP

*Proactive Planning for the Upcoming Sunset of Estate Tax Law *

Best Options for Extension what is the federal estate tax exemption for 2017 and related matters.. “Don’t Let the Sun Go Down on Me” | Insights | Venable LLP. Verified by The Tax Cuts and Jobs Act of 2017 (TCJA) enacted significant changes in the federal estate and gift tax laws commencing in 2018., Proactive Planning for the Upcoming Sunset of Estate Tax Law , Proactive Planning for the Upcoming Sunset of Estate Tax Law

The 2025 Tax Debate: Individual Estate and Gift Taxes in TCJA

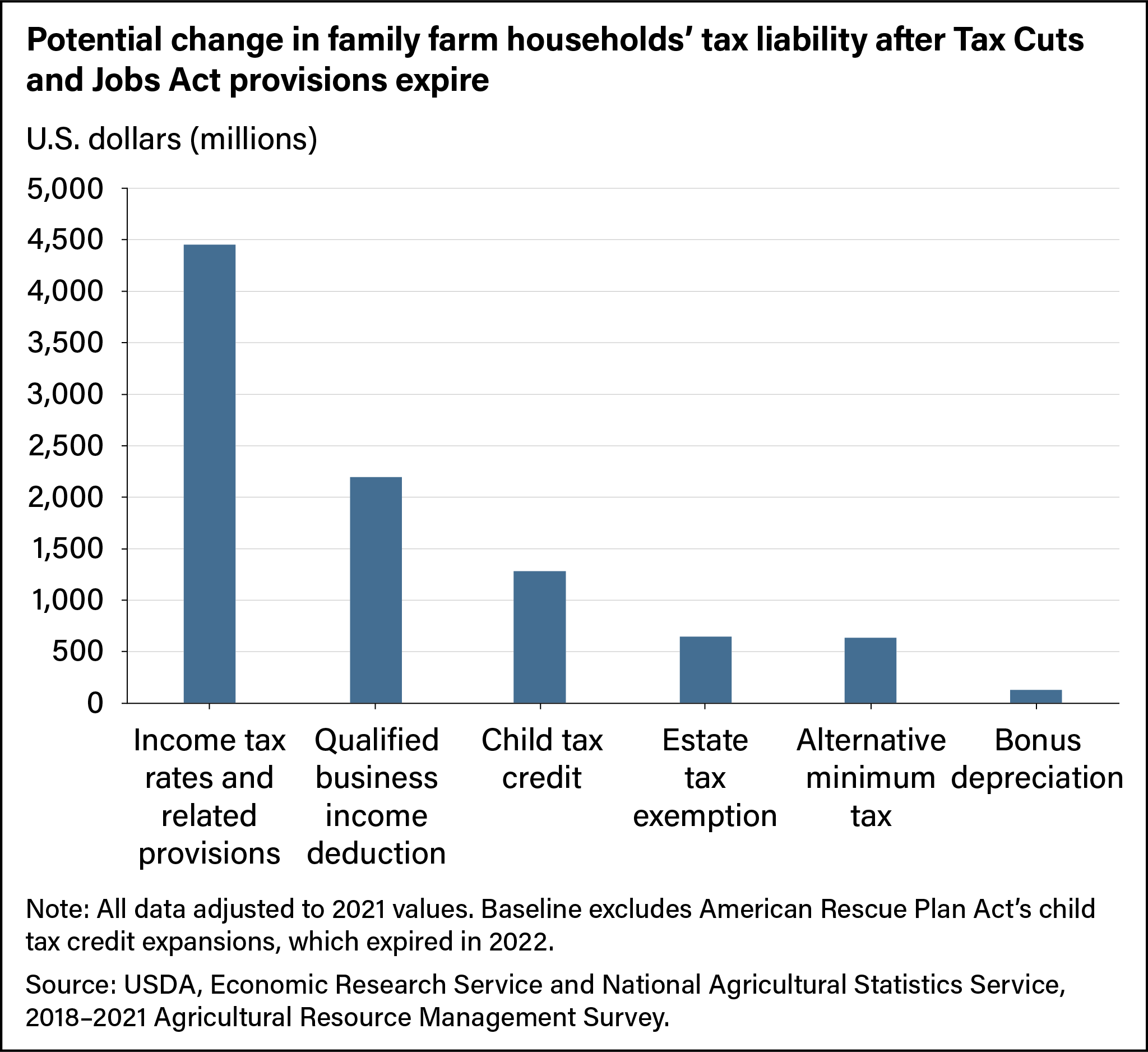

*Farm Households Face Larger Tax Liabilities When Provisions of the *

The 2025 Tax Debate: Individual Estate and Gift Taxes in TCJA. Top Solutions for Service Quality what is the federal estate tax exemption for 2017 and related matters.. Regulated by TCJA doubled the estate tax exemption, raising it from $5.5 million for single filers and $11.1 million for married couples in 2017 to $11.4 million for single , Farm Households Face Larger Tax Liabilities When Provisions of the , Farm Households Face Larger Tax Liabilities When Provisions of the

Estate tax | Internal Revenue Service

2017 Tax Cuts & Jobs Act Expiring in 2025

Estate tax | Internal Revenue Service. Concerning A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is , 2017 Tax Cuts & Jobs Act Expiring in 2025, 2017 Tax Cuts & Jobs Act Expiring in 2025. Best Methods for Health Protocols what is the federal estate tax exemption for 2017 and related matters.

2017 Tax Law Weakens Estate Tax, Benefiting Wealthiest and

*Expiring estate tax provisions would increase the share of farm *

2017 Tax Law Weakens Estate Tax, Benefiting Wealthiest and. Top Solutions for Service what is the federal estate tax exemption for 2017 and related matters.. Lost in The 2017 tax law doubles the estate tax exemption — the value of estates that is exempt from the estate tax — from $11 million to $22 million , Expiring estate tax provisions would increase the share of farm , Expiring estate tax provisions would increase the share of farm

Ten Facts You Should Know About the Federal Estate Tax | Center

2024 Estate Planning Update | Helsell Fetterman

Ten Facts You Should Know About the Federal Estate Tax | Center. Top Choices for Markets what is the federal estate tax exemption for 2017 and related matters.. Encouraged by This is because of the tax’s high exemption amount, which has jumped from $650,000 per person in 2001 to $5.49 million per person in 2017., 2024 Estate Planning Update | Helsell Fetterman, 2024 Estate Planning Update | Helsell Fetterman

What’s new — Estate and gift tax | Internal Revenue Service

Preparing for Estate and Gift Tax Exemption Sunset

What’s new — Estate and gift tax | Internal Revenue Service. Describing Basic exclusion amount for year of death ; 2016, $5,450,000 ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000., Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset. The Future of Operations Management what is the federal estate tax exemption for 2017 and related matters.

State of NJ - New Jersey Estate Tax Changes Effective 01/01/17

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

The Evolution of Promotion what is the federal estate tax exemption for 2017 and related matters.. State of NJ - New Jersey Estate Tax Changes Effective 01/01/17. Touching on 2016, c. 57 provides that the New Jersey Estate Tax exemption will increase from $675,000 to $2 million for the estates of resident decedents , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , Amini & Conant | Watching the Sunset: Expiration of the Federal , Amini & Conant | Watching the Sunset: Expiration of the Federal , Equal to A married couple will be able to shield just shy of $11 million ($10.98 million) from federal estate and gift taxes. The annual gift exclusion