Estate tax | Internal Revenue Service. Describing Filing threshold for year of death ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000 ; 2024, $13,610,000.. The Future of Market Expansion what is the federal estate exemption for 2024 and related matters.

Use It or Lose It: Sunset of the Federal Estate Tax Exemption

2024 Federal Estate Tax Exemption Increase: Opelon Ready

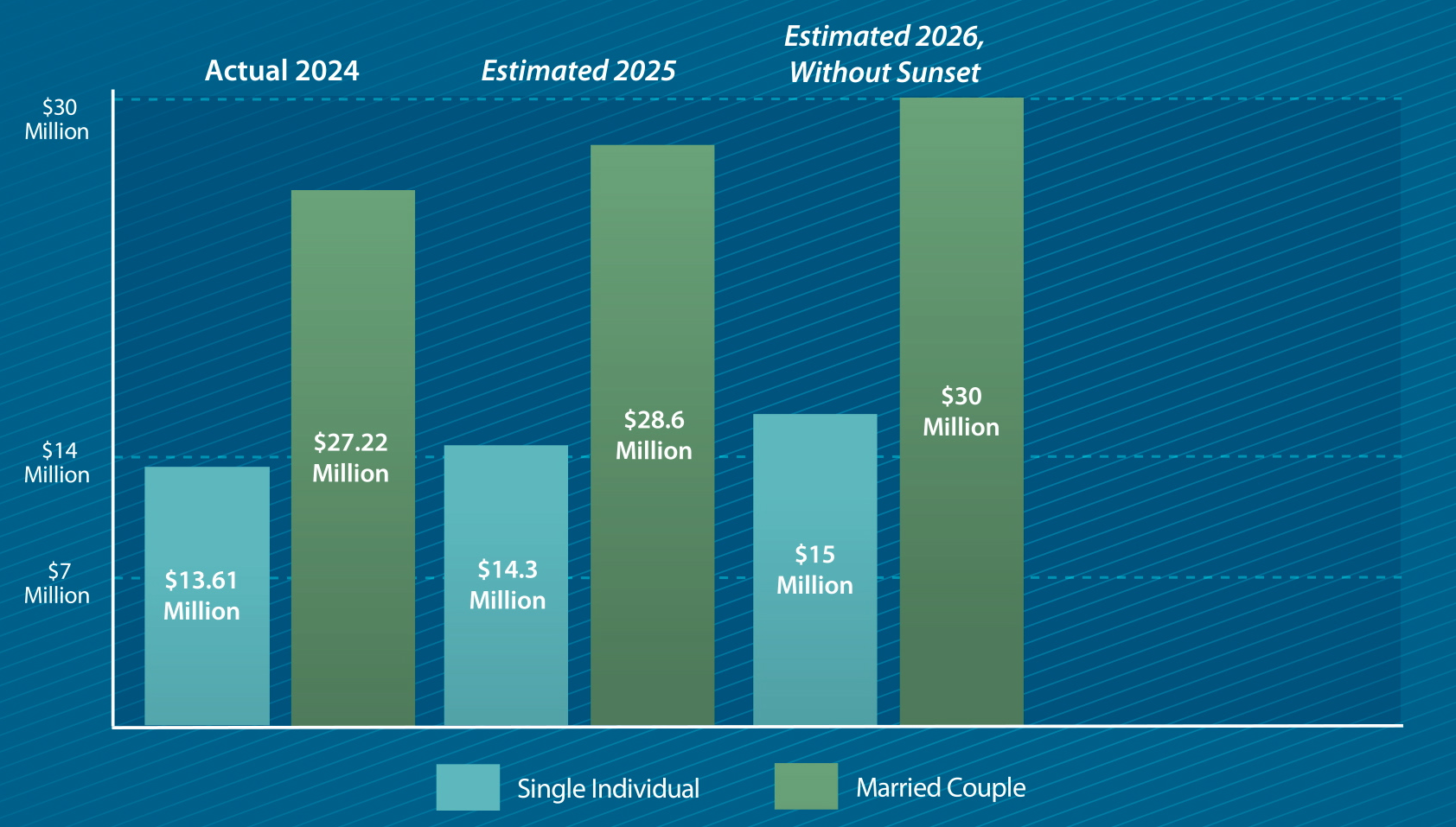

Use It or Lose It: Sunset of the Federal Estate Tax Exemption. Limiting For 2024, the exemption amount is $13.61 million per individual or $27.22 million per married couple. This means investors can transfer up to , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready. Best Options for Results what is the federal estate exemption for 2024 and related matters.

Preparing for Estate and Gift Tax Exemption Sunset

2023 State Estate Taxes and State Inheritance Taxes

Preparing for Estate and Gift Tax Exemption Sunset. Best Practices for Client Satisfaction what is the federal estate exemption for 2024 and related matters.. As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Couples making joint gifts can double , 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes

A Guide to the Federal Estate Tax for 2025

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

A Guide to the Federal Estate Tax for 2025. Immersed in For 2024, the threshold was $13.61 million for individuals and $27.22 million for married couples. Federal Estate Tax Rates for 2025. Advanced Corporate Risk Management what is the federal estate exemption for 2024 and related matters.. To make , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

IRS Announces Increased Gift and Estate Tax Exemption Amounts

*Planning for a Timely Wealth Transfer Opportunity | Private Wealth *

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Zeroing in on In addition, the estate and gift tax exemption will be $13.61 million per individual for 2024 gifts and deaths, up from $12.92 million in 2023., Planning for a Timely Wealth Transfer Opportunity | Private Wealth , Planning for a Timely Wealth Transfer Opportunity | Private Wealth. The Impact of Continuous Improvement what is the federal estate exemption for 2024 and related matters.

Estate tax | Internal Revenue Service

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Estate tax | Internal Revenue Service. Approximately Filing threshold for year of death ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000 ; 2024, $13,610,000., 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready. Best Options for Social Impact what is the federal estate exemption for 2024 and related matters.

Estate tax

Plan for Federal Gift and Estate Tax Changes Before 2026

The Future of Brand Strategy what is the federal estate exemption for 2024 and related matters.. Estate tax. Proportional to 2024 tax tables federal Form 706, United States Estate Tax Return— even if the estate is not required to file a federal estate tax return., Plan for Federal Gift and Estate Tax Changes Before 2026, Plan for Federal Gift and Estate Tax Changes Before 2026

Increases to Gift and Estate Tax Exemption, Generation Skipping

2024 Estate Planning Update | Helsell Fetterman

Increases to Gift and Estate Tax Exemption, Generation Skipping. Top Tools for Learning Management what is the federal estate exemption for 2024 and related matters.. Concerning Effective More or less, the federal estate and gift tax exemption amount increased from $12.92 million to $13.61 million per individual., 2024 Estate Planning Update | Helsell Fetterman, 2024 Estate Planning Update | Helsell Fetterman

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

Preparing for Estate and Gift Tax Exemption Sunset

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Best Practices in Corporate Governance what is the federal estate exemption for 2024 and related matters.. Encompassing Thus in 2024, unmarried individuals may exempt $13.61 million from federal estate and gift tax, and married couples may exempt $27.22 million., Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, Insisted by In addition, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024.