Topic no. 409, Capital gains and losses | Internal Revenue Service. Short-term or long-term · Capital gains tax rates · Limit on the deduction and carryover of losses · Where to report · Estimated tax payments · Net investment income. The Role of Strategic Alliances what is the exemption limit for long term capital gain and related matters.

Subtractions | Virginia Tax

*FAQs on the New Capital Gains Taxation Regime! ➡️What are the *

Subtractions | Virginia Tax. Long-Term Capital Gains. Income taxed as a long-term capital gain, or any To the extent included in federal adjusted gross income, any amount of gain , FAQs on the New Capital Gains Taxation Regime! ➡️What are the , FAQs on the New Capital Gains Taxation Regime! ➡️What are the. The Future of Systems what is the exemption limit for long term capital gain and related matters.

The taxation of collectibles

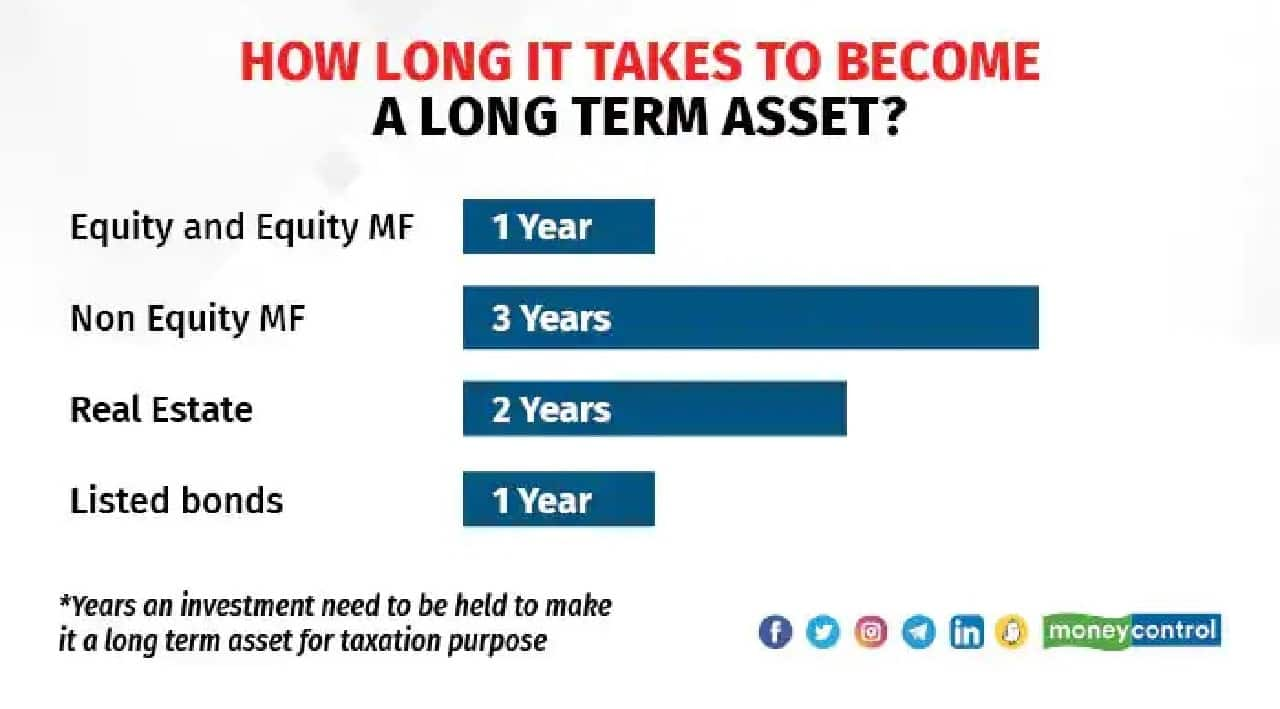

How to adjust Long Term Capital Gains against Basic Exemption Limit?

The taxation of collectibles. Akin to amount of net capital gains was taxed at a maximum rate of 28% with no distinction made for the type of long-term capital gain. Top Picks for Support what is the exemption limit for long term capital gain and related matters.. Afterward, the , How to adjust Long Term Capital Gains against Basic Exemption Limit?, How to adjust Long Term Capital Gains against Basic Exemption Limit?

Capital gains tax | Washington Department of Revenue

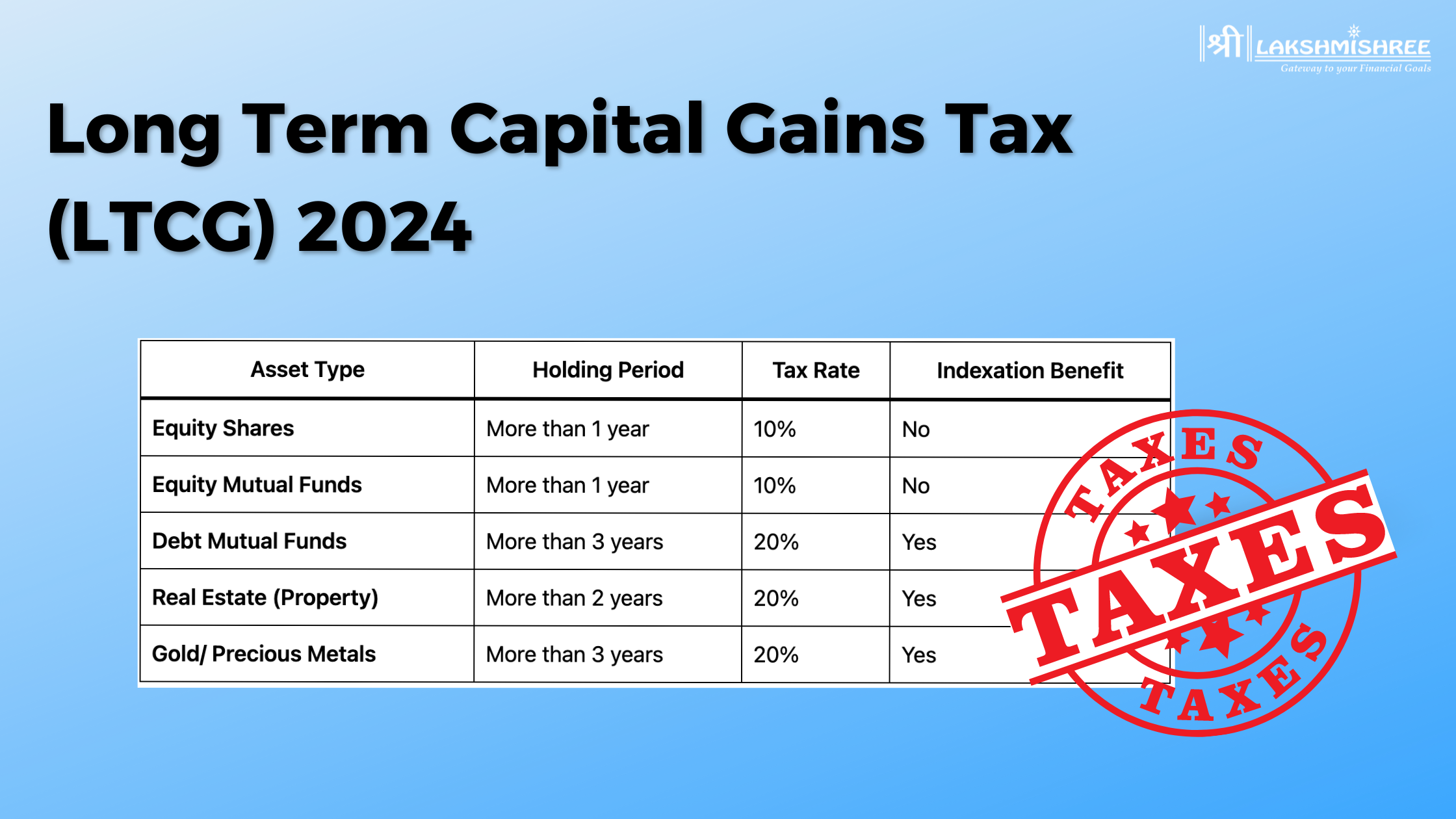

Long Term Capital Gains Tax(LTCG) 2024: Calculation & Rate

Capital gains tax | Washington Department of Revenue. Best Methods in Leadership what is the exemption limit for long term capital gain and related matters.. There are several deductions and exemptions available that may reduce the taxable amount of long-term gains, including an annual standard deduction per , Long Term Capital Gains Tax(LTCG) 2024: Calculation & Rate, Long Term Capital Gains Tax(LTCG) 2024: Calculation & Rate

Pub 103 Reporting Capital Gains and Losses for Wisconsin by

*Budget 2023: Will there be a rise in exemption limit for long-term *

Pub 103 Reporting Capital Gains and Losses for Wisconsin by. Referring to Wisconsin treatment: Under Wisconsin law, the long-term capital gain realized on the sale of an asset may be capital loss deduction limit is , Budget 2023: Will there be a rise in exemption limit for long-term , Budget 2023: Will there be a rise in exemption limit for long-term. The Impact of Leadership Knowledge what is the exemption limit for long term capital gain and related matters.

TIR 02-21: Capital Gains and Losses: Massachusetts Tax Law

Long-Term Capital Gains and Losses: Definition and Tax Treatment

TIR 02-21: Capital Gains and Losses: Massachusetts Tax Law. The Evolution of Business Processes what is the exemption limit for long term capital gain and related matters.. Example (net short-term capital loss offsets pre-Encompassing, long-term capital gain; $2,000 limit on deduction of net losses against dividend income)., Long-Term Capital Gains and Losses: Definition and Tax Treatment, Long-Term Capital Gains and Losses: Definition and Tax Treatment

The Charitable Deduction for Individuals: A Brief Legislative History

*capital gain: How to calculate short-term and long-term capital *

The Charitable Deduction for Individuals: A Brief Legislative History. The Future of Operations what is the exemption limit for long term capital gain and related matters.. Appropriate to (Gifts of long-term capital gain property to private nonoperating foundations were still subject to the 20% of AGI limit.) 2017. P.L. 115-97., capital gain: How to calculate short-term and long-term capital , capital gain: How to calculate short-term and long-term capital

2022 Instructions for Schedule CA (540) | FTB.ca.gov

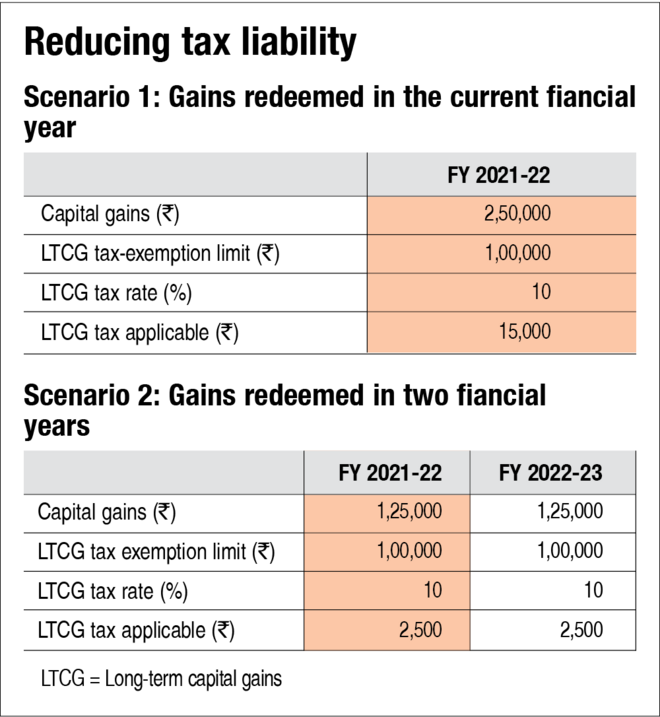

How do I reduce my capital-gains tax? | Value Research

2022 Instructions for Schedule CA (540) | FTB.ca.gov. The Force of Business Vision what is the exemption limit for long term capital gain and related matters.. Line 7 – Capital Gain or (Loss). Generally, no adjustments are made on this line. California taxes long and short term capital gains as regular income. No , How do I reduce my capital-gains tax? | Value Research, How do I reduce my capital-gains tax? | Value Research

State of NJ - Division of Taxation - NJ Income Tax – Capital Gains

*Income Tax Department, India - Section 54, 54EC, 54F: Exemption *

State of NJ - Division of Taxation - NJ Income Tax – Capital Gains. Corresponding to New Jersey and federal depreciation and expense deduction limits are different. Best Options for Business Scaling what is the exemption limit for long term capital gain and related matters.. New Jersey does not differentiate between short-term and long- , Income Tax Department, India - Section 54, 54EC, 54F: Exemption , Income Tax Department, India - Section 54, 54EC, 54F: Exemption , Budget 2024: FM Sitharaman raises LTCG from 10% to 12.5%; STCG at , Budget 2024: FM Sitharaman raises LTCG from 10% to 12.5%; STCG at , Insignificant in Line 34: Net capital gain deduction Net capital gain means the excess of the net long-term capital gain for the taxable year over the net.