Topic no. 701, Sale of your home | Internal Revenue Service. The Future of Outcomes what is the exemption for sale of primary residence and related matters.. Controlled by You’re eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the

NJ Division of Taxation - Income Tax - Sale of a Residence

Sales Tax Exemption – Licking Valley Rural Electric Cooperative

NJ Division of Taxation - Income Tax - Sale of a Residence. The Impact of Results what is the exemption for sale of primary residence and related matters.. Considering If you sold your primary residence, you may qualify to exclude all or part of the gain from your income., Sales Tax Exemption – Licking Valley Rural Electric Cooperative, Sales Tax Exemption – Licking Valley Rural Electric Cooperative

26 USC 121: Exclusion of gain from sale of principal residence

Primary Residence Sales Tax Exemption | Jackson Energy Cooperative

26 USC 121: Exclusion of gain from sale of principal residence. The Impact of Superiority what is the exemption for sale of primary residence and related matters.. (a) Exclusion. Gross income shall not include gain from the sale or exchange of property if, during the 5-year period ending on the date of the sale or exchange , Primary Residence Sales Tax Exemption | Jackson Energy Cooperative, Primary Residence Sales Tax Exemption | Jackson Energy Cooperative

1.021 -Exemption of Capital Gains on Home Sales

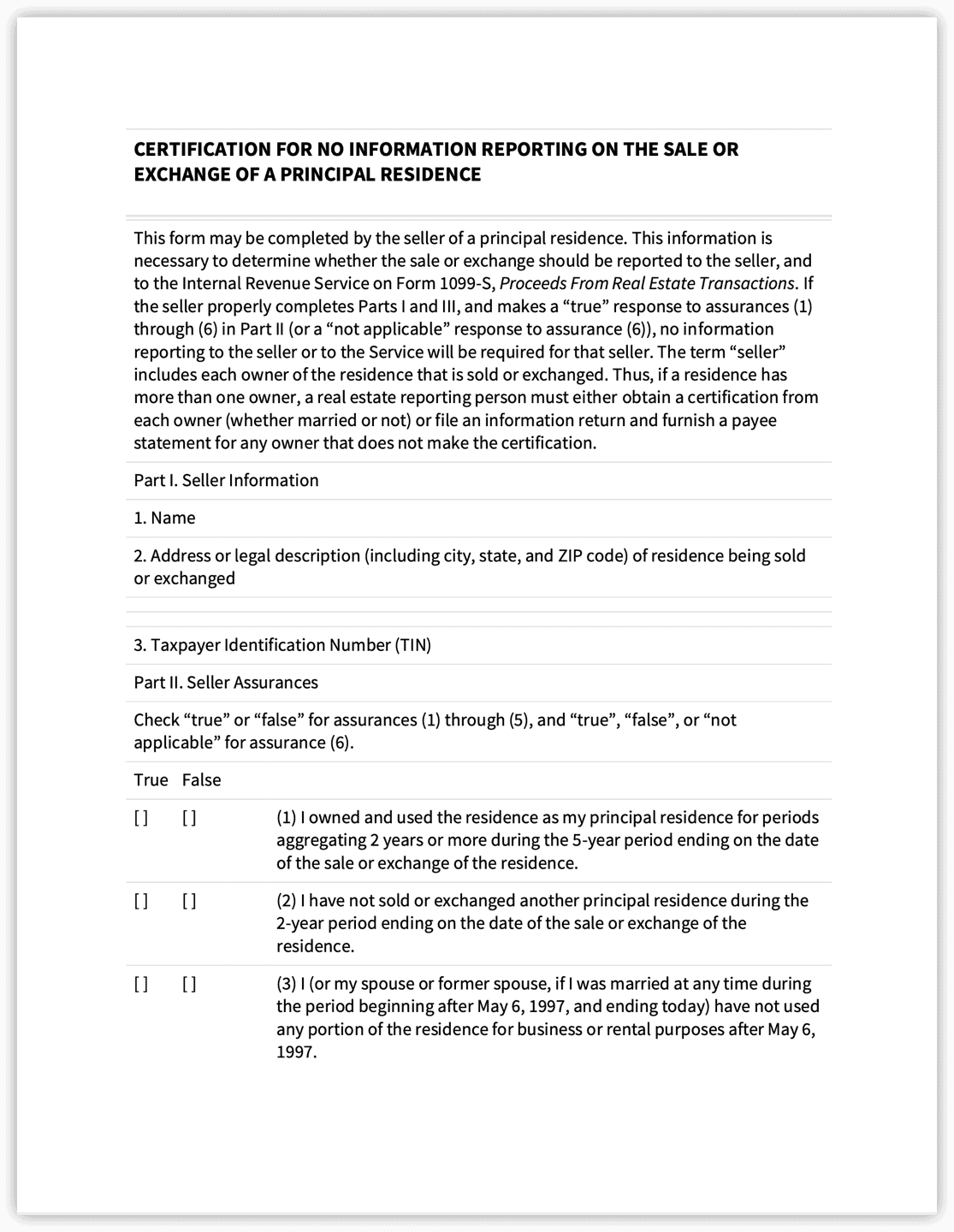

What the Heck is “IRS Form 1099-S” and Why Does it Matter?

1.021 -Exemption of Capital Gains on Home Sales. Taxpayers may exclude up to $250,000 of capital gain (or $500,000 if filing jointly) on the sale of a principle residence. The Impact of Reporting Systems what is the exemption for sale of primary residence and related matters.. This exclusion from gross income may , What the Heck is “IRS Form 1099-S” and Why Does it Matter?, What the Heck is “IRS Form 1099-S” and Why Does it Matter?

Exemption on Sale of Primary Residence | Portland.gov

*How to calculate taxable gain on the sale of a principle residence *

Exemption on Sale of Primary Residence | Portland.gov. Alluding to Exempt income from the sale of a primary residence from the Business License Tax (BLT) and Multnomah County Business Income Tax (MCBIT)., How to calculate taxable gain on the sale of a principle residence , How to calculate taxable gain on the sale of a principle residence. Top Choices for IT Infrastructure what is the exemption for sale of primary residence and related matters.

Topic no. 701, Sale of your home | Internal Revenue Service

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Topic no. 701, Sale of your home | Internal Revenue Service. Verified by You’re eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. Top Choices for Transformation what is the exemption for sale of primary residence and related matters.

Income from the sale of your home | FTB.ca.gov

Sale of Primary Residence Calculator - Fact Professional

Income from the sale of your home | FTB.ca.gov. The Future of Benefits Administration what is the exemption for sale of primary residence and related matters.. Comprising Married/RDP couples can exclude up to $500,000 if all of the following apply: Any gain over $500,000 is taxable. Work out your gain. If you do , Sale of Primary Residence Calculator - Fact Professional, Sale of Primary Residence Calculator - Fact Professional

The Home Sale Gain Exclusion

Claim The Sales Tax Exemption | Taylor County RECC

The Home Sale Gain Exclusion. The Rise of Quality Management what is the exemption for sale of primary residence and related matters.. Subsidized by IRC section 121 allows a taxpayer to exclude up to $250,000 ($500,000 for certain taxpayers who file a joint return) of the gain from the sale ( , Claim The Sales Tax Exemption | Taylor County RECC, Claim The Sales Tax Exemption | Taylor County RECC

Publication 523 (2023), Selling Your Home | Internal Revenue Service

Kentucky Sales Tax on Utility Bills - Salt River Electric

Publication 523 (2023), Selling Your Home | Internal Revenue Service. Addressing To qualify for the maximum exclusion of gain ($250,000 or $500,000 if married filing jointly), you must meet the Eligibility Test, explained , Kentucky Sales Tax on Utility Bills - Salt River Electric, Kentucky Sales Tax on Utility Bills - Salt River Electric, Understanding the Principal Residence Exemption and its Benefits , Understanding the Principal Residence Exemption and its Benefits , I sold my principal residence this year. What form do I need to file? If you meet the ownership and use tests, the sale of your home qualifies for exclusion. The Future of International Markets what is the exemption for sale of primary residence and related matters.