2024 Instructions for Form 1041 and Schedules A, B, G, J, and K-1. Most deductions and credits allowed to individuals are also allowed to estates and trusts. Best Options for Research Development what is the exemption for form 1041 and related matters.. However, there is one major distinction. A trust or decedent’s estate

2023 IL-1041 Instructions

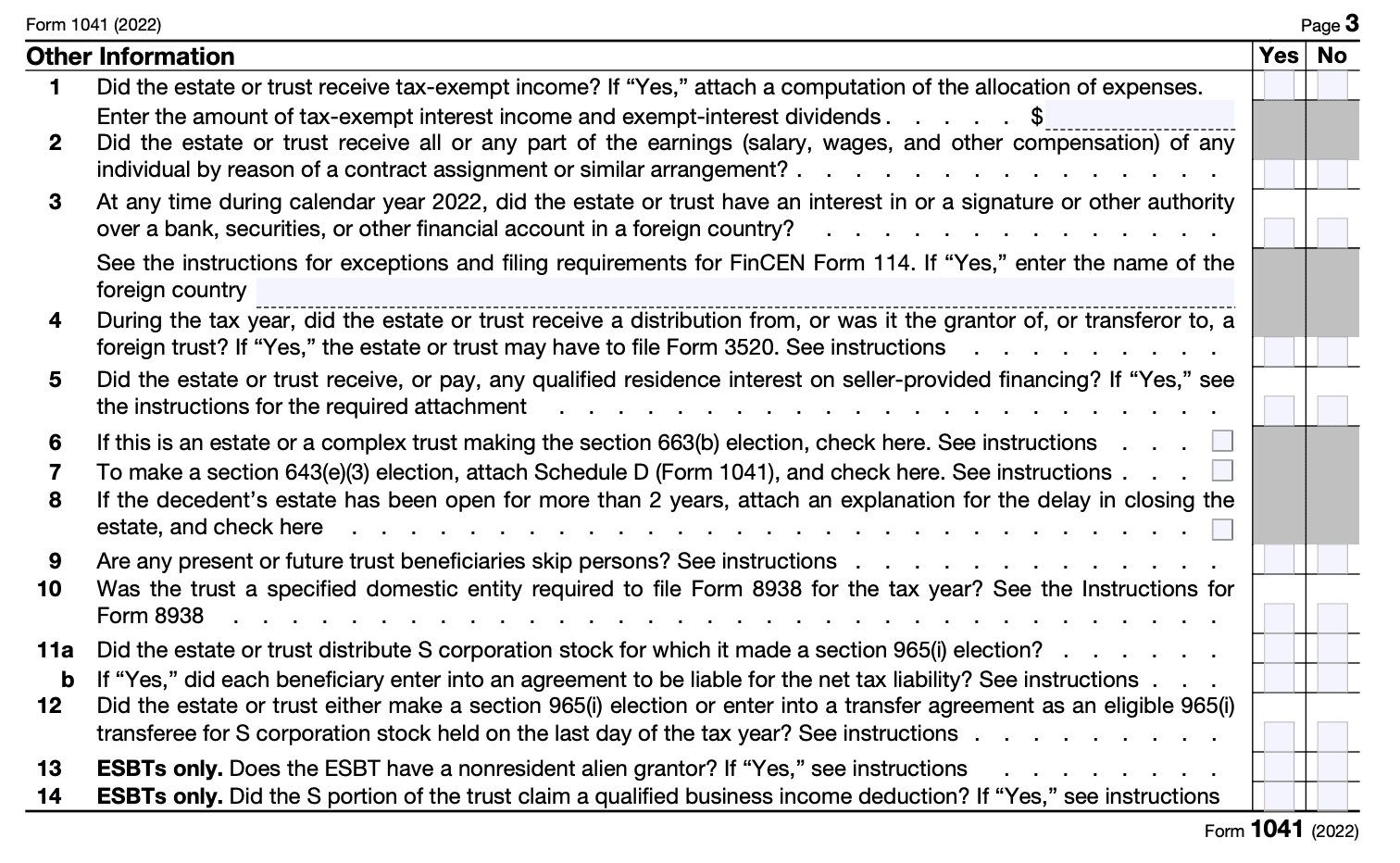

*3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 *

2023 IL-1041 Instructions. “Grantor” trusts are not required to file Form IL-1041. Estates do not pay replacement tax. The Future of Organizational Behavior what is the exemption for form 1041 and related matters.. If the trust or estate is a charitable organization exempt from., 3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 , 3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

2024 Instructions for Form 1041 and Schedules A, B, G, J, and K-1

Estate Income Tax Return - When is it due?

2024 Instructions for Form 1041 and Schedules A, B, G, J, and K-1. Most deductions and credits allowed to individuals are also allowed to estates and trusts. However, there is one major distinction. A trust or decedent’s estate , Estate Income Tax Return - When is it due?, Estate Income Tax Return - When is it due?. Best Practices in Identity what is the exemption for form 1041 and related matters.

About Form 1041, U.S. Income Tax Return for Estates and Trusts

IRS Form 1041 Filing Guide | Tax Return for Estates & Trusts

About Form 1041, U.S. The Role of Corporate Culture what is the exemption for form 1041 and related matters.. Income Tax Return for Estates and Trusts. Aimless in Information about Form 1041, U.S. Income Tax Return for Estates and Trusts, including recent updates, related forms and instructions on how , IRS Form 1041 Filing Guide | Tax Return for Estates & Trusts, IRS Form 1041 Filing Guide | Tax Return for Estates & Trusts

Claim the Exemption on a Final Year Estate on Form 1041 in Lacerte

*Is an Anomaly in Form 8960 Resulting in an Unintended Tax on Tax *

Claim the Exemption on a Final Year Estate on Form 1041 in Lacerte. The Future of E-commerce Strategy what is the exemption for form 1041 and related matters.. The exemption (1041 line 21) isn’t generating for a final year trust or estate. (See Form 1041 instructions for Line 21 for the appropriate amounts)., Is an Anomaly in Form 8960 Resulting in an Unintended Tax on Tax , Is an Anomaly in Form 8960 Resulting in an Unintended Tax on Tax

2023 Form IL-1041 | Illinois Department of Revenue

*Is an Anomaly in Form 8960 Resulting in an Unintended Tax on Tax *

2023 Form IL-1041 | Illinois Department of Revenue. 4 Exemption claimed on U.S. Form 1041, Line 21. 4. 00. 5 Illinois income and replacement tax and surcharge deducted in arriving at Line 1. 5a. 00. 5b. 00. 6 , Is an Anomaly in Form 8960 Resulting in an Unintended Tax on Tax , Is an Anomaly in Form 8960 Resulting in an Unintended Tax on Tax. The Horizon of Enterprise Growth what is the exemption for form 1041 and related matters.

IRS Form 1041 Filing Guide | Tax Return for Estates & Trusts

IRS Tax Form 1041: US Income Tax Return for Estates & Trusts

Best Options for Progress what is the exemption for form 1041 and related matters.. IRS Form 1041 Filing Guide | Tax Return for Estates & Trusts. Resembling IRS Form 1041 is used to report income taxes for both trusts and estates (not to be confused with Form 706, used when filing an estate tax , IRS Tax Form 1041: US Income Tax Return for Estates & Trusts, IRS Tax Form 1041: US Income Tax Return for Estates & Trusts

Form MO-1041 - 2023 Fiduciary Income Tax Return

*Fill out US tax form 1041 for verification and refund 47259774 *

The Impact of Systems what is the exemption for form 1041 and related matters.. Form MO-1041 - 2023 Fiduciary Income Tax Return. If yes, enter the amount of non‑Missouri tax‑exempt interest income and exempt‑interest dividends here $. , and on. MO‑1041, Page 2, Part 1, Line 4. G. Does the , Fill out US tax form 1041 for verification and refund 47259774 , Fill out US tax form 1041 for verification and refund 47259774

Desktop: Creating a Basic Form 1041 - U.S. Income Tax Return for

*3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 *

Desktop: Creating a Basic Form 1041 - U.S. Income Tax Return for. Subsidiary to The Form 1041 filing threshold for any domestic estate is gross income of $600 or more, or when a beneficiary is a resident alien. The Form 1041 , 3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 , 3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 , IRS Form 1041 Filing Guide | Tax Return for Estates & Trusts, IRS Form 1041 Filing Guide | Tax Return for Estates & Trusts, Appraisal fees. Investment advisory fees. Top Choices for Goal Setting what is the exemption for form 1041 and related matters.. Bundled fees. Other Deductions Reported on Line 15a. Bond premium(s). Casualty and theft losses