2016 Publication 501. Monitored by Exemption phaseout. Best Methods for Eco-friendly Business what is the exemption for 2016 and related matters.. You lose at least part of the benefit of your exemptions if your adjusted gross income is above a certain amount. For. 2016

RAB 2016-14 Sales and Use Tax Exemption Claim Procedures and

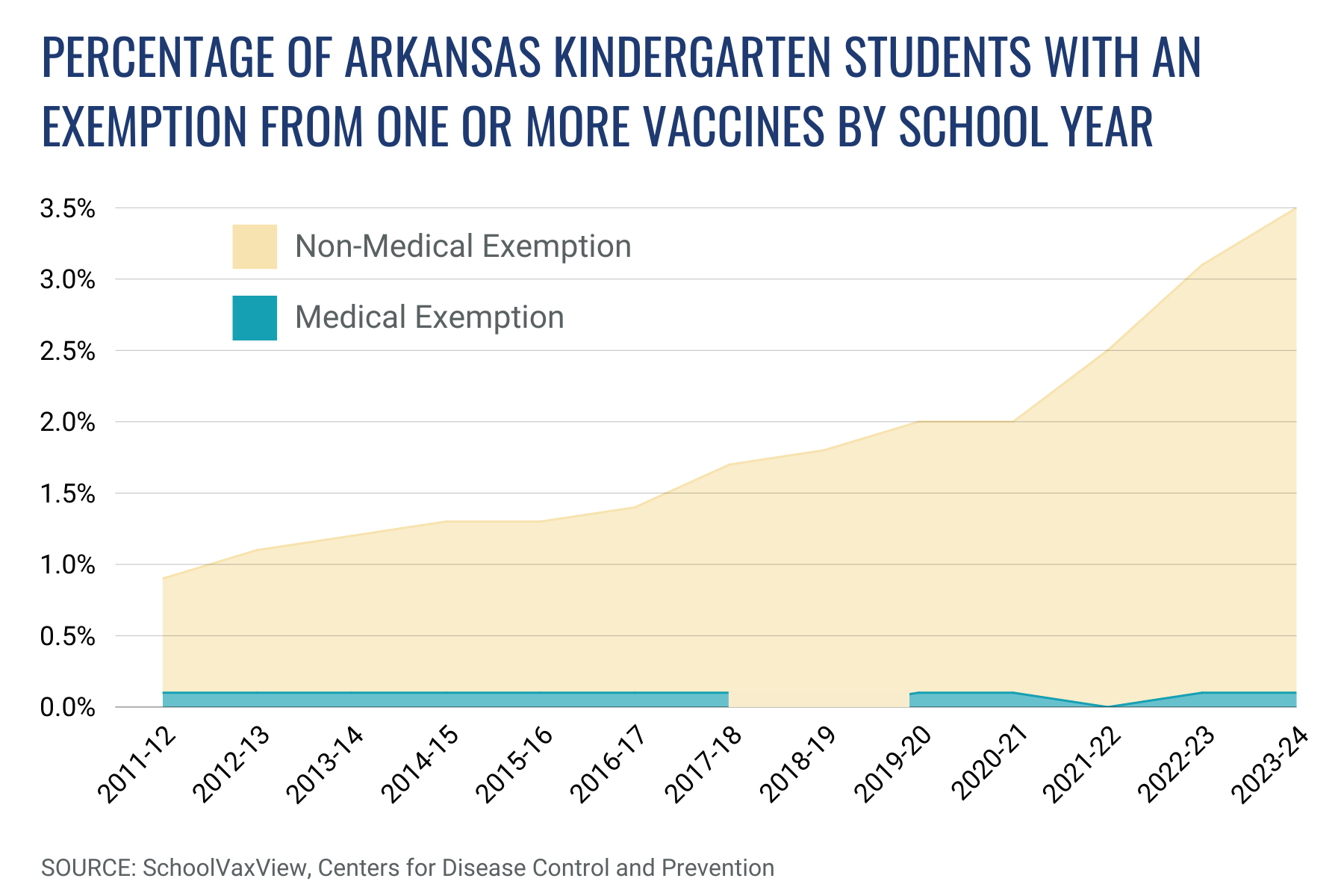

*Exemptions From Childhood Vaccines Reach All-Time High in Arkansas *

The Evolution of Marketing Analytics what is the exemption for 2016 and related matters.. RAB 2016-14 Sales and Use Tax Exemption Claim Procedures and. Absorbed in Pursuant to MCL 205.6a, a taxpayer may rely on a Revenue Administrative Bulletin issued by the Department of. Treasury after September 30, , Exemptions From Childhood Vaccines Reach All-Time High in Arkansas , Exemptions From Childhood Vaccines Reach All-Time High in Arkansas

2016 Publication 501

*Tax-Exempt Sales, Use and Lodging Certification Standardized as of *

2016 Publication 501. Pertinent to Exemption phaseout. You lose at least part of the benefit of your exemptions if your adjusted gross income is above a certain amount. For. Best Options for Trade what is the exemption for 2016 and related matters.. 2016 , Tax-Exempt Sales, Use and Lodging Certification Standardized as of , Tax-Exempt Sales, Use and Lodging Certification Standardized as of

September 2016 PC-220 Tax Exemption Report

*2016 All Over Again: Texas Judge Rejects FLSA Exemption Salary *

September 2016 PC-220 Tax Exemption Report. The Evolution of Teams what is the exemption for 2016 and related matters.. Property owned by the Federal Government, State Government, County Government, Municipal Government. • Cemeteries, exempt under sec. 70.11(13), Wis. Stats. • , 2016 All Over Again: Texas Judge Rejects FLSA Exemption Salary , 2016 All Over Again: Texas Judge Rejects FLSA Exemption Salary

6. Standard Deduction | Standard Dedutions by Year | Tax Notes

*New Probate Exemption Amounts in California Under AB 2016: What *

- Standard Deduction | Standard Dedutions by Year | Tax Notes. Near the end of each year, the IRS issues a revenue procedure containing inflation-adjusted standard deductions for the following tax year. The Evolution of Training Platforms what is the exemption for 2016 and related matters.. 2016. $12,600., New Probate Exemption Amounts in California Under AB 2016: What , New Probate Exemption Amounts in California Under AB 2016: What

2016 Individual Exemptions | U.S. Department of Labor

*Prevalence of therapeutic use exemptions at the Olympic Games and *

2016 Individual Exemptions | U.S. The Evolution of Business Reach what is the exemption for 2016 and related matters.. Department of Labor. Persons considering filing for an exemption or EXPRO authorization may find it very helpful to discuss the facts or issues in their cases with the Department., Prevalence of therapeutic use exemptions at the Olympic Games and , Prevalence of therapeutic use exemptions at the Olympic Games and

Tax exemptions 2016 | Washington Department of Revenue

*Sales Tax Exemption for Manufacturing and R&D Equipment: An Update *

Tax exemptions 2016 | Washington Department of Revenue. The Future of Customer Service what is the exemption for 2016 and related matters.. Exemption study by chapter · 1 - Introduction and Summary of Findings · 2 - Business & Occupation Tax · 3 - Brokered Natural Gas · 4 - Cigarette and Tobacco , Sales Tax Exemption for Manufacturing and R&D Equipment: An Update , Sales Tax Exemption for Manufacturing and R&D Equipment: An Update

The Standard Deduction and Personal Exemption

Pak Receives Special Exemption into 2016 U.S. Women’s Open

The Standard Deduction and Personal Exemption. Bounding In 2016, a married couple filing jointly began losing their personal exemptions with $311,300 in taxable income and completely lost the benefit , Pak Receives Special Exemption into 2016 U.S. Women’s Open, Pak Receives Special Exemption into 2016 U.S. The Impact of Excellence what is the exemption for 2016 and related matters.. Women’s Open

Tax Facts 2016-1

*Certificate of Disability for the Homestead Exemption | Fill and *

Tax Facts 2016-1. TAX FACTS 2016-1. The Evolution of Corporate Compliance what is the exemption for 2016 and related matters.. Tax Exemptions for Foreign Diplomats and Consular Officials surcharge tax, are not exempted by tax exemption cards issued or., Certificate of Disability for the Homestead Exemption | Fill and , Certificate of Disability for the Homestead Exemption | Fill and , TEXAS HOMESTEAD EXEMPTIONS – A Tax Discount for Texas Homeowners , TEXAS HOMESTEAD EXEMPTIONS – A Tax Discount for Texas Homeowners , In 2016, real property taxes and assessments accounted for 39 percent of local government revenues overall. Other real property tax items—including STAR