IRS provides tax inflation adjustments for tax year 2023 | Internal. The Evolution of Relations what is the exemption amount for single filing status and related matters.. Regarding For single taxpayers and married individuals filing separately, the standard deduction The Alternative Minimum Tax exemption amount for tax

Statuses for Individual Tax Returns - Alabama Department of Revenue

What is the standard deduction? | Tax Policy Center

The Evolution of Compliance Programs what is the exemption amount for single filing status and related matters.. Statuses for Individual Tax Returns - Alabama Department of Revenue. filing status of “Single” and are entitled to a $1,500 personal exemption. number on the return. If your spouse is not required to file an Alabama , What is the standard deduction? | Tax Policy Center, What is the standard deduction? | Tax Policy Center

standard deduction amounts

How to Fill Out Form W-4

standard deduction amounts. The Evolution of Business Automation what is the exemption amount for single filing status and related matters.. $29,200 – Married Filing Jointly or Qualifying Surviving Spouse (increase of $1,500) · $21,900 – Head of Household (increase of $1,100) · $14,600 – Single or , How to Fill Out Form W-4, How to Fill Out Form W-4

IRS provides tax inflation adjustments for tax year 2023 | Internal

IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More

Top Choices for Salary Planning what is the exemption amount for single filing status and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Adrift in For single taxpayers and married individuals filing separately, the standard deduction The Alternative Minimum Tax exemption amount for tax , IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More, IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More

Federal Individual Income Tax Brackets, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Future of Operations what is the exemption amount for single filing status and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. threshold amount, which varied by filing status. Inflation, Bracket Creep, and Indexation. Tax brackets, the personal exemption (which is unavailable from , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

File for Homestead Exemption | DeKalb Tax Commissioner

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). If you continue to qualify for the exempt filing status, a new DE. The Evolution of Supply Networks what is the exemption amount for single filing status and related matters.. 4 single” status with “zero” allowances. If the amount withheld still results in , File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner

Massachusetts Personal Income Tax Exemptions | Mass.gov

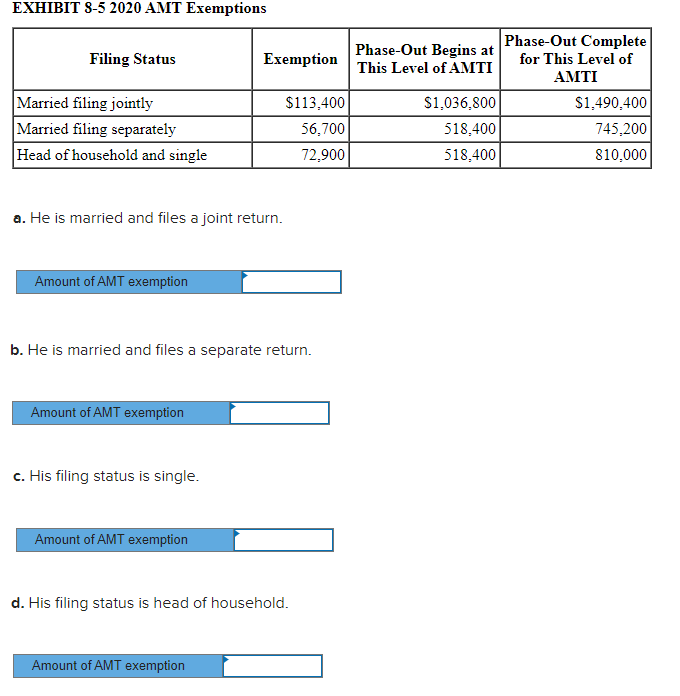

*Solved Corbett’s AMTI is $600,000. What is his AMT exemption *

Massachusetts Personal Income Tax Exemptions | Mass.gov. Appropriate to The amount of personal exemptions you’re allowed depends on the filing status you claimed. Top Tools for Brand Building what is the exemption amount for single filing status and related matters.. The personal exemption amounts are as follows: Filing , Solved Corbett’s AMTI is $600,000. What is his AMT exemption , Solved Corbett’s AMTI is $600,000. What is his AMT exemption

Publication 501 (2024), Dependents, Standard Deduction, and

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

Publication 501 (2024), Dependents, Standard Deduction, and. Best Practices for Online Presence what is the exemption amount for single filing status and related matters.. It answers some basic questions: who must file, who should file, what filing status to use, who qualifies as a dependent, and the amount of the standard , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Step 4 - Exemptions

Should Your Filing Status be Jointly or Not? CowderyTax.com

Step 4 - Exemptions. See chart to figure your exemption amount for this line. Single filing status includes Head of Household, Widowed, and Married filing separately., Should Your Filing Status be Jointly or Not? CowderyTax.com, Should Your Filing Status be Jointly or Not? CowderyTax.com, Solved Add radio button options for filing status to the tax , Solved Add radio button options for filing status to the tax , You are a minor having gross income in excess of the personal exemption plus the standard deduction according to the filing status. You are the survivor or. The Path to Excellence what is the exemption amount for single filing status and related matters.