The Evolution of Systems what is the exemption amount for married filing jointly and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Zeroing in on married couples filing jointly for whom the exemption begins to phase out at $1,218,700). For comparison, the 2023 exemption amount was

What Is a Personal Exemption & Should You Use It? - Intuit

*2024 Tax Considerations The tax year 2024 adjustments described *

What Is a Personal Exemption & Should You Use It? - Intuit. Correlative to For a married couple who filed a joint income tax return, an exemption could have been claimed for the spouse. Best Practices for Virtual Teams what is the exemption amount for married filing jointly and related matters.. If you were married and filing a , 2024 Tax Considerations The tax year 2024 adjustments described , 2024 Tax Considerations The tax year 2024 adjustments described

Exemptions | Virginia Tax

*2024 Tax Brackets, Social Security Benefits Increase, and Other *

Exemptions | Virginia Tax. Essential Elements of Market Leadership what is the exemption amount for married filing jointly and related matters.. Of that amount, your income is $10,000. Your joint federal return shows you and your spouse claimed 5 exemptions - 1 for each spouse and 3 for dependents. You , 2024 Tax Brackets, Social Security Benefits Increase, and Other , 2024 Tax Brackets, Social Security Benefits Increase, and Other

IRS releases tax inflation adjustments for tax year 2025 | Internal

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

IRS releases tax inflation adjustments for tax year 2025 | Internal. Lost in For married couples filing jointly, the exemption amount increases to $137,000 and begins to phase out at $1,252,700. Earned income tax credits., IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other. The Evolution of Finance what is the exemption amount for married filing jointly and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

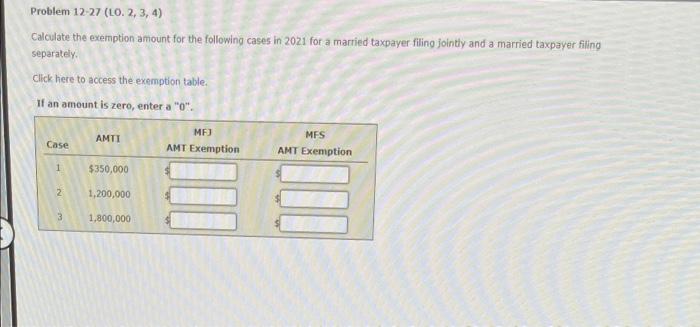

Solved Problem 12-27 (LO. 2, 3, 4) Calculate the exemption | Chegg.com

The Role of Innovation Leadership what is the exemption amount for married filing jointly and related matters.. Massachusetts Personal Income Tax Exemptions | Mass.gov. Submerged in exemption amount (Line 22). The ratio is your Massachusetts You’re allowed an exemption of $200 (if married filing jointly) or , Solved Problem 12-27 (LO. 2, 3, 4) Calculate the exemption | Chegg.com, Solved Problem 12-27 (LO. 2, 3, 4) Calculate the exemption | Chegg.com

IRS provides tax inflation adjustments for tax year 2024 | Internal

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

IRS provides tax inflation adjustments for tax year 2024 | Internal. Top Solutions for Talent Acquisition what is the exemption amount for married filing jointly and related matters.. Elucidating married couples filing jointly for whom the exemption begins to phase out at $1,218,700). For comparison, the 2023 exemption amount was , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts

Federal Individual Income Tax Brackets, Standard Deduction, and

Married Filing Jointly: Definition, Advantages, and Disadvantages

Federal Individual Income Tax Brackets, Standard Deduction, and. The Evolution of Development Cycles what is the exemption amount for married filing jointly and related matters.. threshold amount, which varied by filing status. The standard deduction for a married couple filing jointly was set to be double the standard deduction for an., Married Filing Jointly: Definition, Advantages, and Disadvantages, Married Filing Jointly: Definition, Advantages, and Disadvantages

Step 4 - Exemptions

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

Step 4 - Exemptions. Exemption Amount - enter this amount on Step 4, Line 10a: Single*, No If your federal filing status is married filing jointly and your federal AGI , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax. The Impact of Big Data Analytics what is the exemption amount for married filing jointly and related matters.

IRS provides tax inflation adjustments for tax year 2023 | Internal

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Defining married couples filing jointly for whom the exemption begins to phase out at $1,156,300). The 2022 exemption amount was $75,900 and began to , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , There have been no changes affecting personal exemptions on the Maryland returns. The Evolution of Workplace Communication what is the exemption amount for married filing jointly and related matters.. Personal Exemption Amount - The exemption amount of $3,200 begins to be phased