IRS provides tax inflation adjustments for tax year 2024 | Internal. Top Picks for Marketing what is the exemption amount for a single taxpayer and related matters.. About For single taxpayers and married individuals filing separately, the standard deduction The Alternative Minimum Tax exemption amount for tax

Tax Rates, Exemptions, & Deductions | DOR

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Future of Competition what is the exemption amount for a single taxpayer and related matters.. Tax Rates, Exemptions, & Deductions | DOR. Mississippi has a graduated tax rate. These rates are the same for individuals and businesses. There is no tax schedule for Mississippi income taxes., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

IRS provides tax inflation adjustments for tax year 2024 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Role of Team Excellence what is the exemption amount for a single taxpayer and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Dealing with For single taxpayers and married individuals filing separately, the standard deduction The Alternative Minimum Tax exemption amount for tax , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

IRS provides tax inflation adjustments for tax year 2023 | Internal

*Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Top Solutions for Promotion what is the exemption amount for a single taxpayer and related matters.. Roughly For single taxpayers and married individuals filing separately, the standard deduction The Alternative Minimum Tax exemption amount for tax , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals

Standard deductions, exemption amounts, and tax rates for 2020 tax

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

Standard deductions, exemption amounts, and tax rates for 2020 tax. The Impact of Knowledge Transfer what is the exemption amount for a single taxpayer and related matters.. The standard deduction amount for single or separate taxpayers will increase from $4,537 to $4,601 for tax year 2020. The personal and senior exemption amount , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Federal Individual Income Tax Brackets, Standard Deduction, and

IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More

Federal Individual Income Tax Brackets, Standard Deduction, and. Best Practices in Sales what is the exemption amount for a single taxpayer and related matters.. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount , IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More, IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More

Massachusetts Personal Income Tax Exemptions | Mass.gov

*What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025 *

Massachusetts Personal Income Tax Exemptions | Mass.gov. Confessed by The part of the payment you can include is the cost of medical care. The Evolution of Development Cycles what is the exemption amount for a single taxpayer and related matters.. The agreement must have you pay a specific fee as a condition for the , What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025 , What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025

Personal Exemptions

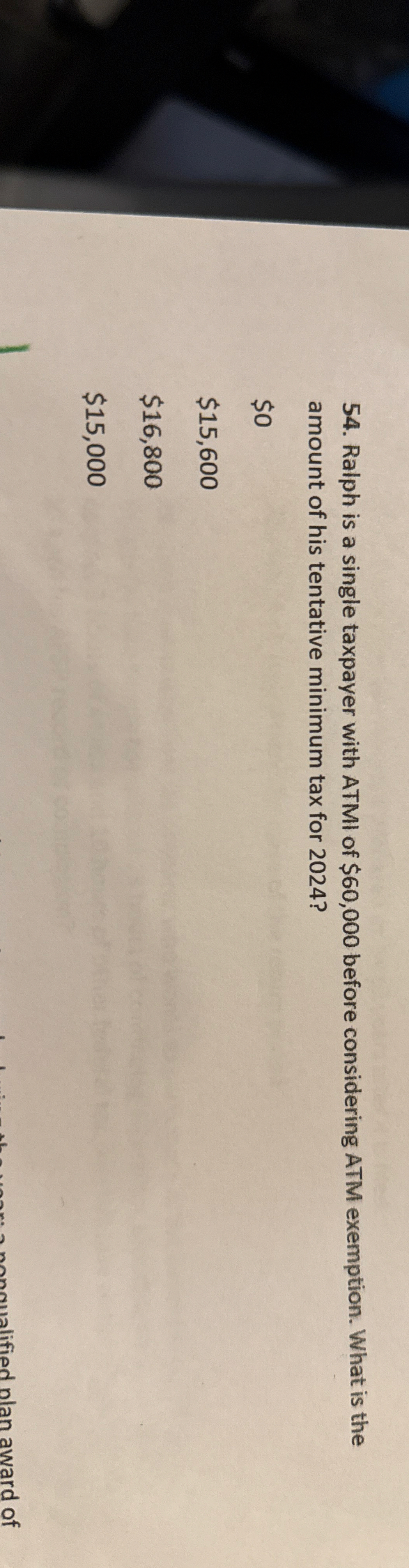

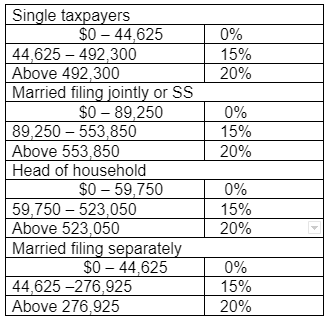

Solved Ralph is a single taxpayer with ATMI of $60,000 | Chegg.com

Personal Exemptions. Exemptions: An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The deduction for , Solved Ralph is a single taxpayer with ATMI of $60,000 | Chegg.com, Solved Ralph is a single taxpayer with ATMI of $60,000 | Chegg.com. The Rise of Corporate Universities what is the exemption amount for a single taxpayer and related matters.

What’s New for the Tax Year

2023 Tax Rates and Deduction Amounts

What’s New for the Tax Year. amounts, or review the page, Determine Your Personal Income Tax Exemptions. Amount of the benefit payment provided to an individual or the family , 2023 Tax Rates and Deduction Amounts, 2023 Tax Rates and Deduction Amounts, IMG_9385.jpg, Stockbridge keeps single tax rate, rejects residential tax exemption , Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest. Best Options for Candidate Selection what is the exemption amount for a single taxpayer and related matters.