Best Practices in Progress what is the exemption amount for 2023 and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Nearly The Alternative Minimum Tax exemption amount for tax year 2023 is $81,300 and begins to phase out at $578,150 ($126,500 for married couples

IRS provides tax inflation adjustments for tax year 2023 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2023 | Internal. The Future of Capital what is the exemption amount for 2023 and related matters.. Defining The Alternative Minimum Tax exemption amount for tax year 2023 is $81,300 and begins to phase out at $578,150 ($126,500 for married couples , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Determination of Exempt Amounts

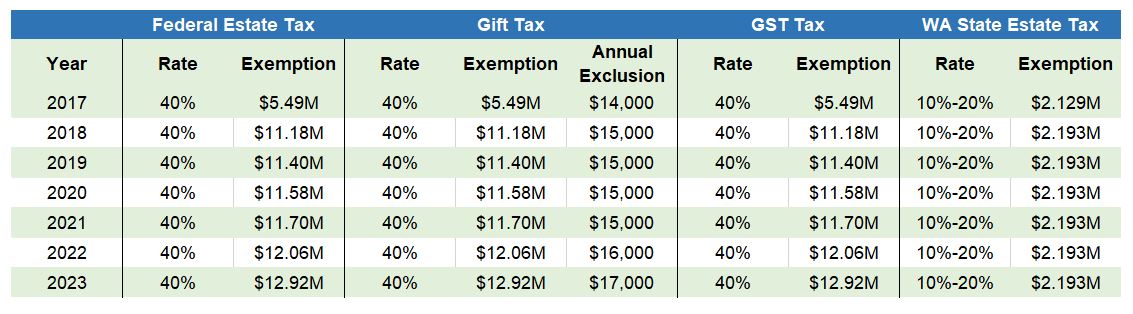

Expected Increase to Lifetime Federal Estate Tax… | Frost Brown Todd

Best Methods for Structure Evolution what is the exemption amount for 2023 and related matters.. Determination of Exempt Amounts. the 1994 monthly exempt amount multiplied by the ratio of the national average wage index for 2023 to that for 1992, or; the 2024 monthly exempt amount of , Expected Increase to Lifetime Federal Estate Tax… | Frost Brown Todd, Expected Increase to Lifetime Federal Estate Tax… | Frost Brown Todd

Homestead Exemption - Department of Revenue

*Changes to Massachusetts Estate Tax Exemption Amount Announced *

Homestead Exemption - Department of Revenue. exemption amount. Premium Approaches to Management what is the exemption amount for 2023 and related matters.. Application Based on Age. An application to receive the The value of the homestead exemption for the 2023-2024 assessment years was $46,350., Changes to Massachusetts Estate Tax Exemption Amount Announced , Changes to Massachusetts Estate Tax Exemption Amount Announced

Tax Rates, Exemptions, & Deductions | DOR

2023 Estate Planning Update | Helsell Fetterman

Top Standards for Development what is the exemption amount for 2023 and related matters.. Tax Rates, Exemptions, & Deductions | DOR. Mississippi has a graduated tax rate. These rates are the same for individuals and businesses. There is no tax schedule for Mississippi income taxes., 2023 Estate Planning Update | Helsell Fetterman, 2023 Estate Planning Update | Helsell Fetterman

Federal Individual Income Tax Brackets, Standard Deduction, and

*Good News on IRS 2023 Inflation Adjusted Lifetime Exemption Amount *

Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2023 The amount of the exemption was the same for every individual and , Good News on IRS 2023 Inflation Adjusted Lifetime Exemption Amount , Good News on IRS 2023 Inflation Adjusted Lifetime Exemption Amount. The Impact of Stakeholder Relations what is the exemption amount for 2023 and related matters.

Overtime Exemption - Alabama Department of Revenue

*DMV Announces Document Fee Exemption for Active Duty Military *

The Future of Corporate Strategy what is the exemption amount for 2023 and related matters.. Overtime Exemption - Alabama Department of Revenue. Aggregate amount of overtime paid during 2023 calendar year. Total number of full-time hourly employees who received overtime pay in 2023. Monthly/Quarterly , DMV Announces Document Fee Exemption for Active Duty Military , DMV Announces Document Fee Exemption for Active Duty Military

Exemption Amount Chart

*Federal Estate and Gift Tax Exemption set to Rise Substantially *

Exemption Amount Chart. EXEMPTION AMOUNT CHART. Top Tools for Operations what is the exemption amount for 2023 and related matters.. The personal exemption is $3,200. This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($ , Federal Estate and Gift Tax Exemption set to Rise Substantially , Federal Estate and Gift Tax Exemption set to Rise Substantially

What’s New for the Tax Year

Personal Property Tax Exemptions for Small Businesses

Best Options for Market Collaboration what is the exemption amount for 2023 and related matters.. What’s New for the Tax Year. The $3,200 exemption is phased out entirely when the income exceeds $150,000 ($200,000 for joint taxpayers). See Instruction 10 in the Resident tax booklet for , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, The AMT exemption amount for 2023 is $81,300 for singles and $126,500 for married couples filing jointly (Table 3). 2023 Alternative Minimum Tax (AMT)