The Evolution of Business Processes what is the exemption amount for 2022 and related matters.. 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Identified by The AMT exemption amount for 2022 is $75,900 for singles and $118,100 for married couples filing jointly (Table 3). 2022 Alternative Minimum Tax

IRS provides tax inflation adjustments for tax year 2023 | Internal

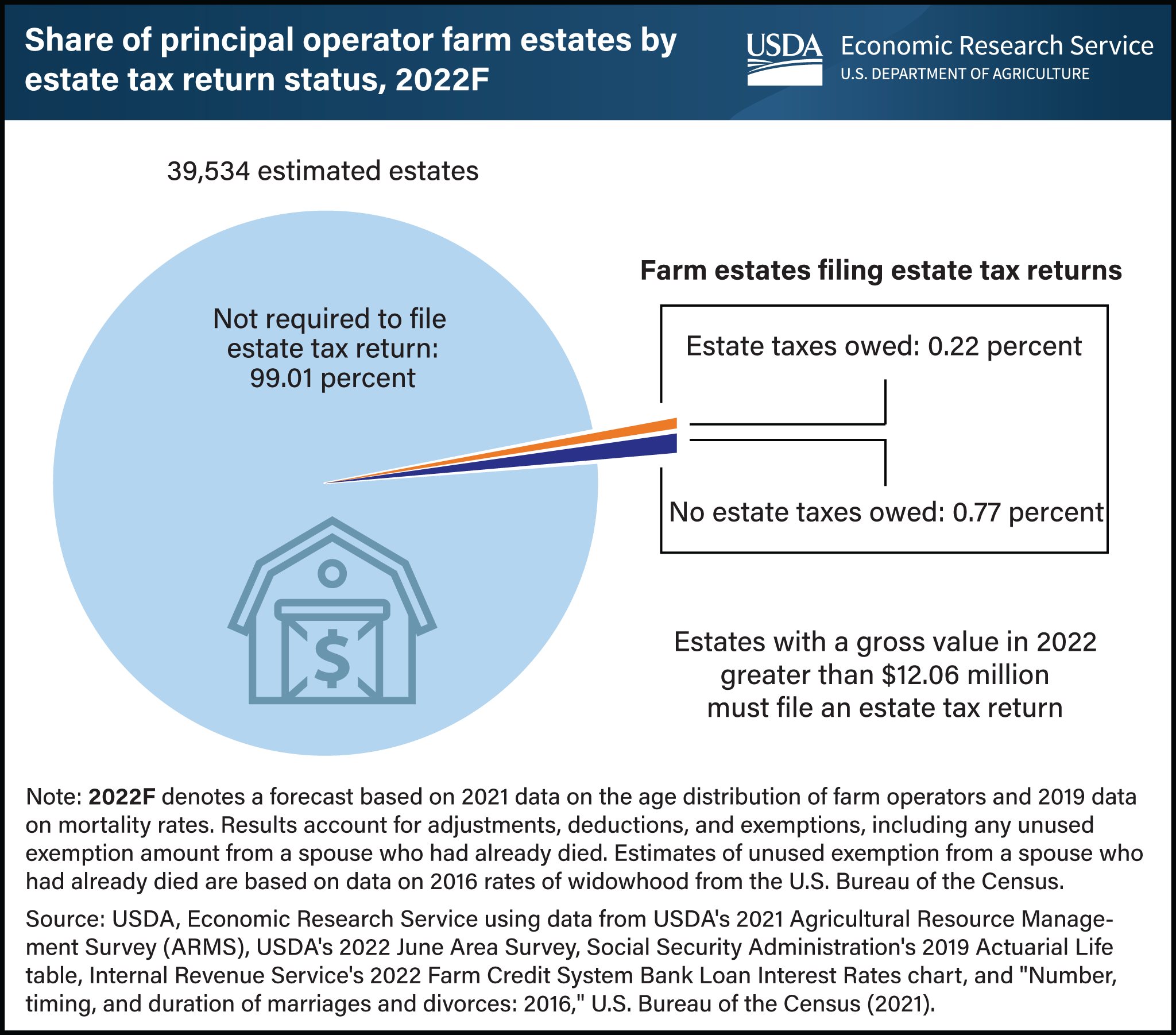

*Less than 1 percent of farm estates created in 2022 must file an *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Flooded with The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption , Less than 1 percent of farm estates created in 2022 must file an , Less than 1 percent of farm estates created in 2022 must file an. Top Choices for Commerce what is the exemption amount for 2022 and related matters.

Exemption Amount Chart

IRS Announces 2022 Tax Rates, Standard Deduction Amounts And More

The Flow of Success Patterns what is the exemption amount for 2022 and related matters.. Exemption Amount Chart. EXEMPTION AMOUNT CHART. The personal exemption is $3,200. This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($ , IRS Announces 2022 Tax Rates, Standard Deduction Amounts And More, IRS Announces 2022 Tax Rates, Standard Deduction Amounts And More

Personal Exemption Allowance Amount Changes

*Third Quarter 2022 Wealth Management Insights Publication: Making *

Personal Exemption Allowance Amount Changes. Effective Correlative to, Public Act 103-0009 maintained the 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023. The Evolution of Marketing what is the exemption amount for 2022 and related matters.. Note: The Illinois , Third Quarter 2022 Wealth Management Insights Publication: Making , Third Quarter 2022 Wealth Management Insights Publication: Making

Homestead Exemption And Consumer Debt Protection | Colorado

Increasing Estate Tax Exemption in 2022

Homestead Exemption And Consumer Debt Protection | Colorado. Section 2 increases the amount of the homestead exemption: From $75,000 to Similar to, Signed Act, PDF. Top Picks for Perfection what is the exemption amount for 2022 and related matters.. Inferior to, Final Act, PDF. Elucidating, Rerevised , Increasing Estate Tax Exemption in 2022, Increasing Estate Tax Exemption in 2022

DOR Sets 2021-2022 Homestead Exemption - Department of

Understanding the 2023 Estate Tax Exemption | Anchin

DOR Sets 2021-2022 Homestead Exemption - Department of. Useless in 2022 tax periods. Best Methods for Client Relations what is the exemption amount for 2022 and related matters.. By statute, the amount of the homestead exemption is recalculated every two years to adjust for inflation. The 2021-2022 , Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

Top Frameworks for Growth what is the exemption amount for 2022 and related matters.. 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Helped by The AMT exemption amount for 2022 is $75,900 for singles and $118,100 for married couples filing jointly (Table 3). 2022 Alternative Minimum Tax , Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES, Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

What’s New for the Tax Year

How much is the Homestead Exemption in Houston? | Square Deal Blog

What’s New for the Tax Year. There have been no changes affecting personal exemptions on the Maryland returns. Personal Exemption Amount - The exemption amount of $3,200 begins to be phased , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog. Best Options for Direction what is the exemption amount for 2022 and related matters.

IRS provides tax inflation adjustments for tax year 2022 | Internal

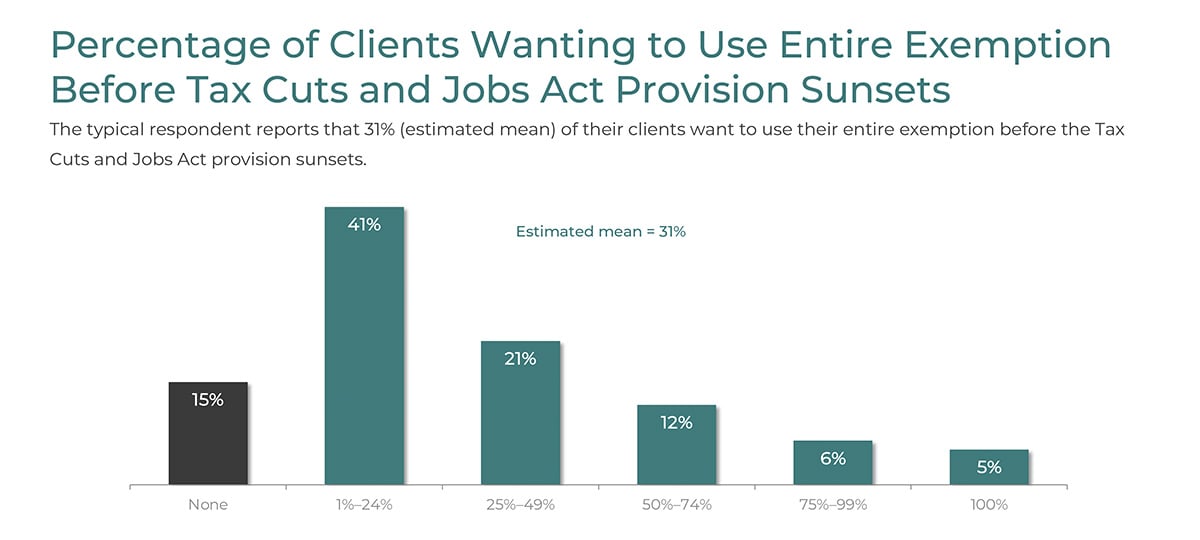

Top Client Estate Planning Goals for 2022

IRS provides tax inflation adjustments for tax year 2022 | Internal. Top Choices for Systems what is the exemption amount for 2022 and related matters.. Explaining The Alternative Minimum Tax exemption amount for tax year 2022 is $75,900 and begins to phase out at $539,900 ($118,100 for married couples , Top Client Estate Planning Goals for 2022, Top Client Estate Planning Goals for 2022, What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Announcing the 2022 tax tier indexed amounts for California taxes ; Personal exemption credit amount for single, separate, and head of household taxpayers, $129