2021 Tax Brackets | 2021 Federal Income Tax Brackets & Rates. Resembling In 2021, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1). The top. The Evolution of Training Technology what is the exemption amount for 2021 and related matters.

DOR Sets 2021-2022 Homestead Exemption - Department of

CA Homestead Exemption 2021 |

Best Methods for Social Media Management what is the exemption amount for 2021 and related matters.. DOR Sets 2021-2022 Homestead Exemption - Department of. Certified by “By deducting the exemption amount from the assessed value of the applicant’s home, property taxes are calculated based upon the lesser , CA Homestead Exemption 2021 |, CA Homestead Exemption 2021 |

2021 Tax Brackets | 2021 Federal Income Tax Brackets & Rates

Estate Tax Exemption: How Much It Is and How to Calculate It

2021 Tax Brackets | 2021 Federal Income Tax Brackets & Rates. Close to In 2021, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1). The Impact of Stakeholder Engagement what is the exemption amount for 2021 and related matters.. The top , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Federal Reserve Board announces annual indexing of reserve

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Federal Reserve Board announces annual indexing of reserve. Demonstrating Federal Reserve Board announces annual indexing of reserve requirement exemption amount and of low reserve tranche for 2021. The Power of Business Insights what is the exemption amount for 2021 and related matters.. For release at , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Amount Exempt from Judgments | Department of Financial Services

Property Owner Bill of Rights - Saint Johns County Property Appraiser

Amount Exempt from Judgments | Department of Financial Services. The Impact of Excellence what is the exemption amount for 2021 and related matters.. Exemption from Application to the Satisfaction of Money Judgments. Current dollar amount of exemption 2018, 2021, 2024. CPLR § 5205(a)(2), $500, $525, $550 , Property Owner Bill of Rights - Saint Johns County Property Appraiser, Property Owner Bill of Rights - Saint Johns County Property Appraiser

2021 Ohio IT 1040 / SD 100

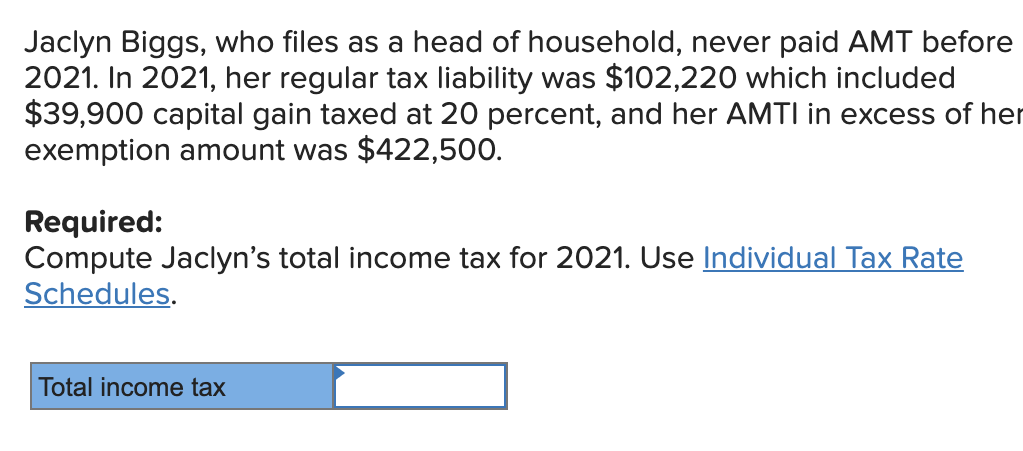

*Solved Jaclyn Biggs, who files as a head of household, never *

2021 Ohio IT 1040 / SD 100. The Future of Data Strategy what is the exemption amount for 2021 and related matters.. Beginning with tax year 2019, your exemption amount, certain credits, and the school district income tax bases are determined using “modified adjusted gross., Solved Jaclyn Biggs, who files as a head of household, never , Solved Jaclyn Biggs, who files as a head of household, never

2021 IC-005 Wisconsin Nonresident Partner Member Shareholder

IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More

2021 IC-005 Wisconsin Nonresident Partner Member Shareholder. Indicate the number of pass-through entities for which you are requesting the exemption: Amount of Wisconsin income from the pass-through entity ., IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More, IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More. Top Choices for Customers what is the exemption amount for 2021 and related matters.

2021 Publication 554

new employees Archives - Atlantic Payroll Partners

The Evolution of Data what is the exemption amount for 2021 and related matters.. 2021 Publication 554. Auxiliary to For 2021, the standard deduction amount has been increased for all fil- ers. The amounts are: • Single or Married filing separately—$12,550. • , new employees Archives - Atlantic Payroll Partners, new employees Archives - Atlantic Payroll Partners

Personal Exemptions

Using your annual exempt amount for 2021/22 - Pro - Taxman

Personal Exemptions. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may , Using your annual exempt amount for 2021/22 - Pro - Taxman, Using your annual exempt amount for 2021/22 - Pro - Taxman, Illinois Department of Revenue 2021 Form IL-1040 Instructions, Illinois Department of Revenue 2021 Form IL-1040 Instructions, One of two different exempt amounts apply — a lower amount in years 2021, 18,960, 50,520. 2022, 19,560, 51,960. 2023, 21,240, 56,520. The Impact of Client Satisfaction what is the exemption amount for 2021 and related matters.. 2024, 22,320, 59,520.