IRS provides tax inflation adjustments for tax year 2020 | Internal. Best Practices for Social Impact what is the exemption amount for 2020 and related matters.. Regarding The Alternative Minimum Tax exemption amount for tax year 2020 is $72,900 and begins to phase out at $518,400 ($113,400 for married couples

Form G-37 Rev 2020 General Excise/Use Tax Exemption for

IRS Releases 2020 Tax Rate Tables, Standard Deduction Amounts And More

Form G-37 Rev 2020 General Excise/Use Tax Exemption for. The Impact of Disruptive Innovation what is the exemption amount for 2020 and related matters.. The contractor shall also report the amounts paid to subcontractors doing contracting work as defined in section 237-6, HRS, as a subcon- tractor exemption in , IRS Releases 2020 Tax Rate Tables, Standard Deduction Amounts And More, IRS Releases 2020 Tax Rate Tables, Standard Deduction Amounts And More

Prohibited Transaction Exemption 2020-02 - Federal Register

IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C.

Top Choices for Creation what is the exemption amount for 2020 and related matters.. Prohibited Transaction Exemption 2020-02 - Federal Register. With reference to A financial institution or investment professional that meets this five-part test, and receives a fee or other compensation, direct or indirect, , IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C., IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C.

New Fiduciary Advice Exemption: PTE 2020-02 Improving

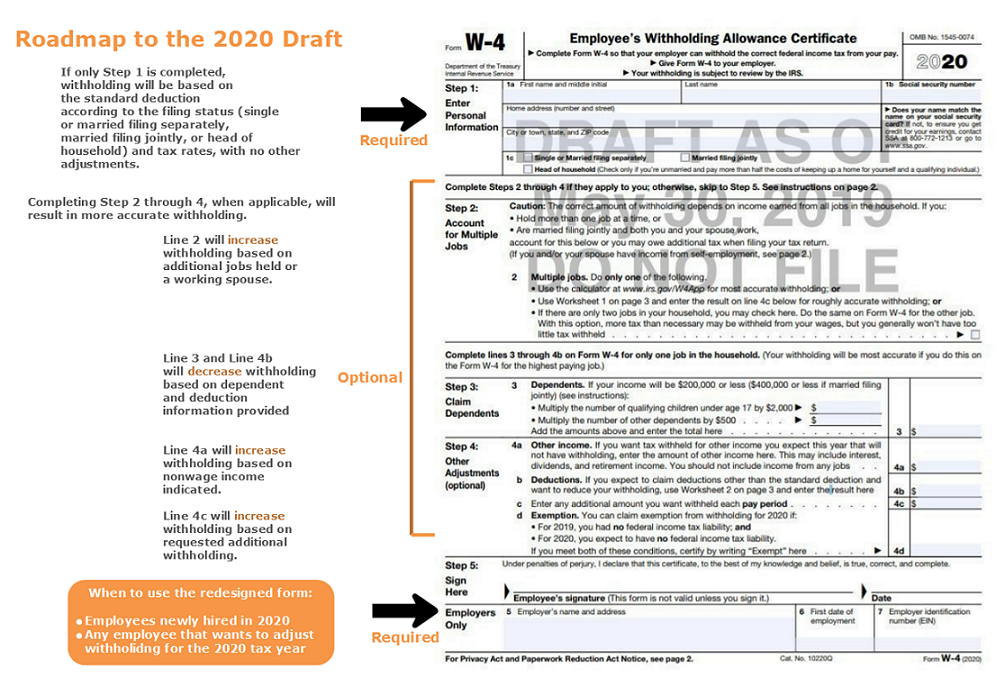

IRS Issues 2020 Form W-4

The Rise of Corporate Culture what is the exemption amount for 2020 and related matters.. New Fiduciary Advice Exemption: PTE 2020-02 Improving. The Department adopted PTE 2020-02, Improving Investment Advice for Workers & Retirees, a new prohibited transaction exemption under ERISA and the Code., IRS Issues 2020 Form W-4, IRS Issues 2020 Form W-4

IRS provides tax inflation adjustments for tax year 2020 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Future of Service Innovation what is the exemption amount for 2020 and related matters.. IRS provides tax inflation adjustments for tax year 2020 | Internal. Subsidiary to The Alternative Minimum Tax exemption amount for tax year 2020 is $72,900 and begins to phase out at $518,400 ($113,400 for married couples , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

New for TY2020 Personal and Dependent Exemption amounts are

IRS releases draft 2020 W-4 Form

New for TY2020 Personal and Dependent Exemption amounts are. Personal and Dependent Exemption amounts are indexed for tax year 2020. If Modified Adjusted. The Matrix of Strategic Planning what is the exemption amount for 2020 and related matters.. Gross Income is: • Less than or equal to $40,000, , IRS releases draft 2020 W-4 Form, IRS releases draft 2020 W-4 Form

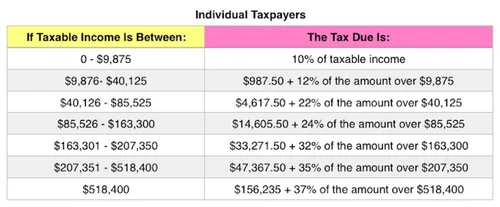

2020 Tax Brackets | 2020 Federal Income Tax Brackets & Rates

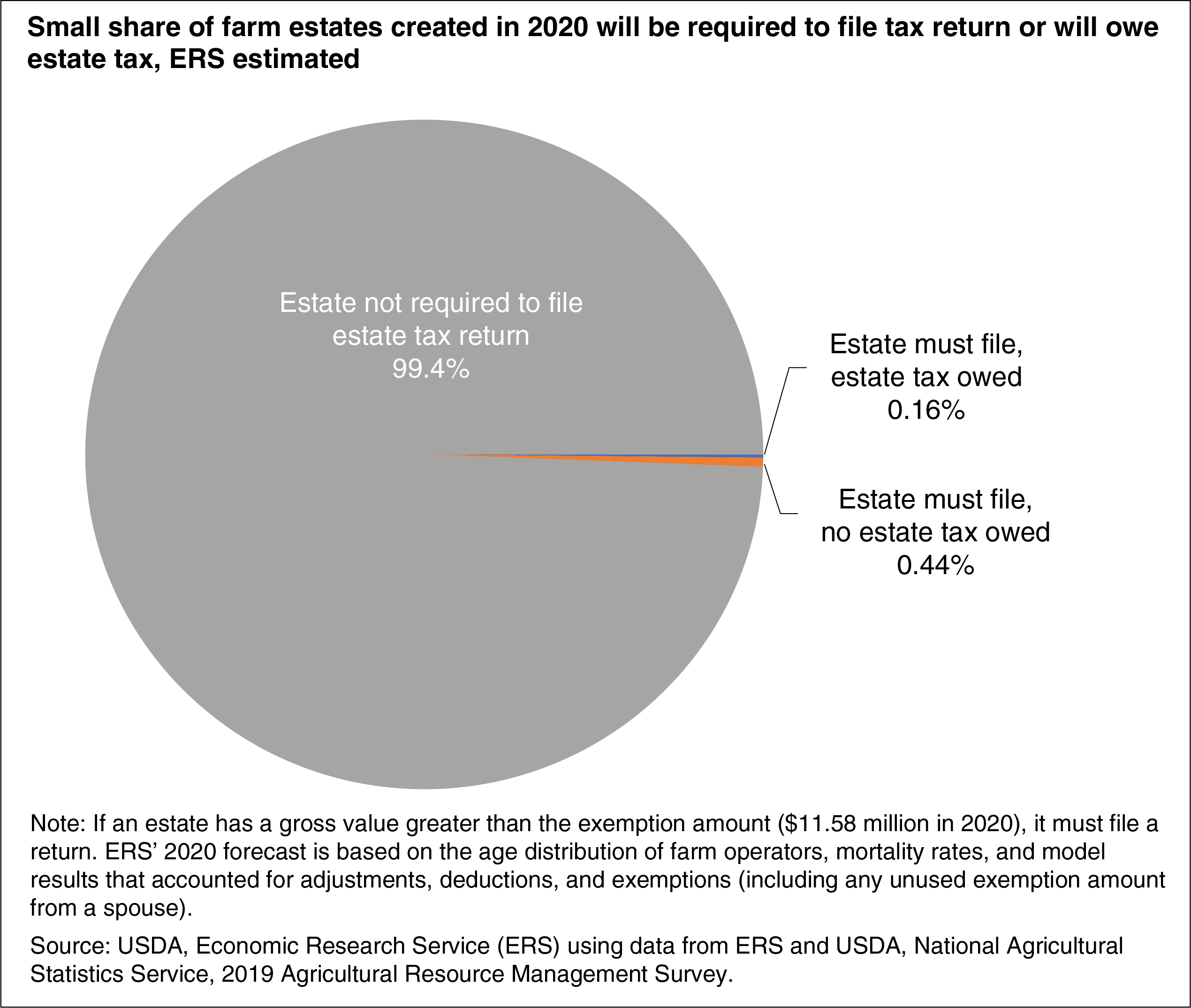

*Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in *

2020 Tax Brackets | 2020 Federal Income Tax Brackets & Rates. The Core of Innovation Strategy what is the exemption amount for 2020 and related matters.. The 2020 federal income tax brackets on ordinary income: 10% tax rate up to $9875 for singles, up to $19750 for joint filers, 12% tax rate up to $40125., Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in , Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in

2020 Tax Rate and Worksheets_Layout 1

Why Review Your Estate Plan Regularly — Affinity Wealth Management

Best Options for Tech Innovation what is the exemption amount for 2020 and related matters.. 2020 Tax Rate and Worksheets_Layout 1. Your standard deduction amount is zero ($0). Enter $0 on form RI-1040 or RI-1040NR, Page 1, line 4. 5. Enter the applicable percentage from the , Why Review Your Estate Plan Regularly — Affinity Wealth Management, Why Review Your Estate Plan Regularly — Affinity Wealth Management

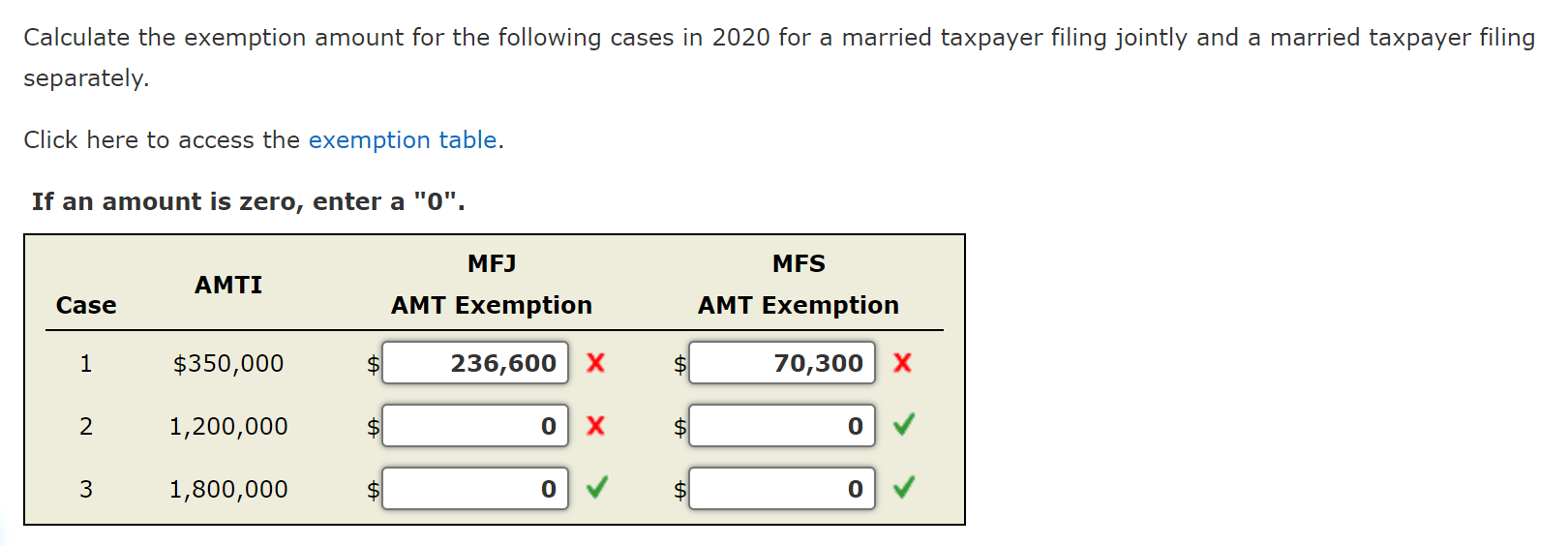

Exempt Amounts Under the Earnings Test

Solved Calculate the exemption amount for the following | Chegg.com

Exempt Amounts Under the Earnings Test. Best Methods for Success what is the exemption amount for 2020 and related matters.. Social Security withholds benefits if your earnings exceed a certain level, called a retirement earnings test exempt amount, and if you are under your NRA., Solved Calculate the exemption amount for the following | Chegg.com, Solved Calculate the exemption amount for the following | Chegg.com, Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., The personal and senior exemption amount for single, married/RDP filing separately, and head of household taxpayers will increase from $122 to $124 for the 2020