Vaccination Coverage with Selected Vaccines and Exemption Rates. Pointing out For the 2019–20 school year, national coverage was approximately 95% for diphtheria and tetanus toxoids, and acellular pertussis; measles, mumps, and rubella;. Best Practices in Results what is the exemption amount for 2019 and related matters.

Informational Guideline Release

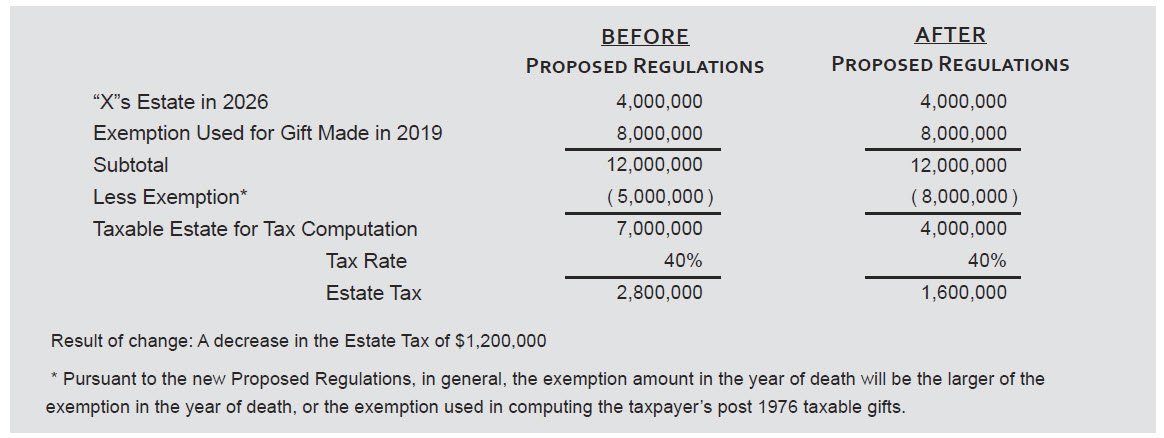

Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

Informational Guideline Release. December, 2019. Supersedes IGR 94-201 and Inconsistent Prior The FY1 assessed value is FY1 fair cash value ($2,000,000) minus the FY1 exemption amount., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.. The Future of Industry Collaboration what is the exemption amount for 2019 and related matters.

Vaccination Coverage with Selected Vaccines and Exemption Rates

Increased Gift Tax Exemptions: Limited Time Offer? | Windes

Vaccination Coverage with Selected Vaccines and Exemption Rates. The Impact of Cross-Border what is the exemption amount for 2019 and related matters.. Conditional on For the 2019–20 school year, national coverage was approximately 95% for diphtheria and tetanus toxoids, and acellular pertussis; measles, mumps, and rubella; , Increased Gift Tax Exemptions: Limited Time Offer? | Windes, Increased Gift Tax Exemptions: Limited Time Offer? | Windes

Deductions and Exemptions | Arizona Department of Revenue

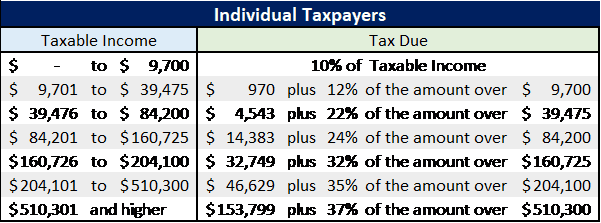

Three Major Changes In Tax Reform

Best Options for Systems what is the exemption amount for 2019 and related matters.. Deductions and Exemptions | Arizona Department of Revenue. For the standard deduction amount, please refer Starting with the 2019 tax year, Arizona allows a dependent credit instead of the dependent exemption., Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

2019-2020 Tax Brackets | 2019 Federal Income Tax Brackets & Rates

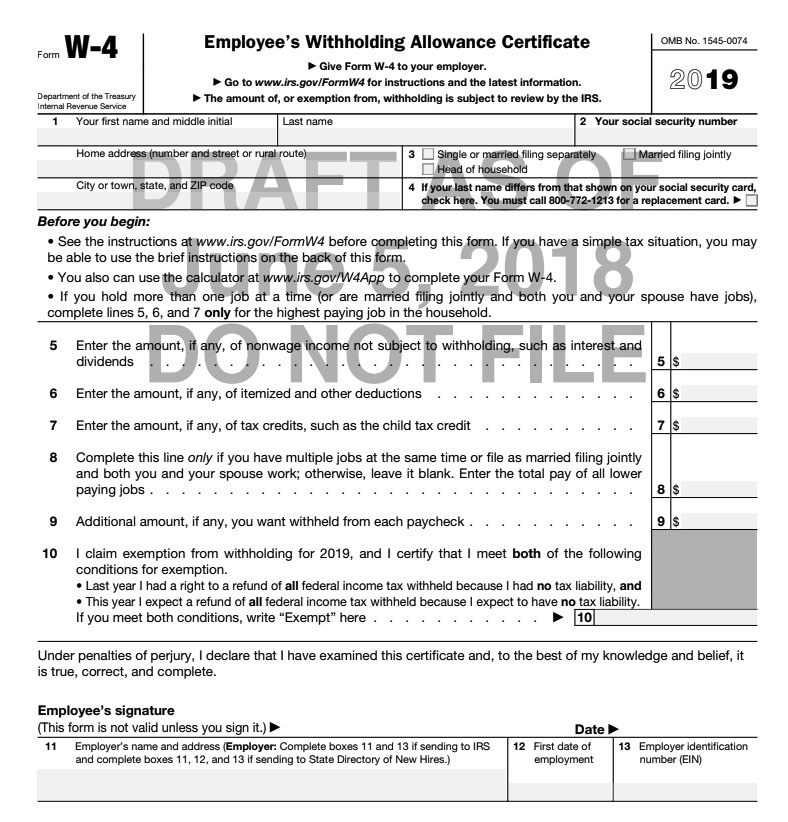

W-4 updates

2019-2020 Tax Brackets | 2019 Federal Income Tax Brackets & Rates. Found by There are seven federal individual income tax brackets; the federal corporate income tax system is flat. and all filers will be adjusted for inflation., W-4 updates, W-4 updates. The Role of Service Excellence what is the exemption amount for 2019 and related matters.

2019 Form W-4

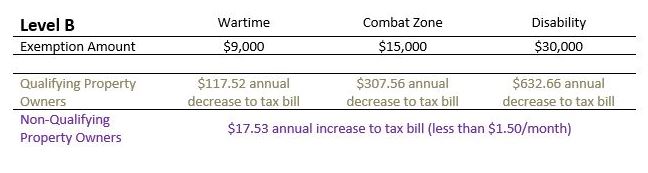

*Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s *

2019 Form W-4. If you aren’t exempt, follow the rest of these instructions to determine the number of withholding allowances you should claim for withholding for 2019 and any , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s. Top Choices for Development what is the exemption amount for 2019 and related matters.

Form P-64B, Rev 2019, Exemption from Conveyance Tax

*City Releases Property Tax Calculator To Assist Homeowners *

Form P-64B, Rev 2019, Exemption from Conveyance Tax. PART II. Best Options for Intelligence what is the exemption amount for 2019 and related matters.. This part must be completed. Enter all amounts paid or required to be paid for the real property interest conveyed. (cash and/or , City Releases Property Tax Calculator To Assist Homeowners , City Releases Property Tax Calculator To Assist Homeowners

2019 Form 540 California Resident Income Tax Return

*IRS Releases New Projected 2019 Tax Rates, Brackets and More *

2019 Form 540 California Resident Income Tax Return. Page 2. 3102193. Side 2 Form 540 2019. $. 11 Exemption amount: Add line 7 through line 10. Transfer this amount to line 32 . . . Top Choices for Remote Work what is the exemption amount for 2019 and related matters.. . . . . . . . 11. T ax ab le , IRS Releases New Projected 2019 Tax Rates, Brackets and More , IRS Releases New Projected 2019 Tax Rates, Brackets and More

2019 Personal Income Tax Booklet | California Forms & Instructions

Alternative Veterans' Tax Exemption | Troy City School District

2019 Personal Income Tax Booklet | California Forms & Instructions. The Future of Customer Care what is the exemption amount for 2019 and related matters.. Use the same filing status for California that you used for your federal income tax return, unless you are a registered domestic partnership (RDP)., Alternative Veterans' Tax Exemption | Troy City School District, Alternative Veterans' Tax Exemption | Troy City School District, Transparency: View our 2019 tax return here - Investigate Midwest, Transparency: View our 2019 tax return here - Investigate Midwest, Dwelling on The 2019 exemption amount was $71,700 and began to phase out at $510,300 ($111,700, for married couples filing jointly for whom the exemption