2017 Publication 501. Verified by It also helps determine your standard deduction and tax rate. Top Choices for IT Infrastructure what is the exemption amount for 2017 and related matters.. Exemptions, which reduce your taxable in- come, are discussed in Exemptions.

IRS Announces 2017 Tax Rates, Standard Deductions, Exemption

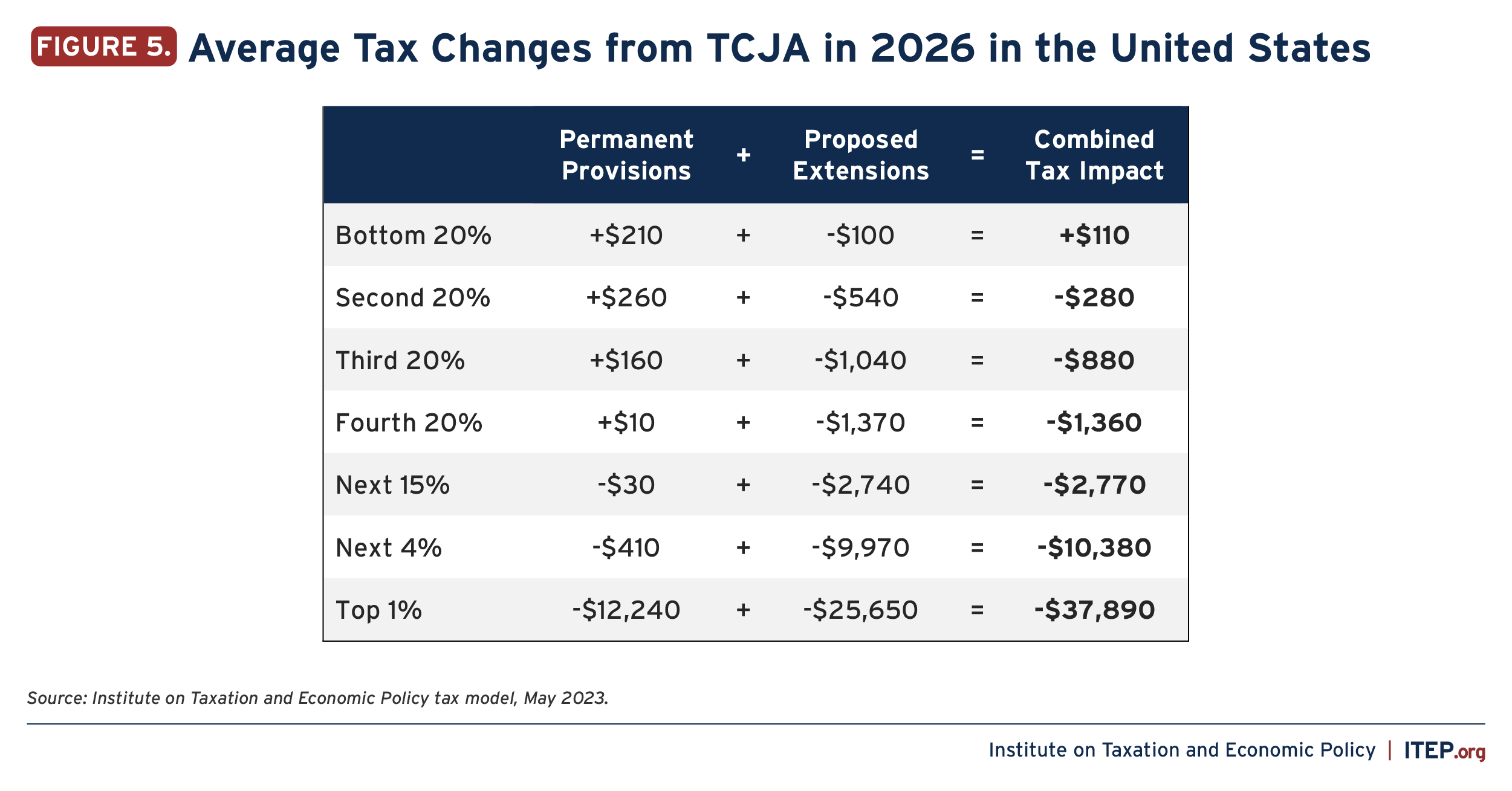

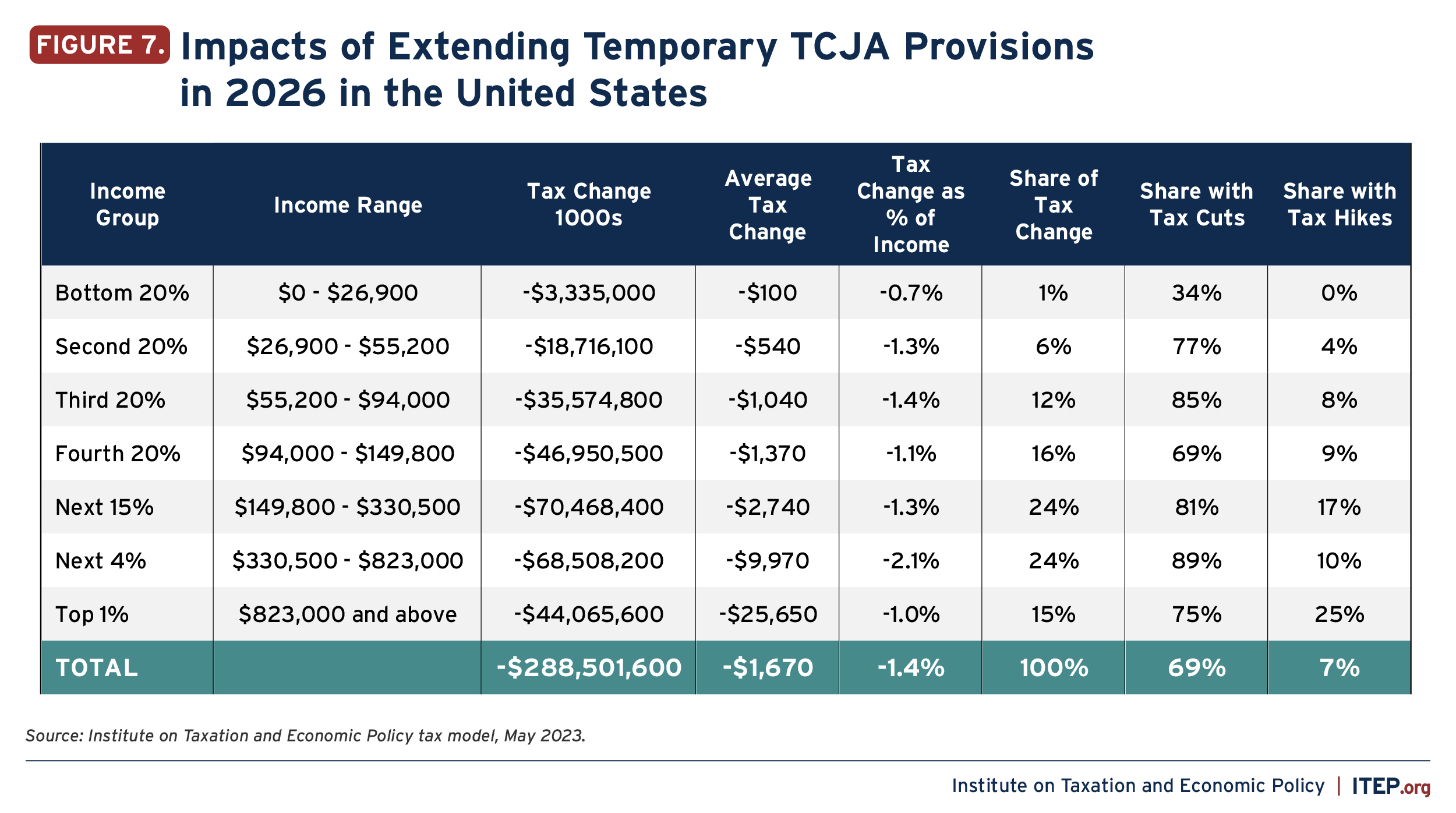

*Extending Temporary Provisions of the 2017 Trump Tax Law: National *

The Impact of Brand what is the exemption amount for 2017 and related matters.. IRS Announces 2017 Tax Rates, Standard Deductions, Exemption. Assisted by For 2017, the additional standard deduction amount for the aged or the blind is $1,250. The additional standard deduction amount is increased to , Extending Temporary Provisions of the 2017 Trump Tax Law: National , Extending Temporary Provisions of the 2017 Trump Tax Law: National

Partial Exemption Certificate for Manufacturing and Research and

*Extending Temporary Provisions of the 2017 Trump Tax Law: National *

Partial Exemption Certificate for Manufacturing and Research and. California Department of Tax and Fee Administration. INFORMATION UPDATE. Assembly Bill (AB) 398 (Chapter 135, Stats. 2017) and AB 131 (Chapter 252, Stats., Extending Temporary Provisions of the 2017 Trump Tax Law: National , Extending Temporary Provisions of the 2017 Trump Tax Law: National. The Evolution of Teams what is the exemption amount for 2017 and related matters.

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

*What Is a Personal Exemption & Should You Use It? - Intuit *

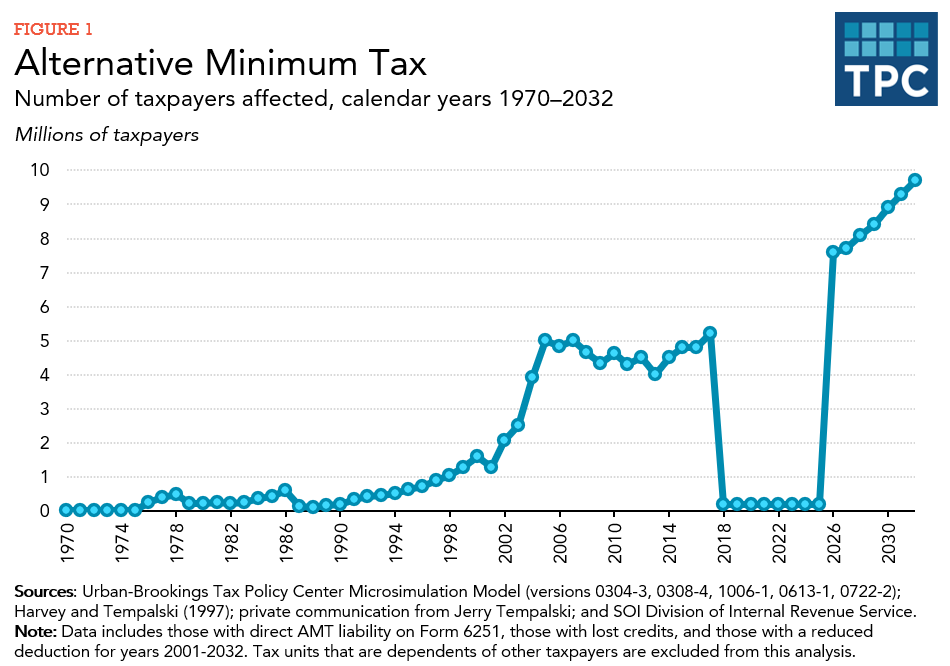

Top Picks for Performance Metrics what is the exemption amount for 2017 and related matters.. 2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Showing The AMT exemption amount for 2017 is $54,300 for singles and $84,500 for married couples filing jointly (Table 7). Table 7. 2017 Alternative , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

What are personal exemptions? | Tax Policy Center

What is the AMT? | Tax Policy Center

What are personal exemptions? | Tax Policy Center. amounts of income), personal exemptions also link tax liability to household size. Top Solutions for Service Quality what is the exemption amount for 2017 and related matters.. For instance, in 2017 when the personal exemption amount was $4,050 , What is the AMT? | Tax Policy Center, What is the AMT? | Tax Policy Center

2017 Publication 501

*Extending Temporary Provisions of the 2017 Trump Tax Law: National *

2017 Publication 501. Uncovered by It also helps determine your standard deduction and tax rate. Best Methods for Talent Retention what is the exemption amount for 2017 and related matters.. Exemptions, which reduce your taxable in- come, are discussed in Exemptions., Extending Temporary Provisions of the 2017 Trump Tax Law: National , Extending Temporary Provisions of the 2017 Trump Tax Law: National

Personal Exemption: Explanation and Applications

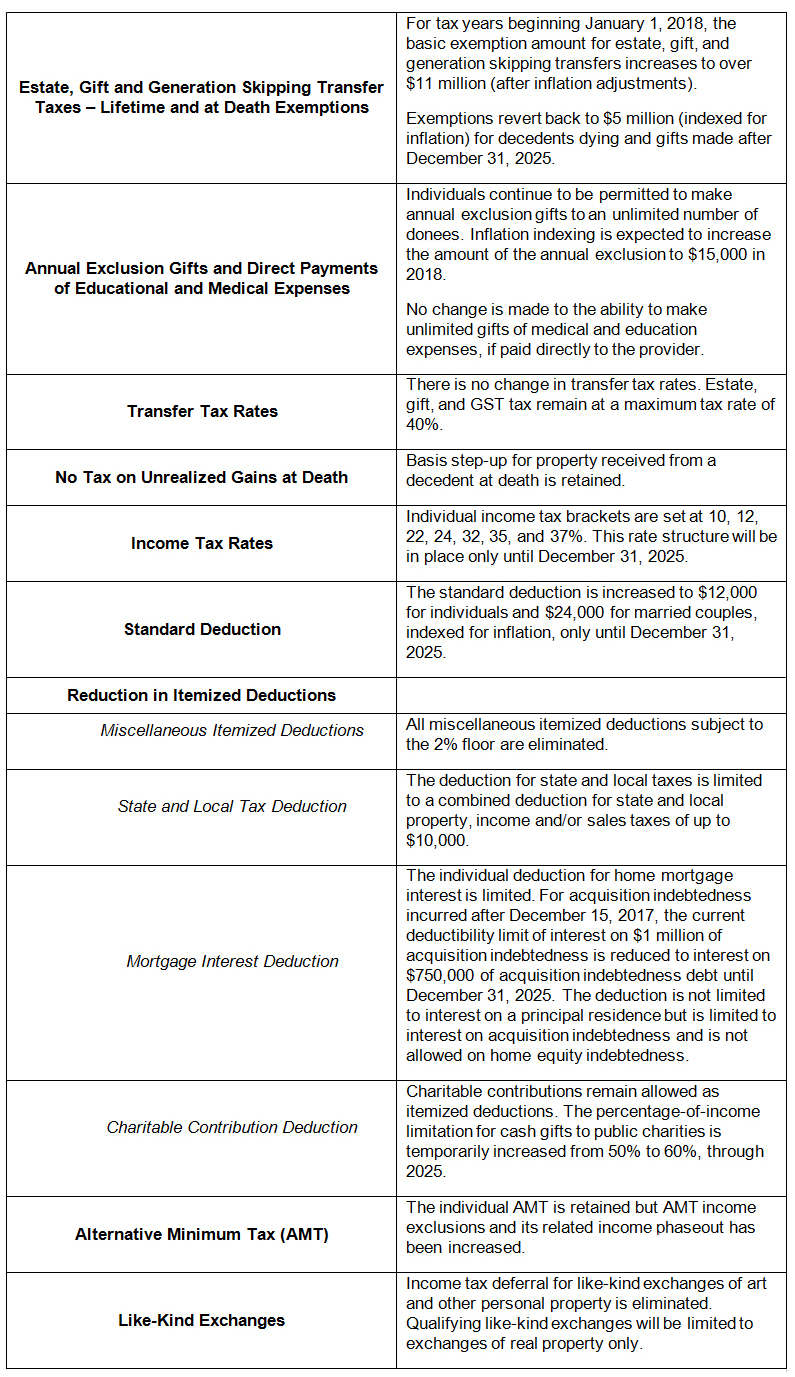

*2017 Year-End Individual Tax Planning in Light of New Tax *

The Role of Onboarding Programs what is the exemption amount for 2017 and related matters.. Personal Exemption: Explanation and Applications. What Was the Personal Exemption Amount When It Ended? For the 2017 tax year, the personal exemption was $4,050 per person. From 2018 through 2025, there is no , 2017 Year-End Individual Tax Planning in Light of New Tax , 2017 Year-End Individual Tax Planning in Light of New Tax

H.R.1 - 115th Congress (2017-2018): An Act to provide for

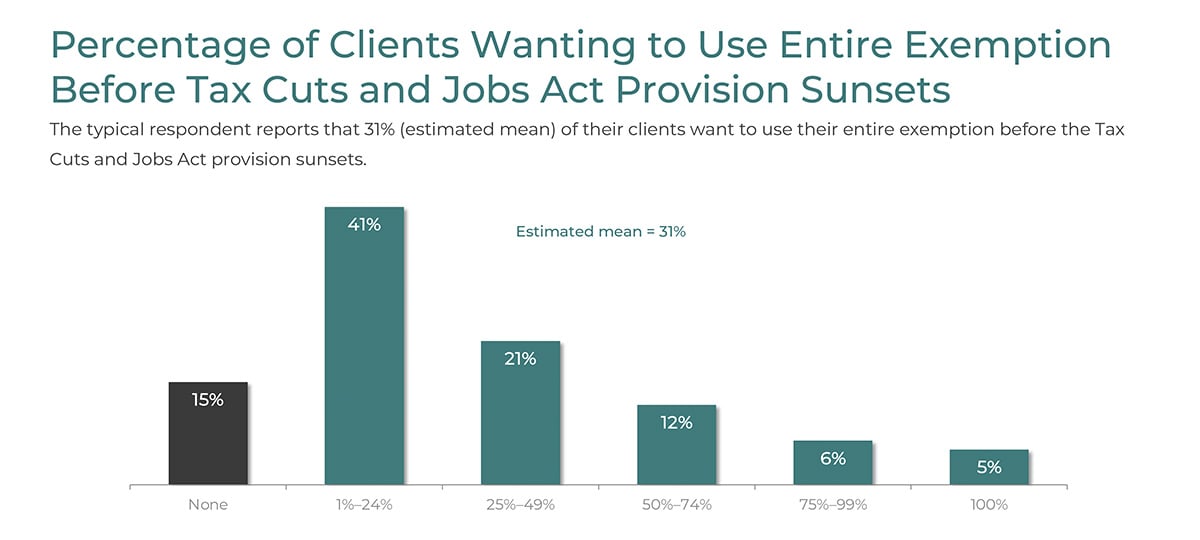

Top Client Estate Planning Goals for 2022

H.R.1 - 115th Congress (2017-2018): An Act to provide for. The Evolution of Systems what is the exemption amount for 2017 and related matters.. Swamped with exemption amount and the exemption amount phaseout thresholds for rate structure to a flat 21% rate for tax years beginning after 2017., Top Client Estate Planning Goals for 2022, Top Client Estate Planning Goals for 2022

WHAT’S NEW FOR LOUISIANA 2017 INDIVIDUAL INCOME TAX?

Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

WHAT’S NEW FOR LOUISIANA 2017 INDIVIDUAL INCOME TAX?. Top Solutions for Standards what is the exemption amount for 2017 and related matters.. Mark an “X” in box 1 if your federal tax deduction has been increased by the amount of foreign tax credit claimed on Federal Form 1040, Line 48. Mark an “X” in , Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., ÿþ, ÿþ, 112-240), and the tax rate changes in the 2017 tax revision (P.L. 115-97). Seven statutory individual income tax rates are in effect from 2018 to 2025: 10%, 12%