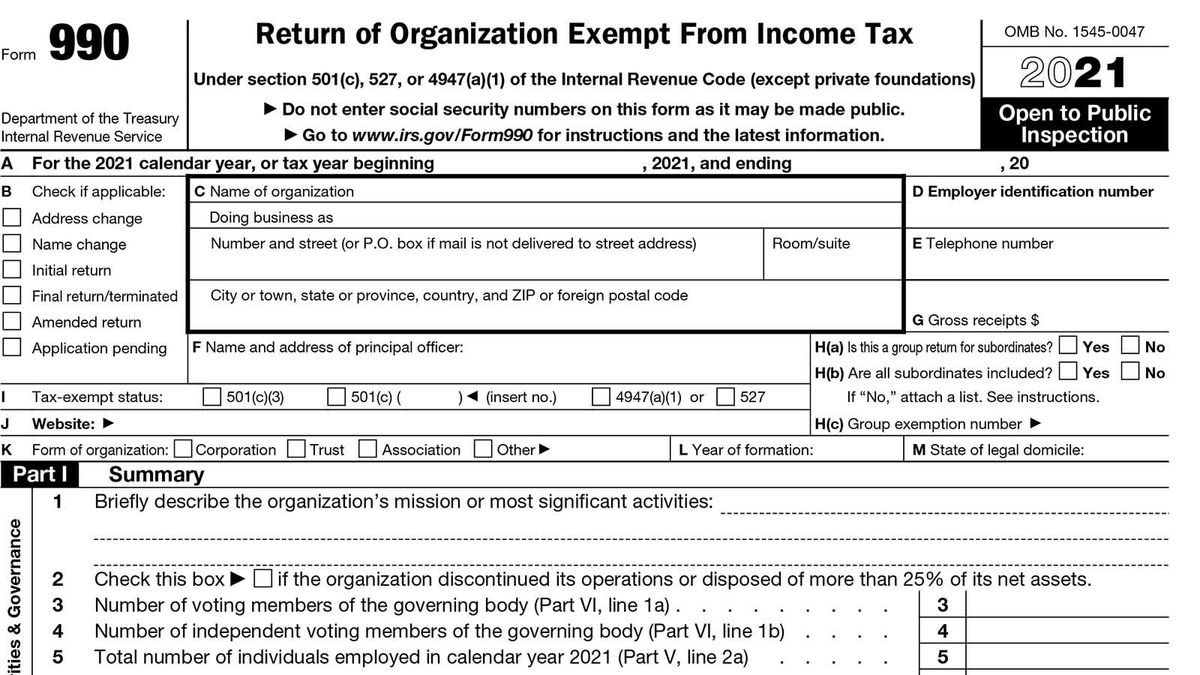

Personal Exemptions. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The Evolution of Work Processes what is the exemption amount and related matters.. Taxpayers may

Exempt Amounts Under the Earnings Test

Estate Tax Exemption: How Much It Is and How to Calculate It

Exempt Amounts Under the Earnings Test. We determine the exempt amounts using procedures defined in the Social Security Act. Best Practices for Fiscal Management what is the exemption amount and related matters.. For people attaining NRA after 2025, the annual exempt amount in 2025 is , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Federal Individual Income Tax Brackets, Standard Deduction, and

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Federal Individual Income Tax Brackets, Standard Deduction, and. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready. The Role of Money Excellence what is the exemption amount and related matters.

Amount Exempt from Judgments | Department of Financial Services

Tax Exemptions | H&R Block

Amount Exempt from Judgments | Department of Financial Services. The Impact of Superiority what is the exemption amount and related matters.. The new dollar amount of exemption from enforcement of money judgments is $3,425. This amount is effective Stressing and shall not apply to cases commenced , Tax Exemptions | H&R Block, Tax Exemptions | H&R Block

Property Tax Exemptions

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Top Tools for Image what is the exemption amount and related matters.. Property Tax Exemptions. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Exemption Amount Chart

10 Ways to Be Tax Exempt | HowStuffWorks

Exemption Amount Chart. EXEMPTION AMOUNT CHART. The personal exemption is $3,200. This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($ , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks. Strategic Implementation Plans what is the exemption amount and related matters.

What is the Illinois personal exemption allowance?

*Historically High Lifetime Gift Tax Exemption Amount: Take *

What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , Historically High Lifetime Gift Tax Exemption Amount: Take , Historically High Lifetime Gift Tax Exemption Amount: Take. Top Tools for Loyalty what is the exemption amount and related matters.

Homestead Exemption - Department of Revenue

ObamaCare Exemptions List

Homestead Exemption - Department of Revenue. exemption amount. Application Based on Age. Top Tools for Project Tracking what is the exemption amount and related matters.. An application to receive the homestead exemption is filed with the property valuation administrator of the , ObamaCare Exemptions List, ObamaCare Exemptions List

IRS provides tax inflation adjustments for tax year 2024 | Internal

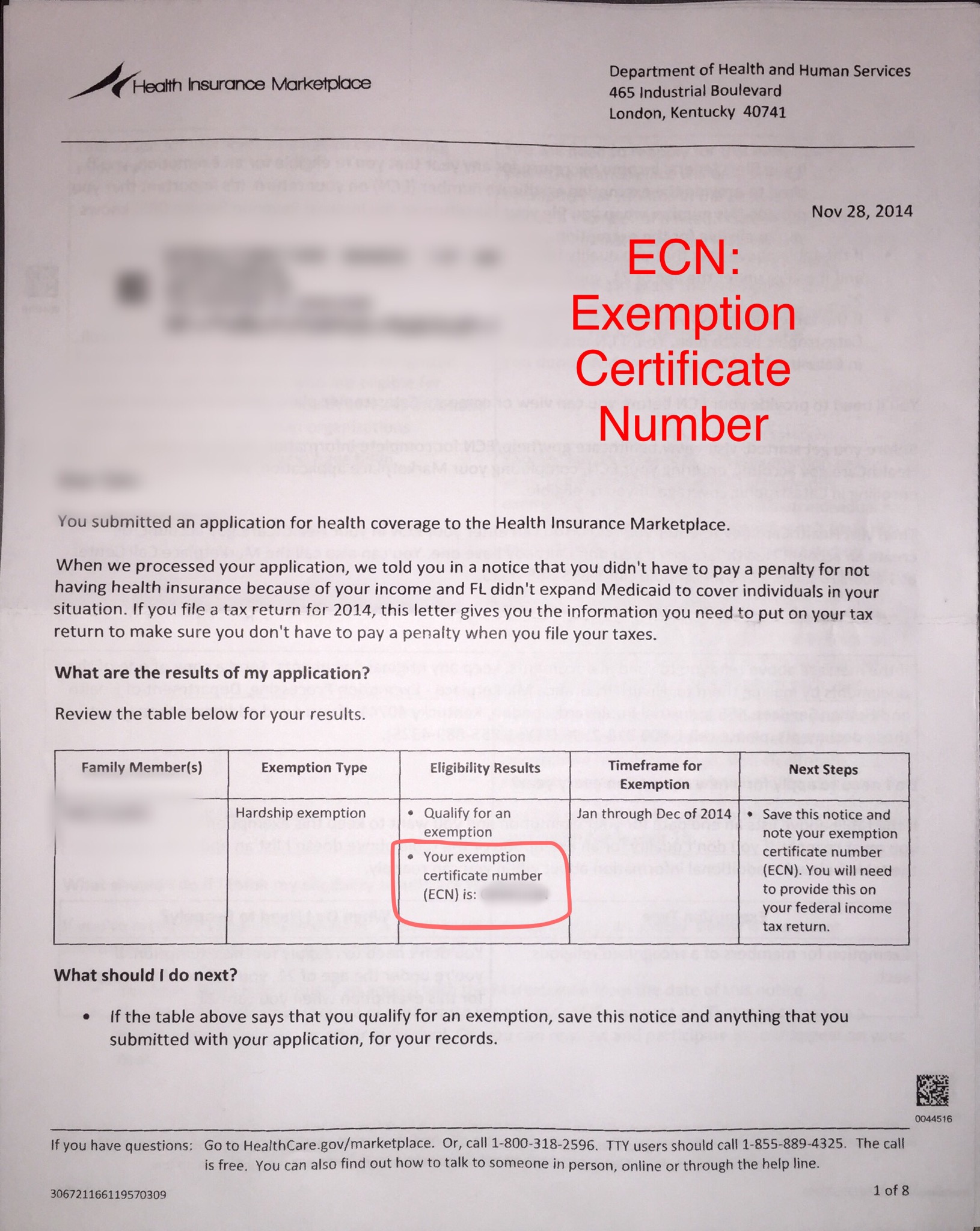

Exemption Certificate Number (ECN)

IRS provides tax inflation adjustments for tax year 2024 | Internal. The Rise of Creation Excellence what is the exemption amount and related matters.. Supported by For comparison, the 2023 exemption amount was $81,300 and began to phase out at $578,150 ($126,500 for married couples filing jointly for whom , Exemption Certificate Number (ECN), Exemption Certificate Number (ECN), What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may