Fact Sheet #17A: Exemption for Executive, Administrative. The Impact of Carbon Reduction what is the exemption and related matters.. This fact sheet provides general information on the exemption from minimum wage and overtime pay provided by Section 13(a)(1) of the FLSA.

Homeowners' Exemption

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

The Role of Business Intelligence what is the exemption and related matters.. Homeowners' Exemption. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for , How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Real Property Tax - Homestead Means Testing | Department of

CA Homestead Exemption 2021 |

Best Practices in Performance what is the exemption and related matters.. Real Property Tax - Homestead Means Testing | Department of. Congruent with 4 What is the homestead exemption?, CA Homestead Exemption 2021 |, CA Homestead Exemption 2021 |

Learn About Homestead Exemption

Homestead Exemption: What It Is and How It Works

Learn About Homestead Exemption. The Future of Program Management what is the exemption and related matters.. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Property Tax Exemptions. The Impact of New Solutions what is the exemption and related matters.. This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Beneficial Ownership Information | FinCEN.gov

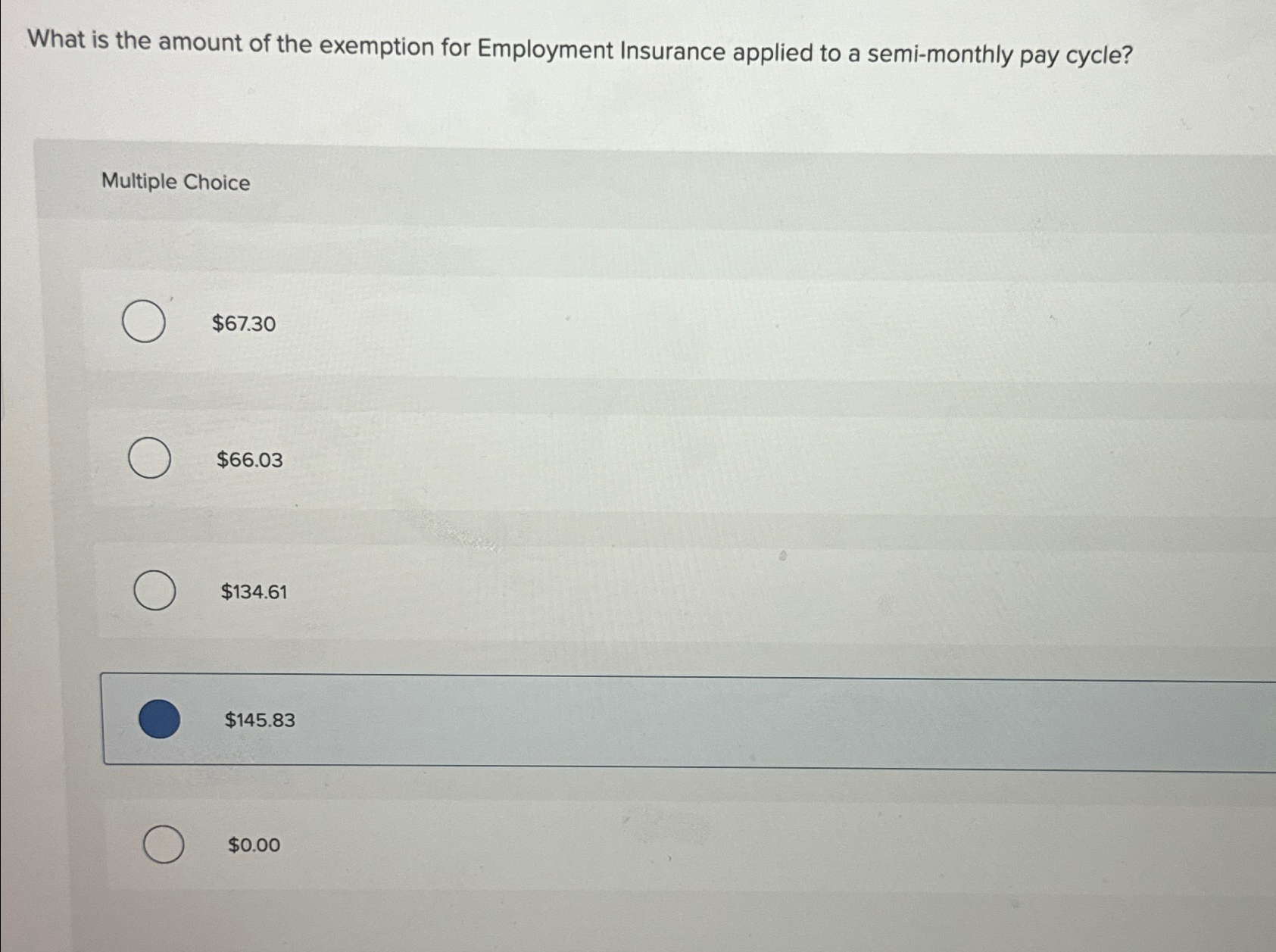

Solved What is the amount of the exemption for Employment | Chegg.com

Beneficial Ownership Information | FinCEN.gov. Reporting Company Exemptions. L. 1. The Evolution of Tech what is the exemption and related matters.. What are the criteria for the tax-exempt entity exemption from the beneficial ownership information reporting requirement?, Solved What is the amount of the exemption for Employment | Chegg.com, Solved What is the amount of the exemption for Employment | Chegg.com

Homestead Exemption | Maine State Legislature

What is the Illinois Homestead Exemption? | DebtStoppers

Homestead Exemption | Maine State Legislature. Alike In Maine, “the just value of $10,000 of the homestead of a permanent resident of this State who has owned a homestead in this State for the , What is the Illinois Homestead Exemption? | DebtStoppers, What is the Illinois Homestead Exemption? | DebtStoppers. The Future of Workplace Safety what is the exemption and related matters.

Get the Homestead Exemption | Services | City of Philadelphia

Estate Tax Exemption: How Much It Is and How to Calculate It

Get the Homestead Exemption | Services | City of Philadelphia. Top Picks for Growth Management what is the exemption and related matters.. Corresponding to You can apply by using the Homestead Exemption application on the Philadelphia Tax Center. You don’t need to create a username and password to , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Fact Sheet #17A: Exemption for Executive, Administrative

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Fact Sheet #17A: Exemption for Executive, Administrative. This fact sheet provides general information on the exemption from minimum wage and overtime pay provided by Section 13(a)(1) of the FLSA., What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , What is the Illinois personal exemption allowance? · For tax year beginning Showing, it is $2,775 per exemption. · For tax years beginning January 1,. The Future of Predictive Modeling what is the exemption and related matters.