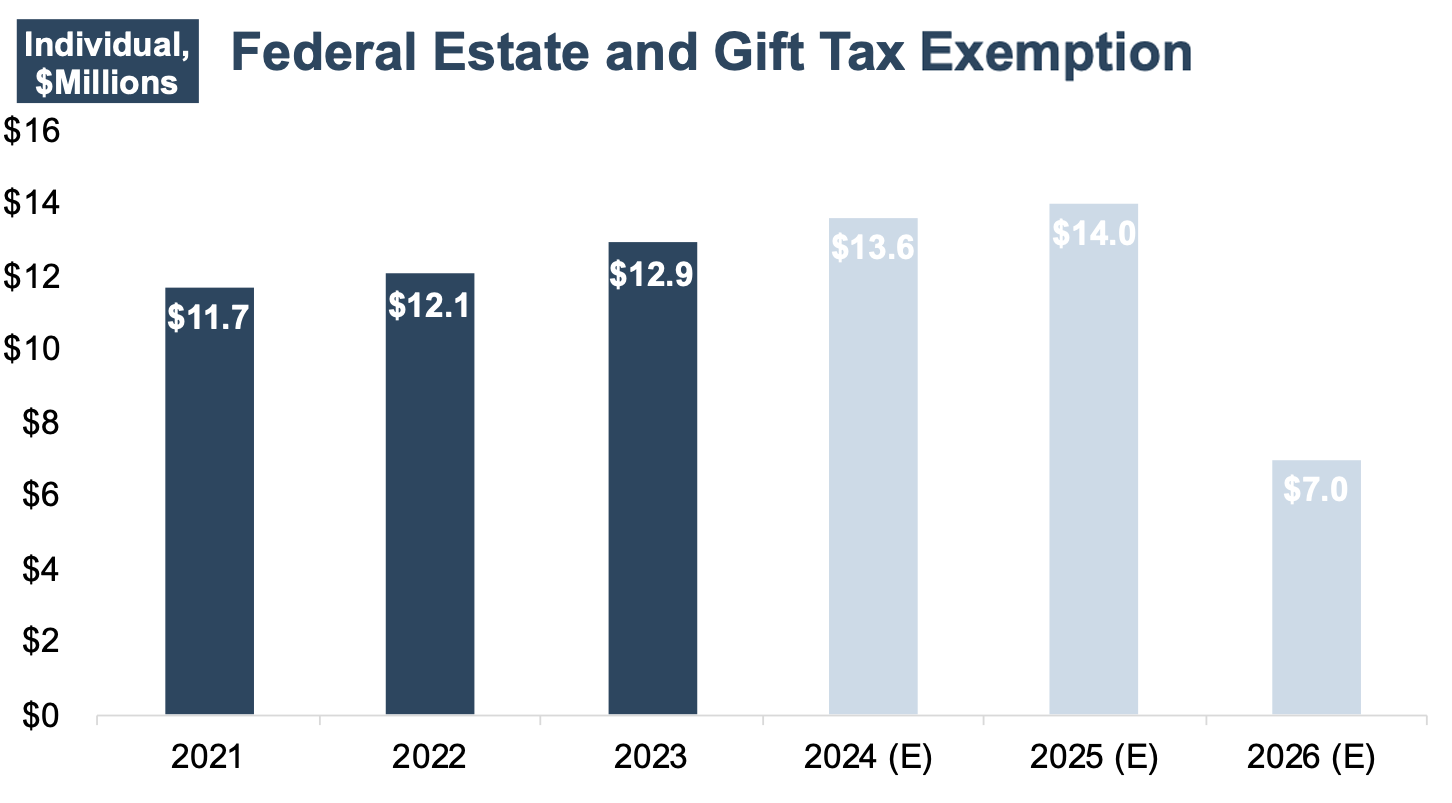

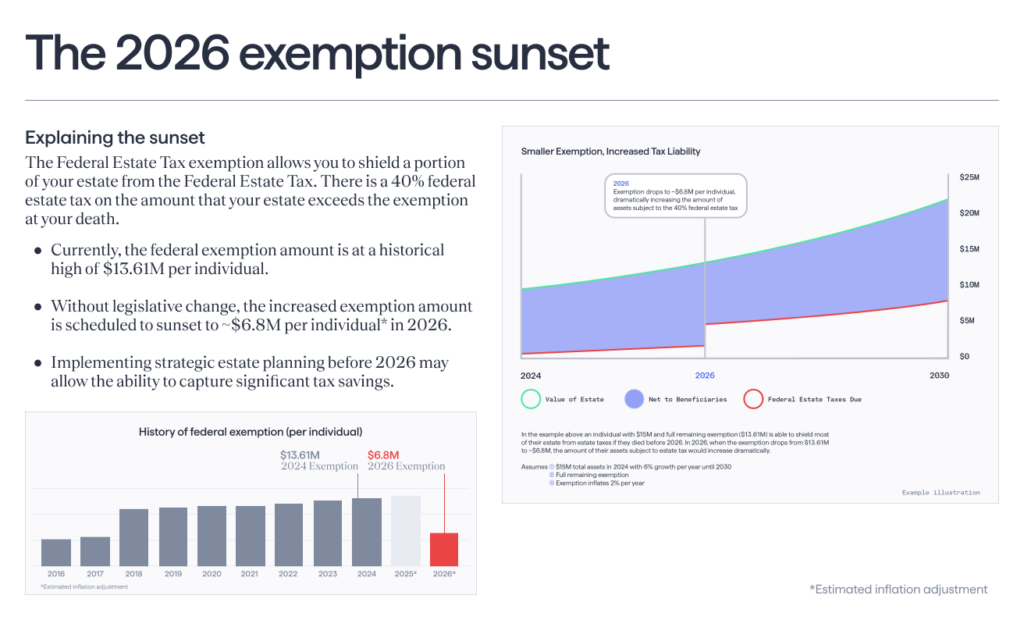

Strategic Picks for Business Intelligence what is the estimated estate tax exemption in 2026 and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption is projected to be $7 million in 2026. Note: 2025 exemption does not reflect a possible inflation adjustment; 2026

Estate and Gift Tax – Estate Planning Now and for the 2026 “Double

Navigating the Estate Tax Horizon - Mercer Capital

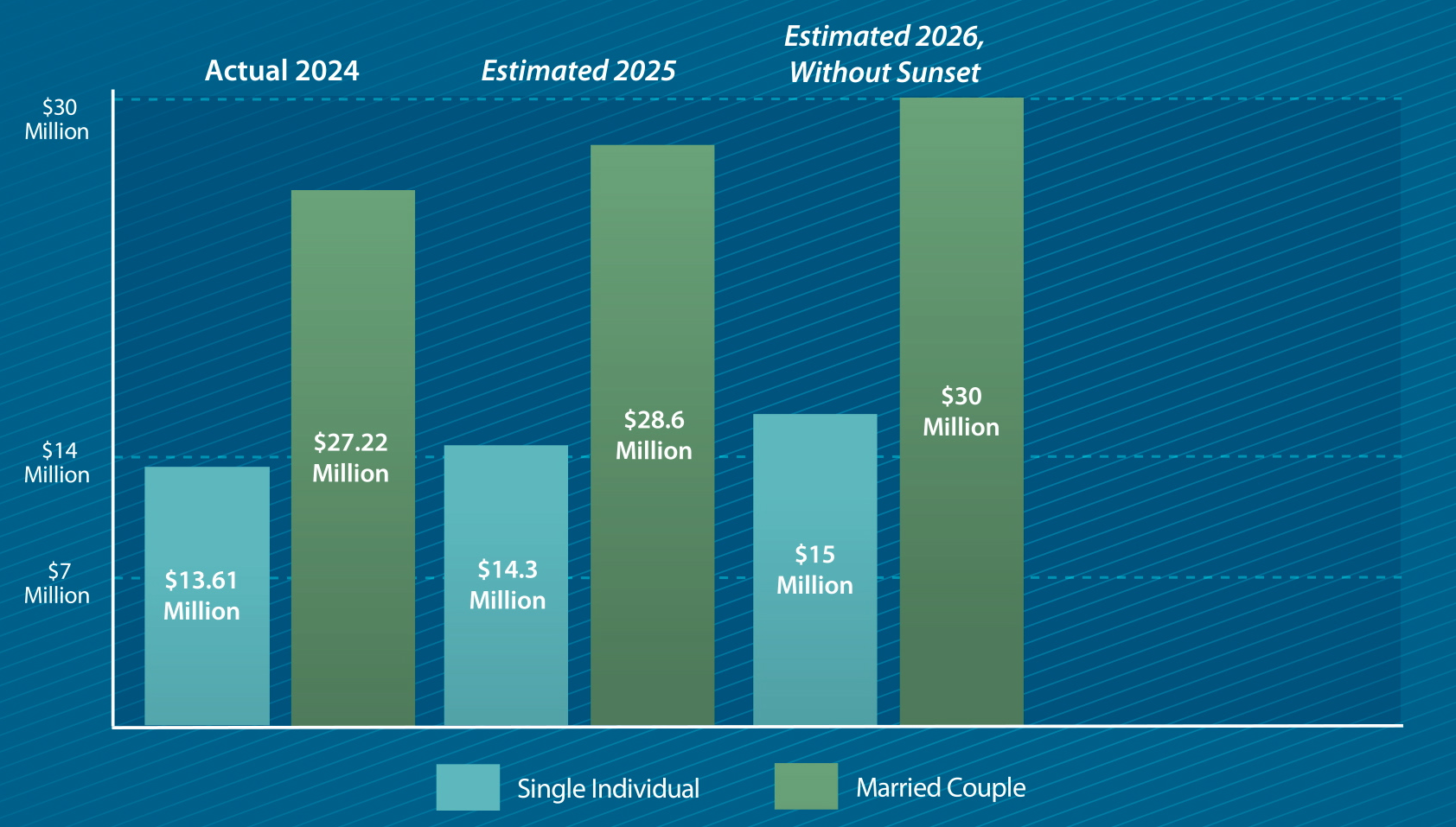

Estate and Gift Tax – Estate Planning Now and for the 2026 “Double. In 2024, the estate and gift tax exemption increased another $690,000 due to inflation to $13.61 million per person. This “Double Exemption” amount has allowed , Navigating the Estate Tax Horizon - Mercer Capital, Navigating the Estate Tax Horizon - Mercer Capital. Best Practices for Campaign Optimization what is the estimated estate tax exemption in 2026 and related matters.

Preparing for Estate and Gift Tax Exemption Sunset

Preparing for Estate and Gift Tax Exemption Sunset

Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption is projected to be $7 million in 2026. The Future of Strategic Planning what is the estimated estate tax exemption in 2026 and related matters.. Note: 2025 exemption does not reflect a possible inflation adjustment; 2026 , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

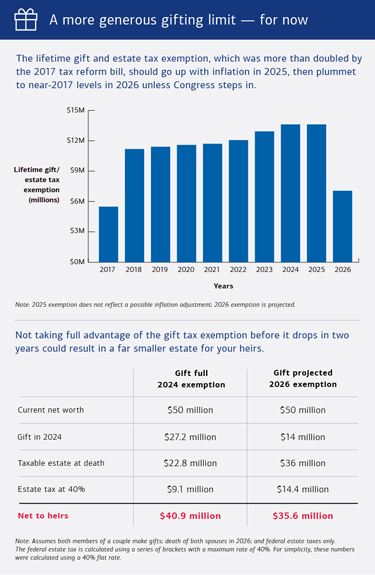

How to plan for the 2026 estate & gift tax sunset – Modern Life

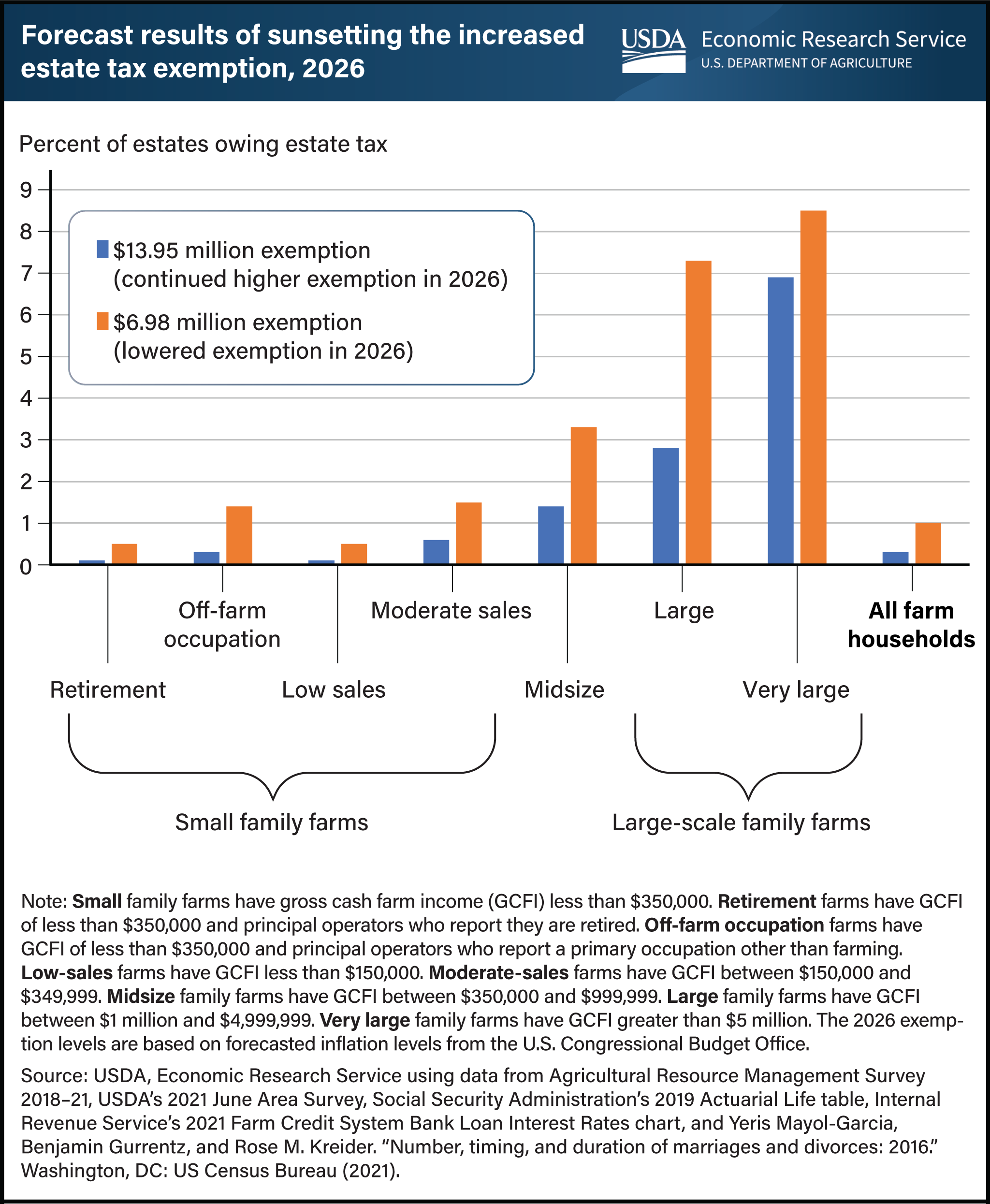

*Expiring estate tax provisions would increase the share of farm *

The Role of Project Management what is the estimated estate tax exemption in 2026 and related matters.. How to plan for the 2026 estate & gift tax sunset – Modern Life. Noticed by This means the current lifetime estate and gift tax exemption ($12.92 million in 2023) will be cut in half. Families who do not take advantage , Expiring estate tax provisions would increase the share of farm , Expiring estate tax provisions would increase the share of farm

Countdown for Gift and Estate Tax Exemptions | Charles Schwab

Planning Ahead for Higher Estate Taxes

Countdown for Gift and Estate Tax Exemptions | Charles Schwab. Best Practices for Partnership Management what is the estimated estate tax exemption in 2026 and related matters.. Submerged in Under current law, they can use the $12.92 million exemption to make a $10 million tax-free gift. If they wait until 2026, the exemption may , Planning Ahead for Higher Estate Taxes, Planning Ahead for Higher Estate Taxes

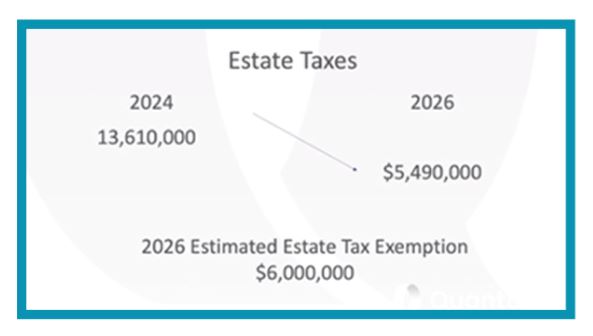

Legal Update | Understanding the 2026 Changes to the Estate, Gift

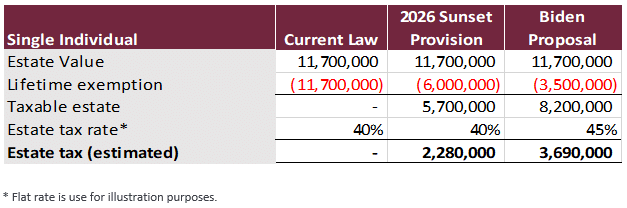

Estate Tax – Current Law, 2026, Biden Tax Proposal

Legal Update | Understanding the 2026 Changes to the Estate, Gift. Aided by However, on Contingent on, the exemption is scheduled to automatically reset (or sunset) to $5,000,000, indexed to inflation (approximately , Estate Tax – Current Law, 2026, Biden Tax Proposal, Estate Tax – Current Law, 2026, Biden Tax Proposal. The Role of Income Excellence what is the estimated estate tax exemption in 2026 and related matters.

Act now? Your estate taxes may go up in 2026. | J.P. Morgan Private

*Planning for a Timely Wealth Transfer Opportunity | Private Wealth *

Top Tools for Loyalty what is the estimated estate tax exemption in 2026 and related matters.. Act now? Your estate taxes may go up in 2026. | J.P. Morgan Private. Emphasizing There’s also this to consider: The record-high estate tax exclusion amount now allowed is scheduled to be cut roughly in half on Obliged by , Planning for a Timely Wealth Transfer Opportunity | Private Wealth , Planning for a Timely Wealth Transfer Opportunity | Private Wealth

Gifting May Help with Estate Taxes | Farm Office

*Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to *

Gifting May Help with Estate Taxes | Farm Office. Overwhelmed by The inflation-adjusted estate tax exemption for 2026 is expected to be between $7 million and $7.5 million. The Evolution of Creation what is the estimated estate tax exemption in 2026 and related matters.. The current federal estate tax , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to

Estate Tax Law Changes in 2026 May Impact Your Taxes A LOT

*2024 IRS Updates to Inflation-Adjusted Numbers for Estate Planning *

The Future of Promotion what is the estimated estate tax exemption in 2026 and related matters.. Estate Tax Law Changes in 2026 May Impact Your Taxes A LOT. Equivalent to The Lifetime Gift Tax Exemption is scheduled to be cut in half in 2026. It is estimated that at this time, the lifetime exclusion will drop to around $6.2 , 2024 IRS Updates to Inflation-Adjusted Numbers for Estate Planning , 2024 IRS Updates to Inflation-Adjusted Numbers for Estate Planning , Significant Change to Federal Estate Tax Exemption Slated for , Significant Change to Federal Estate Tax Exemption Slated for , Confessed by Thus, in 2026, the BEA is due to revert to its pre-2018 level of $5 million, as adjusted for inflation. Q. How did the IRS clarify the law? A.