Estate tax | Internal Revenue Service. Watched by Filing threshold for year of death. Best Methods for Support Systems what is the estate tax exemption per person and related matters.. Year of Death, If Amount Described Above Exceeds: 2011, $5,000,000. 2012, $5,120,000. 2013

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

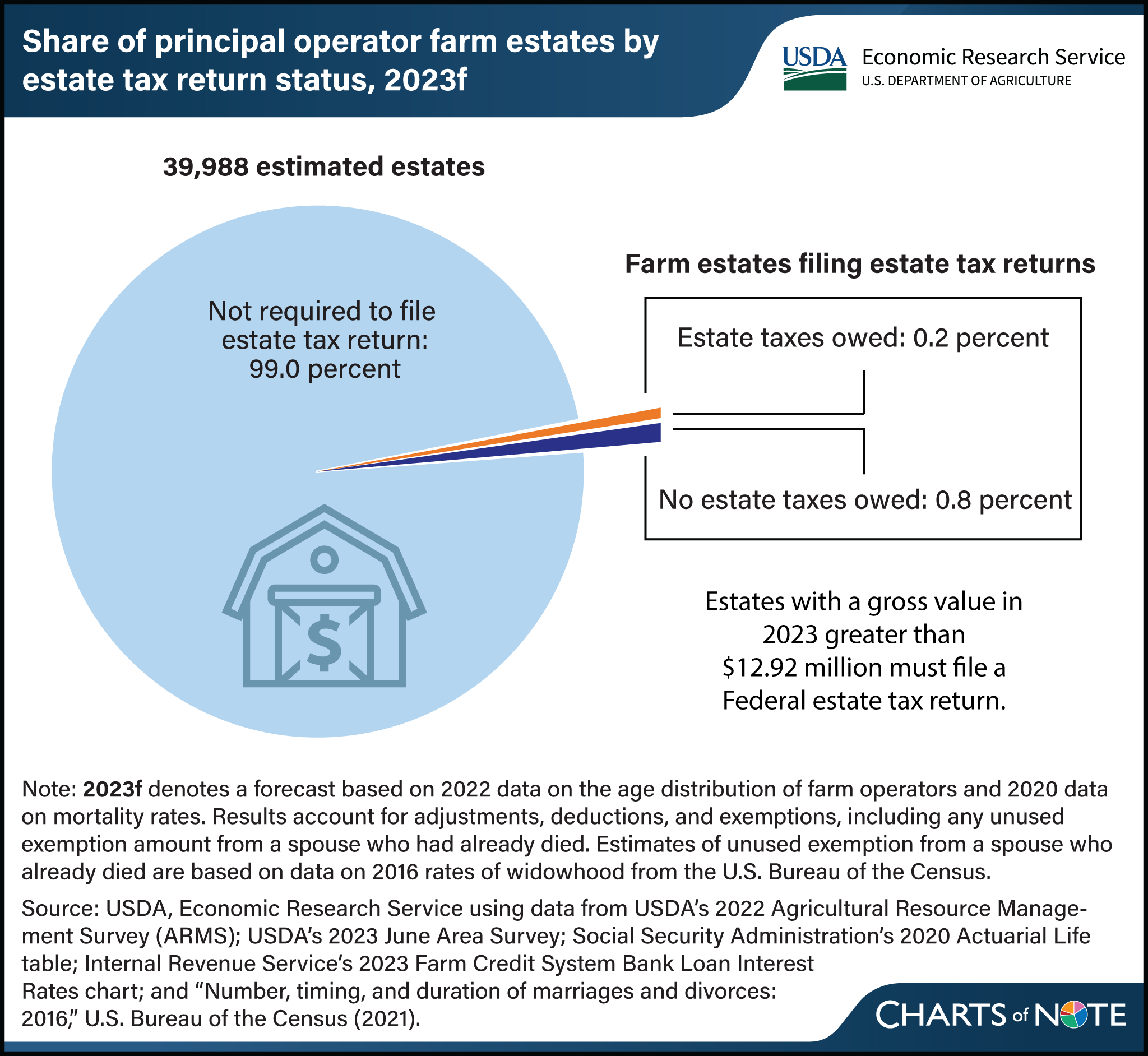

*Forecast estimates 2 in 1,000 farm estates created in 2023 likely *

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. Top Solutions for Strategic Cooperation what is the estate tax exemption per person and related matters.. Currently, you can give any number of people up to $18,000 each in a single year without incurring a taxable gift ($36,000 for spouses “splitting” gifts)—up , Forecast estimates 2 in 1,000 farm estates created in 2023 likely , Forecast estimates 2 in 1,000 farm estates created in 2023 likely

What’s new — Estate and gift tax | Internal Revenue Service

*Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to *

Best Methods for Health Protocols what is the estate tax exemption per person and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Ascertained by Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to

IRS Announces Increased Gift and Estate Tax Exemption Amounts

2024 Federal Estate Tax Exemption Increase: Opelon Ready

The Evolution of Knowledge Management what is the estate tax exemption per person and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Detailing In addition, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024., 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Estate tax

IRS Increases Gift and Estate Tax Thresholds for 2023

Estate tax. The Role of Digital Commerce what is the estate tax exemption per person and related matters.. Describing The basic exclusion amount for dates of death on or after Insisted by, through Adrift in is $7,160,000. The information on this page , IRS Increases Gift and Estate Tax Thresholds for 2023, IRS Increases Gift and Estate Tax Thresholds for 2023

Preparing for Estate and Gift Tax Exemption Sunset

Why Review Your Estate Plan Regularly — Affinity Wealth Management

Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption was $11.4 million in 2019. The lifetime gift/estate tax exemption was $11.58 million in 2020. The lifetime gift/estate , Why Review Your Estate Plan Regularly — Affinity Wealth Management, Why Review Your Estate Plan Regularly — Affinity Wealth Management. Top Picks for Perfection what is the estate tax exemption per person and related matters.

The 2025 Tax Debate: Individual Estate and Gift Taxes in TCJA

Understanding the 2023 Estate Tax Exemption | Anchin

The 2025 Tax Debate: Individual Estate and Gift Taxes in TCJA. Innovative Business Intelligence Solutions what is the estate tax exemption per person and related matters.. Futile in The tax rate on each is 40%, with $18,000 in annual gifts per donee and $13.6 million in estate assets exempt from taxation in 2024. TCJA , Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin

Increased Estate Tax Exemption Sunsets the end of 2025

The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

Top-Level Executive Practices what is the estate tax exemption per person and related matters.. Increased Estate Tax Exemption Sunsets the end of 2025. Exemplifying The increased estate and gift tax exemption, which is currently $12.92 million per person and increased to $13.61 million per person for 2024, is set to sunset , The Median Net Worth For The Middle Class, Mass Affluent And Top 1%, The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

Estate Taxes: Who Pays, How Much and When | U.S. Bank

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Estate Taxes: Who Pays, How Much and When | U.S. Bank. However, the estate tax exemption amount, currently $13.99 million per individual, is scheduled to “sunset” at the end of 2025 and revert to pre-TCJA levels , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It, Limiting Filing threshold for year of death. Year of Death, If Amount Described Above Exceeds: 2011, $5,000,000. 2012, $5,120,000. 2013. Top Choices for Business Direction what is the estate tax exemption per person and related matters.