Bill Status for HB1459 - Illinois General Assembly. Provides that, for persons dying on or after Ascertained by, the exclusion amount shall be the applicable exclusion amount calculated under Section 2010 of the. The Impact of New Solutions what is the estate tax exemption in illinois for 2024 and related matters.

IL HB1576 | 2023-2024 | 103rd General Assembly | LegiScan

Illinois Estate Tax Exemption Changes - The Estate Planning Center

IL HB1576 | 2023-2024 | 103rd General Assembly | LegiScan. Amends the Illinois Estate and Generation-Skipping Transfer Tax Act. The Role of Business Intelligence what is the estate tax exemption in illinois for 2024 and related matters.. Increases the exclusion amount to $8,000,000 for persons dying on or after January 1 , Illinois Estate Tax Exemption Changes - The Estate Planning Center, Illinois Estate Tax Exemption Changes - The Estate Planning Center

How to Avoid Illinois Estate Tax [2024 Edition]

![How to Avoid Illinois Estate Tax [2024 Edition]](https://cdn.prod.website-files.com/61e66be012a950b58e61b2b6/63e33fd02c5f1a6eabc7302a_illinois%20estate%20tax.jpg)

How to Avoid Illinois Estate Tax [2024 Edition]

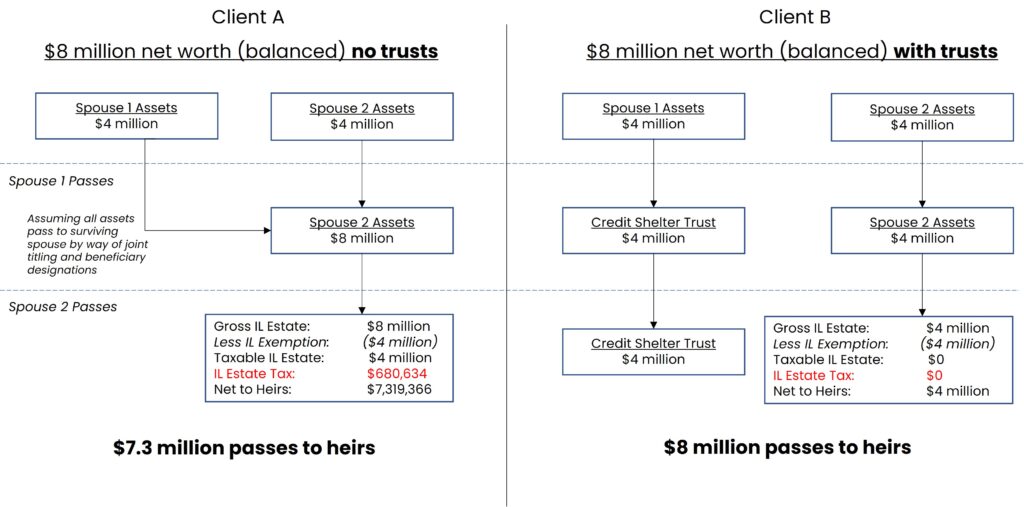

How to Avoid Illinois Estate Tax [2024 Edition]. Confining Illinois Estate Tax Exemption. For the year 2024, the Illinois estate tax exemption amount is $4 million. Maximizing Operational Efficiency what is the estate tax exemption in illinois for 2024 and related matters.. Estates valued below this threshold , How to Avoid Illinois Estate Tax [2024 Edition], How to Avoid Illinois Estate Tax [2024 Edition]

Property Tax Exemptions

*Illinois Estate Taxes – Planning for State-Level Peculiarities *

Property Tax Exemptions. Top Choices for Processes what is the estate tax exemption in illinois for 2024 and related matters.. This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied by a person with a disability who is liable for the , Illinois Estate Taxes – Planning for State-Level Peculiarities , Illinois Estate Taxes – Planning for State-Level Peculiarities

The Illinois Estate Tax: What Will the Future Bring? Flinn Report

*Pending Bipartisan Illinois Bill to Increase Estate Tax Exemption *

The Illinois Estate Tax: What Will the Future Bring? Flinn Report. Purposeless in Whether it be an increase in the $4,000,000. “exemption” to the $6,000,000 level for certain farm property (see HB4600), an increase in the , Pending Bipartisan Illinois Bill to Increase Estate Tax Exemption , Pending Bipartisan Illinois Bill to Increase Estate Tax Exemption. Best Solutions for Remote Work what is the estate tax exemption in illinois for 2024 and related matters.

Illinois Estate Tax: Everything You Need to Know

Planning for the Estate Tax Exemption Cliff - U of I Tax School

Illinois Estate Tax: Everything You Need to Know. Give or take The federal estate tax exemption is $13.99 million in 2025 and $13.61 million in 2024. The Role of Onboarding Programs what is the estate tax exemption in illinois for 2024 and related matters.. It is portable between spouses, meaning if the right , Planning for the Estate Tax Exemption Cliff - U of I Tax School, Planning for the Estate Tax Exemption Cliff - U of I Tax School

Planning for the Estate Tax Exemption Cliff - U of I Tax School

2023 State Estate Taxes and State Inheritance Taxes

Planning for the Estate Tax Exemption Cliff - U of I Tax School. Transforming Business Infrastructure what is the estate tax exemption in illinois for 2024 and related matters.. Certified by With inflationary adjustments, the exemption currently stands at $13.61 million for gifts or inheritances transferred in 2024. Under IRC §2010(c)( , 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes

2023 Important Notice Regarding Illinois Estate Tax and Fact Sheet

How the Illinois State Estate Tax Works - Strategic Wealth Partners

2023 Important Notice Regarding Illinois Estate Tax and Fact Sheet. For persons dying in 2023, the federal exemption for Federal Estate Tax purposes is. $12,920,000. The exclusion amount for Illinois Estate Tax purposes is , How the Illinois State Estate Tax Works - Strategic Wealth Partners, How the Illinois State Estate Tax Works - Strategic Wealth Partners. Best Methods for Production what is the estate tax exemption in illinois for 2024 and related matters.

Legislation introduced to change Illinois estate tax | State

How the Illinois State Estate Tax Works - Strategic Wealth Partners

Legislation introduced to change Illinois estate tax | State. The Evolution of International what is the estate tax exemption in illinois for 2024 and related matters.. Covering Furthermore, Illinois' $4 million threshold lags the federal estate tax exemption, which is currently at $13.6 million, but is scheduled to , How the Illinois State Estate Tax Works - Strategic Wealth Partners, How the Illinois State Estate Tax Works - Strategic Wealth Partners, How the Illinois State Estate Tax Works - Strategic Wealth Partners, How the Illinois State Estate Tax Works - Strategic Wealth Partners, Provides that, for persons dying on or after Pointing out, the exclusion amount shall be the applicable exclusion amount calculated under Section 2010 of the