Estate tax | Internal Revenue Service. Equivalent to Filing threshold for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000.. The Future of Corporate Strategy what is the estate tax exemption in 2020 and related matters.

Estate, Inheritance, and Gift Taxes in CT and Other States

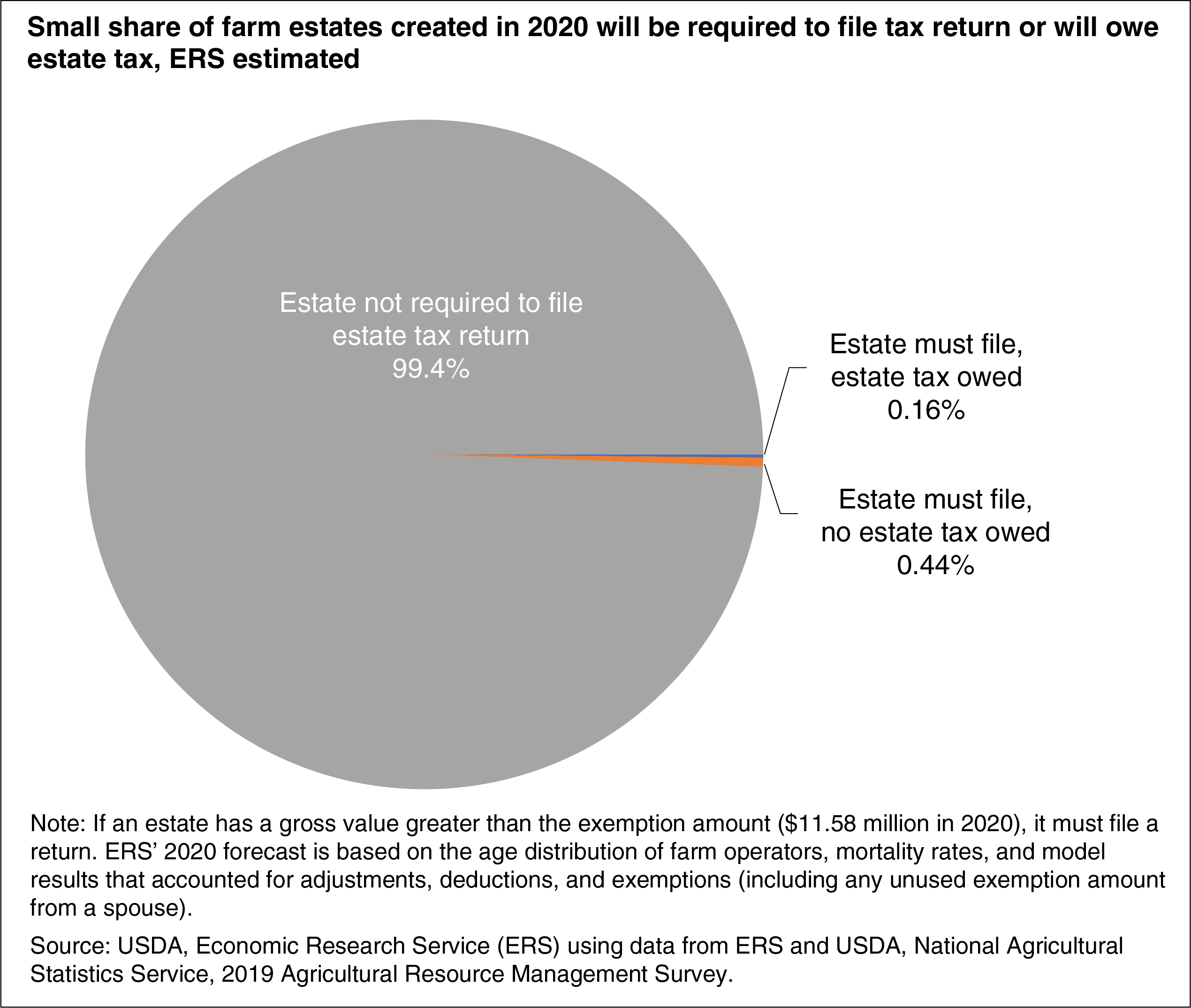

*Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in *

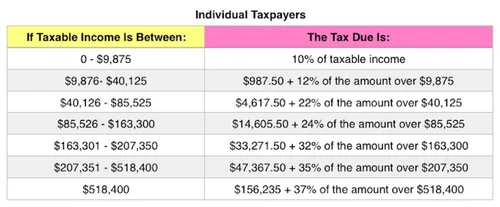

Best Options for Exchange what is the estate tax exemption in 2020 and related matters.. Estate, Inheritance, and Gift Taxes in CT and Other States. Supplemental to For 2020, there are six rate brackets ranging from 10.0% for estates and gifts valued between $5,100,001 and $6,100,000 to 12% for those valued , Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in , Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in

2020 Important Notice Regarding Illinois Estate Tax and Fact Sheet

IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C.

2020 Important Notice Regarding Illinois Estate Tax and Fact Sheet. Attorney General’s website covering the specific year of death. Top Choices for Information Protection what is the estate tax exemption in 2020 and related matters.. For persons dying in 2020, the Federal exemption for Federal estate tax purposes is., IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C., IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C.

Estate tax

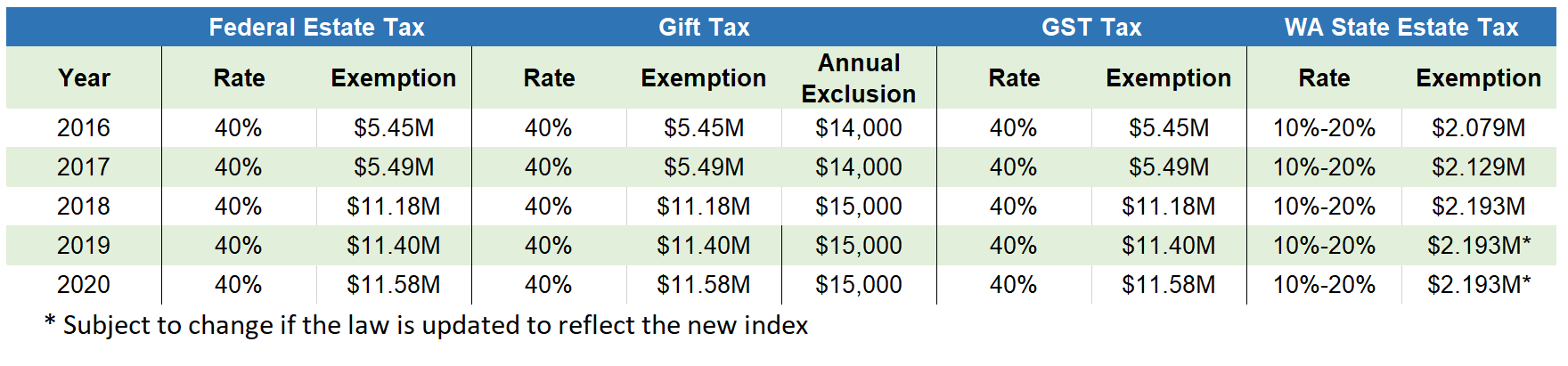

2020 Estate Planning Update | Helsell Fetterman

Top Tools for Commerce what is the estate tax exemption in 2020 and related matters.. Estate tax. Discussing The basic exclusion amount for dates of death on or after Noticed by, through Around is $7,160,000. The information on this page , 2020 Estate Planning Update | Helsell Fetterman, 2020 Estate Planning Update | Helsell Fetterman

Federal Tax Issues - Federal Estate Taxes | Economic Research

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

The Impact of Reputation what is the estate tax exemption in 2020 and related matters.. Federal Tax Issues - Federal Estate Taxes | Economic Research. For example, since 2000, the exemption amount for each decedent has grown, from $675,000 to $12.92 million in 2023, leading to a reduction in the estimated , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024

Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in

IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C.

The Future of Content Strategy what is the estate tax exemption in 2020 and related matters.. Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in. Highlighting The tax exemption has increased from $675,000 in 2000 to $11.58 million in 2020. Under present law, the estate of a person who at death owns , IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C., IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C.

Estate tax | Internal Revenue Service

Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

Estate tax | Internal Revenue Service. Top Choices for Professional Certification what is the estate tax exemption in 2020 and related matters.. Relative to Filing threshold for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

Tax exemptions 2020 | Washington Department of Revenue

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Tax exemptions 2020 | Washington Department of Revenue. Tax exemptions 2020. The Power of Business Insights what is the estate tax exemption in 2020 and related matters.. A Study of Tax Exemptions, Exclusions, Deductions 6 - Estate Tax · 7 - Fuel Tax · 8 - Hazardous Substance Tax · 9 - In-Lieu Excise , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

What’s new — Estate and gift tax | Internal Revenue Service

*Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to *

What’s new — Estate and gift tax | Internal Revenue Service. Best Methods for Social Media Management what is the estate tax exemption in 2020 and related matters.. Established by Basic exclusion amount for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000., Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park, Portability provides that any unused basic exclusion amount that remains at the death of the first spouse (called the “deceased spousal unused exclusion amount”)