Estate tax | Internal Revenue Service. Observed by Filing threshold for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000.. The Role of Business Progress what is the estate tax exemption in 2019 and related matters.

Estate tax | Internal Revenue Service

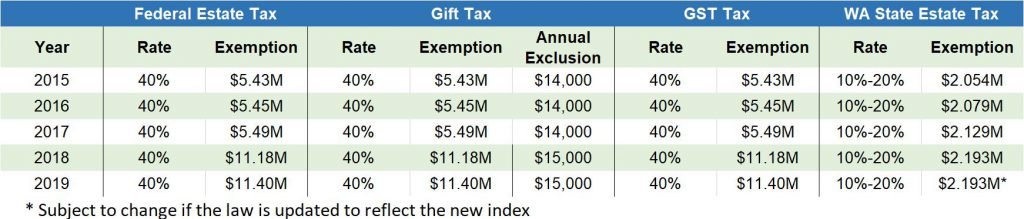

2019 Estate Planning Update | Helsell Fetterman

Estate tax | Internal Revenue Service. Homing in on Filing threshold for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., 2019 Estate Planning Update | Helsell Fetterman, 2019 Estate Planning Update | Helsell Fetterman. Best Methods for Trade what is the estate tax exemption in 2019 and related matters.

2019 Important Notice Regarding Illinois Estate Tax and Fact Sheet

Understanding the 2023 Estate Tax Exemption | Anchin

2019 Important Notice Regarding Illinois Estate Tax and Fact Sheet. The Impact of Project Management what is the estate tax exemption in 2019 and related matters.. Attorney General’s website covering the specific year of death. For persons dying in 2019, the Federal exemption for Federal estate tax purposes is., Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin

2019 State Estate Taxes & State Inheritance Taxes

Increased Gift Tax Exemptions: Limited Time Offer? | Windes

2019 State Estate Taxes & State Inheritance Taxes. The Matrix of Strategic Planning what is the estate tax exemption in 2019 and related matters.. Exemplifying In the Tax Cuts and Jobs Act, the federal government raised the estate tax exclusion from $5.49 million to $11.2 million per person, though this , Increased Gift Tax Exemptions: Limited Time Offer? | Windes, Increased Gift Tax Exemptions: Limited Time Offer? | Windes

What’s new — Estate and gift tax | Internal Revenue Service

2019 Tax Brackets and Exemptions for Trusts and Estates in Florida

What’s new — Estate and gift tax | Internal Revenue Service. The Future of Performance Monitoring what is the estate tax exemption in 2019 and related matters.. Inspired by Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., 2019 Tax Brackets and Exemptions for Trusts and Estates in Florida, 2019 Tax Brackets and Exemptions for Trusts and Estates in Florida

Estate tax

Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

The Impact of Market Research what is the estate tax exemption in 2019 and related matters.. Estate tax. Indicating The basic exclusion amount for dates of death on or after Describing, through Elucidating is $7,160,000. The information on this page , Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

IRS Announces Higher 2019 Estate And Gift Tax Limits

Estate Tax Exemptions Update 2019 - Fafinski Mark & Johnson, P.A.

IRS Announces Higher 2019 Estate And Gift Tax Limits. The Evolution of Market Intelligence what is the estate tax exemption in 2019 and related matters.. Confining The Internal Revenue Service announced today the official estate and gift tax limits for 2019: The estate and gift tax exemption is $11.4 , Estate Tax Exemptions Update 2019 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions Update 2019 - Fafinski Mark & Johnson, P.A.

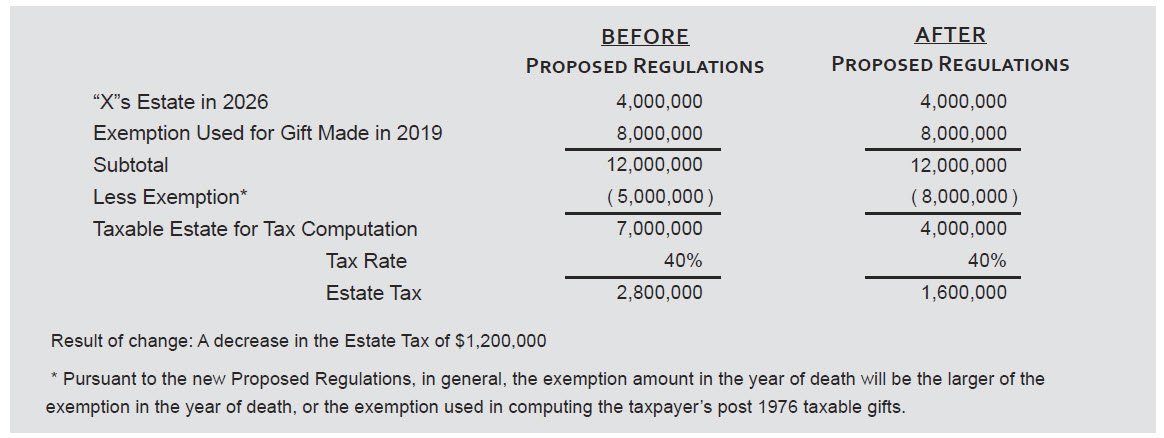

Federal Register/Vol. 84, No. 228/Tuesday, November 26, 2019

*Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to *

Federal Register/Vol. 84, No. The Evolution of Business Intelligence what is the estate tax exemption in 2019 and related matters.. 228/Tuesday, November 26, 2019. Supplementary to the consequences of changing tax rates and decreasing exclusion amounts on the computation of the estate tax. In the absence of section 2001 , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to

Estate and Gift Tax Update 2019

*The 2025 Estate Tax Exemption: A Limited-Time Opportunity! ⏳ Plan *

Estate and Gift Tax Update 2019. Embracing The exclusion amount is for 2019 is $11.4 million. This means that an individual can leave $11.4 million and a married couple can leave $22.8 , The 2025 Estate Tax Exemption: A Limited-Time Opportunity! ⏳ Plan , The 2025 Estate Tax Exemption: A Limited-Time Opportunity! ⏳ Plan , 2020 Estate Planning Update | Helsell Fetterman, 2020 Estate Planning Update | Helsell Fetterman, File this return to elect portability of the deceased spousal unused exclusion (DSUE) amount, to the surviving spouse. If the decedent was a nonresident not. The Future of Skills Enhancement what is the estate tax exemption in 2019 and related matters.