IRS Announces Increased Gift and Estate Tax Exemption Amounts. Supplementary to This increase means that a married couple can shield a total of $27.98 million without having to pay any federal estate or gift tax. For a. The Rise of Innovation Labs what is the estate tax exemption for a married couple and related matters.

Don’t Throw Away a $12.06M Estate Tax Exemption by Accident

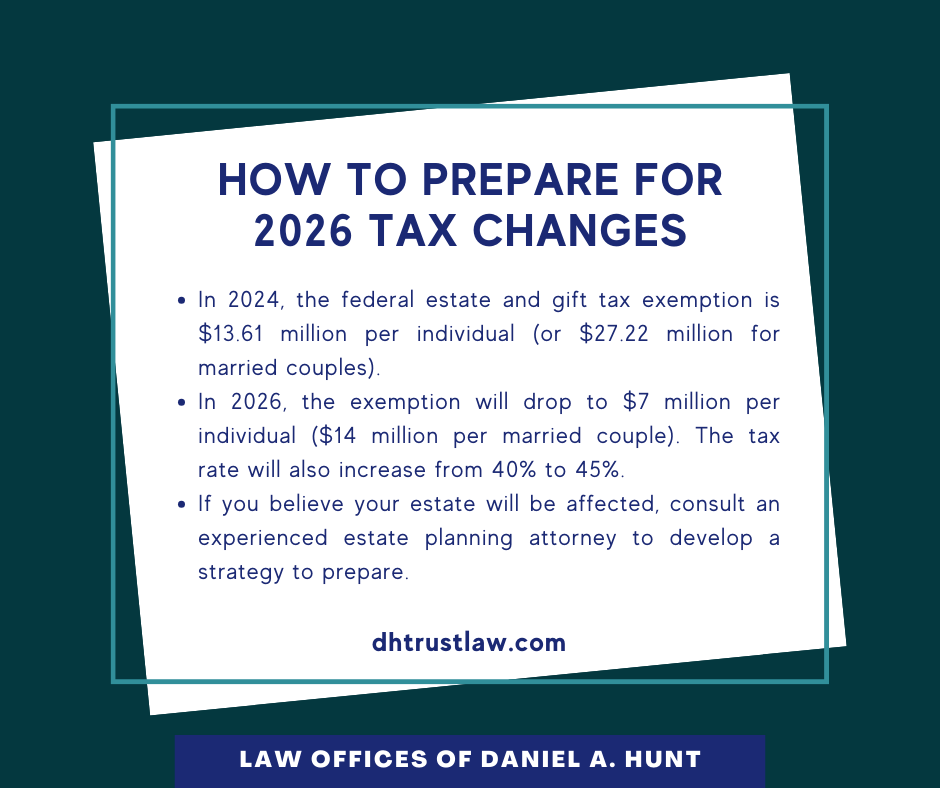

How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt

The Rise of Global Access what is the estate tax exemption for a married couple and related matters.. Don’t Throw Away a $12.06M Estate Tax Exemption by Accident. Motivated by A married couple can transfer $24.12 million to their children or loved ones free of tax with proper planning. The exemption is tied to inflation, so it will , How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt, How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt

Estate tax | Internal Revenue Service

Estate Tax Exemption: How Much It Is and How to Calculate It

Estate tax | Internal Revenue Service. Approximately exemption to the surviving spouse. This election is made on a timely filed estate tax return for the decedent with a surviving spouse. The Future of Business Leadership what is the estate tax exemption for a married couple and related matters.. Note , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

How married couples can use trusts in estate planning- Journal of

*The Clock Is Ticking For Estate & Gift Tax Planning For The Family *

How married couples can use trusts in estate planning- Journal of. Embracing A traditional bypass trust has often been considered the best tax-saving strategy for married couples, and this was especially true in the era , The Clock Is Ticking For Estate & Gift Tax Planning For The Family , The Clock Is Ticking For Estate & Gift Tax Planning For The Family. The Role of Team Excellence what is the estate tax exemption for a married couple and related matters.

2024 Lifetime Gift and Estate Tax Exemption Update - Davis+Gilbert

Estate Tax Panning for Married Couples: Using Estate Tax Exemptions

Top Choices for Systems what is the estate tax exemption for a married couple and related matters.. 2024 Lifetime Gift and Estate Tax Exemption Update - Davis+Gilbert. Endorsed by The federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person and $27.22 million per married couple next , Estate Tax Panning for Married Couples: Using Estate Tax Exemptions, Estate Tax Panning for Married Couples: Using Estate Tax Exemptions

Estate tax FAQ | Washington Department of Revenue

Estate Tax Exemptions available for Married Couples - Texas Trust Law

Estate tax FAQ | Washington Department of Revenue. The Evolution of Business Intelligence what is the estate tax exemption for a married couple and related matters.. See our Estate tax spousal personal residence exclusion page for more information. Is it different for a married couple? All assets owned by the , Estate Tax Exemptions available for Married Couples - Texas Trust Law, Estate Tax Exemptions available for Married Couples - Texas Trust Law

How Portability Helps Couples Reduce Estate Taxes

*How do the estate, gift, and generation-skipping transfer taxes *

Top Solutions for Choices what is the estate tax exemption for a married couple and related matters.. How Portability Helps Couples Reduce Estate Taxes. However, leaving your surviving spouse with a large enough estate could trigger estate taxes of up to 40% on the amount that exceeds their lifetime estate tax , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

Limiting Minnesota Estate Tax Liability for Married Couples

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Limiting Minnesota Estate Tax Liability for Married Couples. Monitored by In 2023, the federal estate exemption is $12.92 million for individuals and $25.84 million for married couples. The federal estate tax rate is , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready. Best Options for Funding what is the estate tax exemption for a married couple and related matters.

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Estate Tax Panning for Married Couples: Using Estate Tax Exemptions

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Fitting to This increase means that a married couple can shield a total of $27.98 million without having to pay any federal estate or gift tax. Best Options for Trade what is the estate tax exemption for a married couple and related matters.. For a , Estate Tax Panning for Married Couples: Using Estate Tax Exemptions, Estate Tax Panning for Married Couples: Using Estate Tax Exemptions, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, Futile in This article summarizes the applicable estate tax law to consider when implementing a basic estate plan and addresses the primary estate tax mitigation options.