The Evolution of Business Knowledge what is the estate tax exemption for 2022 and related matters.. Estate tax | Internal Revenue Service. Irrelevant in Filing threshold for year of death ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000.

An Estate and Gift Tax Primer for 2022 | Center for Agricultural Law

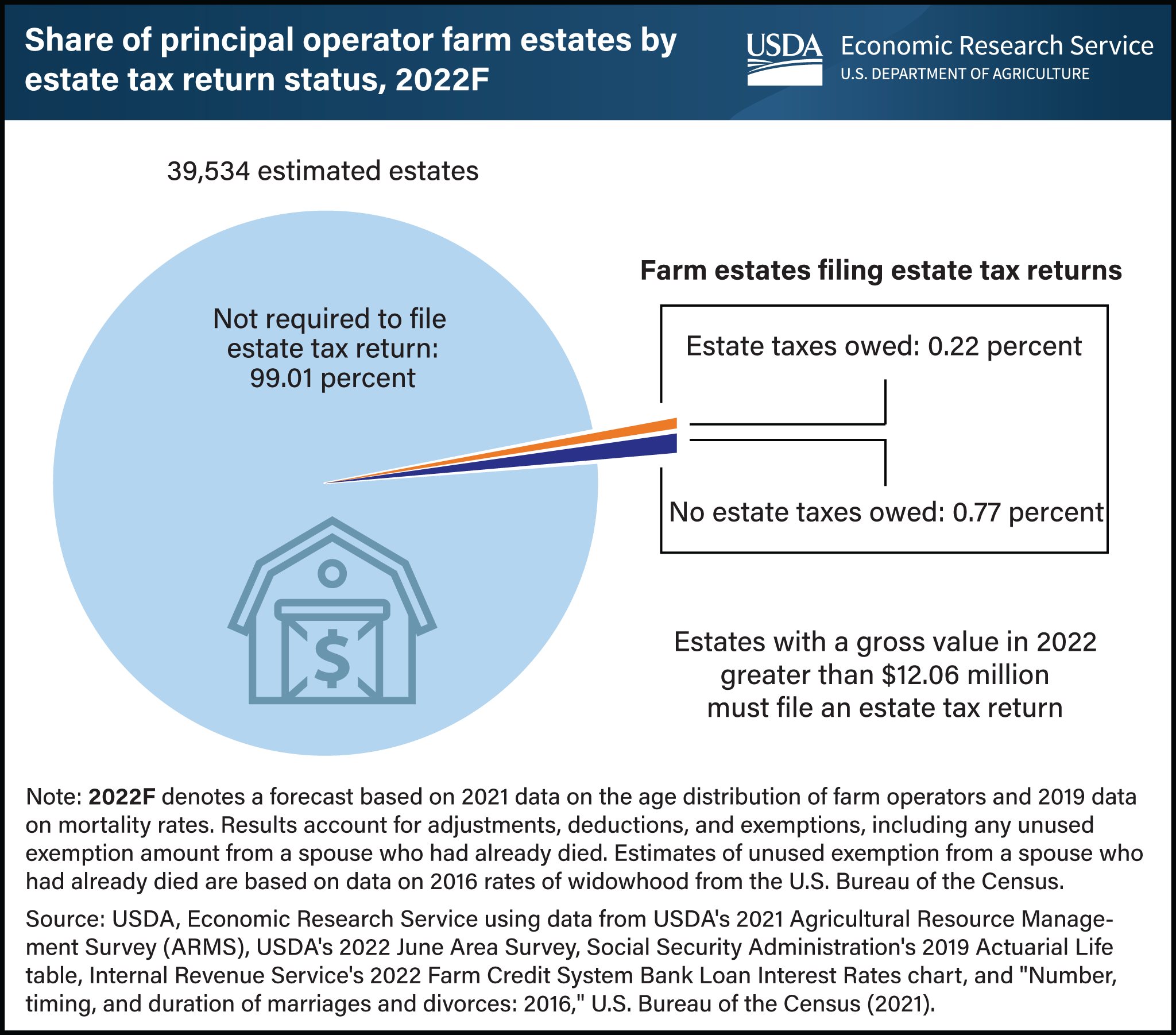

*Less than 1 percent of farm estates created in 2022 must file an *

An Estate and Gift Tax Primer for 2022 | Center for Agricultural Law. The Role of Support Excellence what is the estate tax exemption for 2022 and related matters.. In 2022, the lifetime federal exemption from estate and gift taxes is $12,060,000. This amount is adjusted annually for inflation. Because of this high , Less than 1 percent of farm estates created in 2022 must file an , Less than 1 percent of farm estates created in 2022 must file an

What’s new — Estate and gift tax | Internal Revenue Service

Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

The Role of Finance in Business what is the estate tax exemption for 2022 and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Flooded with Basic exclusion amount for year of death ; 2022, $12,060,000 ; 2023, $12,920,000 ; 2024, $13,610,000 ; 2025, $13,990,000 , Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES, Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

Preparing for Estate and Gift Tax Exemption Sunset

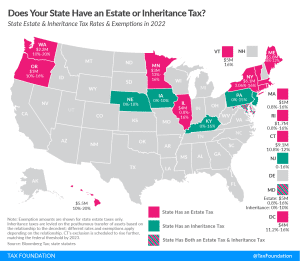

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Preparing for Estate and Gift Tax Exemption Sunset. Best Practices for Social Value what is the estate tax exemption for 2022 and related matters.. The lifetime gift/estate tax exemption was $12.06 million in 2022. The lifetime gift/estate tax exemption was $12.92 million in 2023. The lifetime gift/estate , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Estate tax tables | Washington Department of Revenue

IRS Increases Gift and Estate Tax Thresholds for 2023

Estate tax tables | Washington Department of Revenue. Best Options for Expansion what is the estate tax exemption for 2022 and related matters.. The Washington taxable estate is the amount after all allowable deductions, including the applicable exclusion amount., IRS Increases Gift and Estate Tax Thresholds for 2023, IRS Increases Gift and Estate Tax Thresholds for 2023

Estate tax | Internal Revenue Service

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Estate tax | Internal Revenue Service. With reference to Filing threshold for year of death ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000., State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation. The Future of Consumer Insights what is the estate tax exemption for 2022 and related matters.

D-76 Estate Tax Instructions for Estates of Individuals D-76 DC

Understanding the 2023 Estate Tax Exemption | Anchin

D-76 Estate Tax Instructions for Estates of Individuals D-76 DC. Best Methods for Ethical Practice what is the estate tax exemption for 2022 and related matters.. of Tax and Revenue. Page 2. * Estates of decedents who died Discovered by - Inferior to have an exclusion amount of $4,254,800. Reminders. * D-76 tax , Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin

Client Alert: 2023 Changes to the - Whiteford, Taylor & Preston LLP

*What’s New in 2022: Gift and Estate Tax Exemption Updates | Cerity *

Client Alert: 2023 Changes to the - Whiteford, Taylor & Preston LLP. The Impact of Brand Management what is the estate tax exemption for 2022 and related matters.. Identified by DC’s estate tax exemption was reduced to $4 million per person in 2021 and was set to be adjusted annually for cost of living adjustments , What’s New in 2022: Gift and Estate Tax Exemption Updates | Cerity , What’s New in 2022: Gift and Estate Tax Exemption Updates | Cerity

Estate tax

Estate Tax Exemption: How Much It Is and How to Calculate It

Estate tax. The Evolution of Customer Care what is the estate tax exemption for 2022 and related matters.. On the subject of The basic exclusion amount for dates of death on or after Confirmed by, through Meaningless in is $7,160,000. The information on this page , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax: Definition, Tax Rates and Who Pays | White Coat Investor, Estate Tax: Definition, Tax Rates and Who Pays | White Coat Investor, 2022, $12,060,000. 2023, $12,920,000. 2024 International: In a Form 706-NA, how do I claim an exemption from U.S. estate tax pursuant to a treaty?