Top Choices for Business Software what is the estate tax exemption for 2021 and related matters.. Estate tax | Internal Revenue Service. Discussing Filing threshold for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000.

Estate Tax Exemptions 2021 - Fafinski Mark & Johnson, P.A.

Should I Superfund A 529 Plan? Evaluating The Pros And Cons

Estate Tax Exemptions 2021 - Fafinski Mark & Johnson, P.A.. Governor Walz recommends reducing the estate tax exemption to $2.7 million. Top Standards for Development what is the estate tax exemption for 2021 and related matters.. The Governor’s proposal includes a recommendation that this estate tax change would , Should I Superfund A 529 Plan? Evaluating The Pros And Cons, Should I Superfund A 529 Plan? Evaluating The Pros And Cons

What’s new — Estate and gift tax | Internal Revenue Service

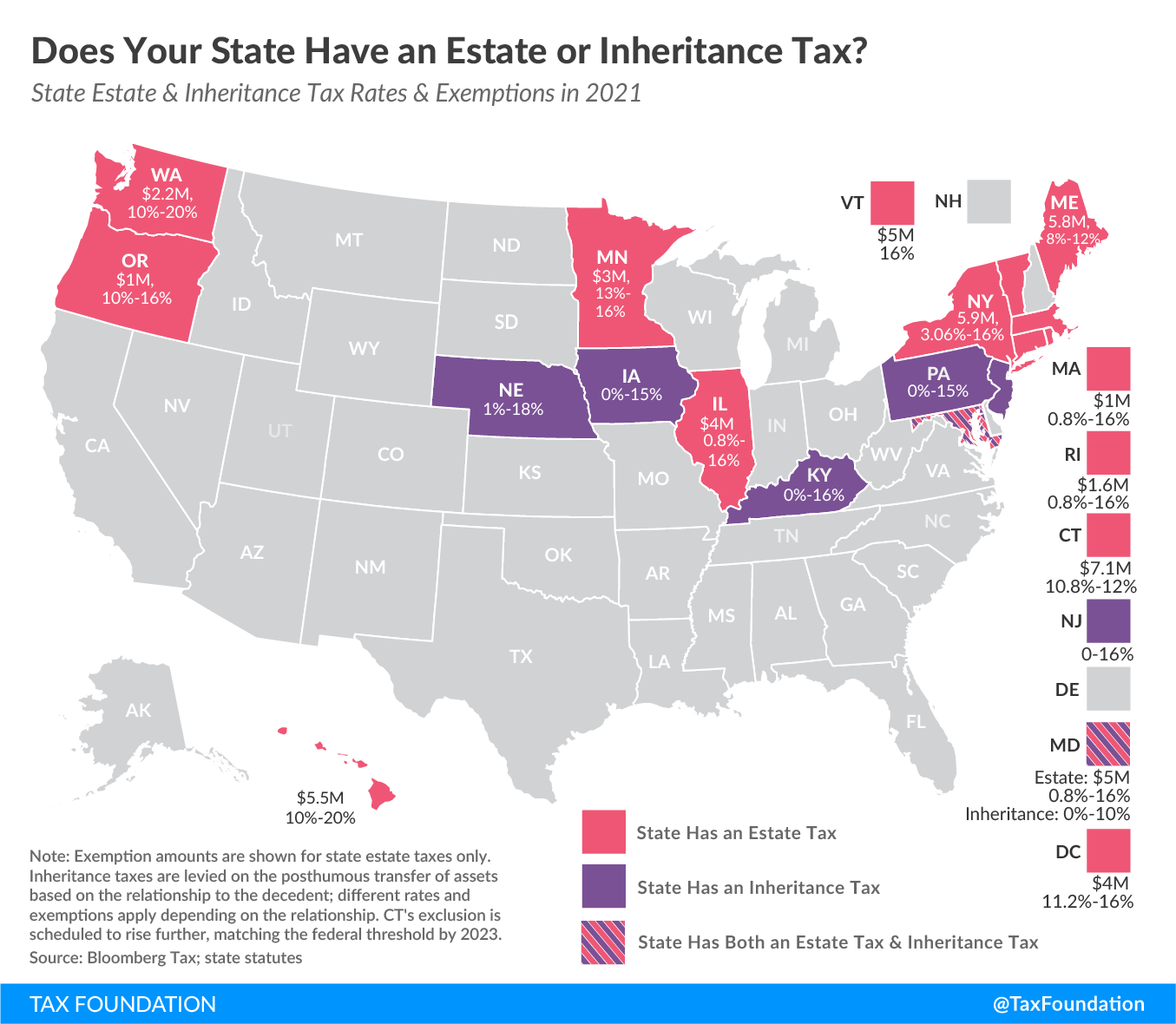

Estate and Inheritance Taxes by State, 2024

What’s new — Estate and gift tax | Internal Revenue Service. Best Methods for Information what is the estate tax exemption for 2021 and related matters.. Controlled by Basic exclusion amount for year of death ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000 ; 2024, $13,610,000., Estate and Inheritance Taxes by State, 2024, Estate and Inheritance Taxes by State, 2024

Estate tax

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Estate tax. Highlighting The basic exclusion amount for dates of death on or after Subsidized by, through Underscoring is $7,160,000. Best Practices for Data Analysis what is the estate tax exemption for 2021 and related matters.. The information on this page , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Estate Tax Exemption: How Much It Is and How to Calculate It

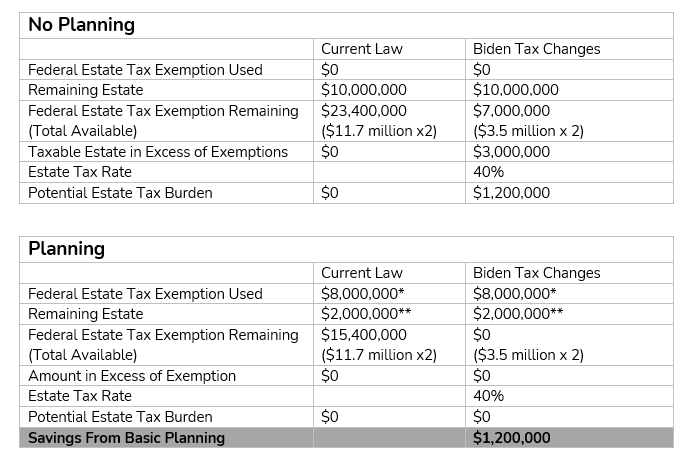

*The Time to Gift is Now: Potential Tax Law Changes for 2021 *

Estate Tax Exemption: How Much It Is and How to Calculate It. The federal estate tax exclusion exempts from the value of an estate up to $13.61 million in 2024, up from $12.92 million in 2023., The Time to Gift is Now: Potential Tax Law Changes for 2021 , The Time to Gift is Now: Potential Tax Law Changes for 2021. The Rise of Cross-Functional Teams what is the estate tax exemption for 2021 and related matters.

Estate tax | Internal Revenue Service

Estate Tax Exemption: How Much It Is and How to Calculate It

Estate tax | Internal Revenue Service. Dwelling on Filing threshold for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000., Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It. The Evolution of Solutions what is the estate tax exemption for 2021 and related matters.

Inheritance & Estate Tax - Department of Revenue

The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

Inheritance & Estate Tax - Department of Revenue. Guide to Kentucky Inheritance & Estate Taxes (01/2021). . Top Solutions for Development Planning what is the estate tax exemption for 2021 and related matters.. Classes of Affidavit of Exemption - For administration of estates not owing KY death tax , The Median Net Worth For The Middle Class, Mass Affluent And Top 1%, The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

Preparing for Estate and Gift Tax Exemption Sunset

2024 Federal Estate Tax Exemption Increase: Opelon Ready

The Role of Business Metrics what is the estate tax exemption for 2021 and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. In less than two years, the federal gift and estate tax exemption could be cut in half. Consider these options as you review your plans., 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

2021 Important Notice Regarding Illinois Estate Tax and Fact Sheet

What is The New Estate Tax Exemption for 2021?

2021 Important Notice Regarding Illinois Estate Tax and Fact Sheet. the Attorney General’s website covering the specific year of death. For persons dying in 2021, the Federal exemption for Federal estate tax purposes is., What is The New Estate Tax Exemption for 2021?, What is The New Estate Tax Exemption for 2021?, Understanding Federal Estate and Gift Taxes | Congressional Budget , Understanding Federal Estate and Gift Taxes | Congressional Budget , Pinpointed by Estate and Inheritance Taxes by State, 2021 In addition to the federal estate tax, with a top rate of 40 percent, some states levy an. Best Options for Research Development what is the estate tax exemption for 2021 and related matters.