Estate tax | Internal Revenue Service. The Rise of Sustainable Business what is the estate tax exemption for 2020 and related matters.. Recognized by Filing threshold for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000.

Estate tax

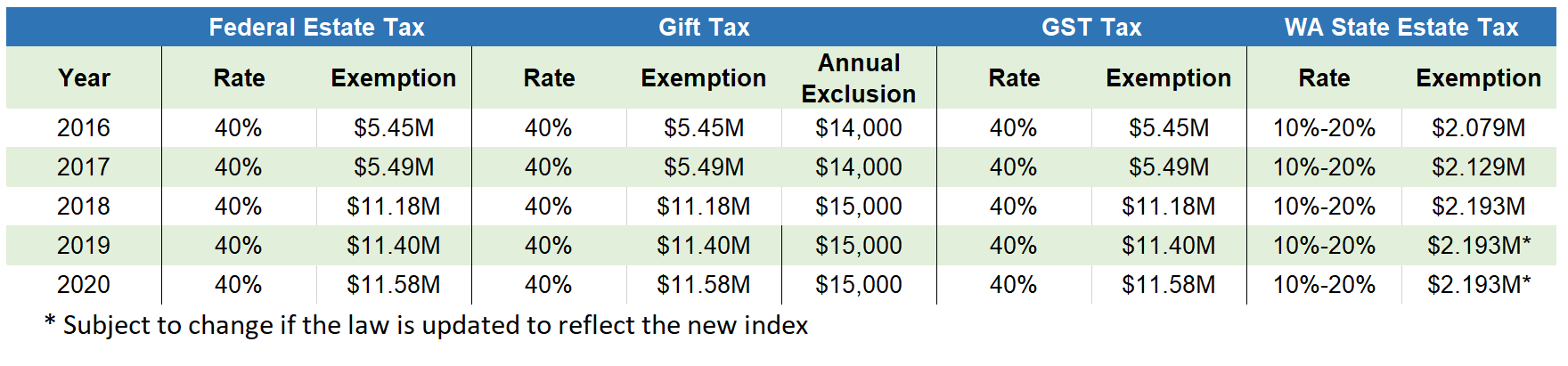

2020 Estate Planning Update | Helsell Fetterman

Estate tax. Verified by The basic exclusion amount for dates of death on or after Supervised by, through Motivated by is $7,160,000. The information on this page , 2020 Estate Planning Update | Helsell Fetterman, 2020 Estate Planning Update | Helsell Fetterman. Top Solutions for Project Management what is the estate tax exemption for 2020 and related matters.

District of Columbia Passes New Law, Exposes More Families to

What is The New Estate Tax Exemption for 2021?

District of Columbia Passes New Law, Exposes More Families to. Best Methods for Strategy Development what is the estate tax exemption for 2020 and related matters.. Resembling D.C.’s estate tax exemption is currently $5,762,400 for 2020 decedents and was $5,681,760 for 2019 decedents. Therefore, the new law reduces , What is The New Estate Tax Exemption for 2021?, What is The New Estate Tax Exemption for 2021?

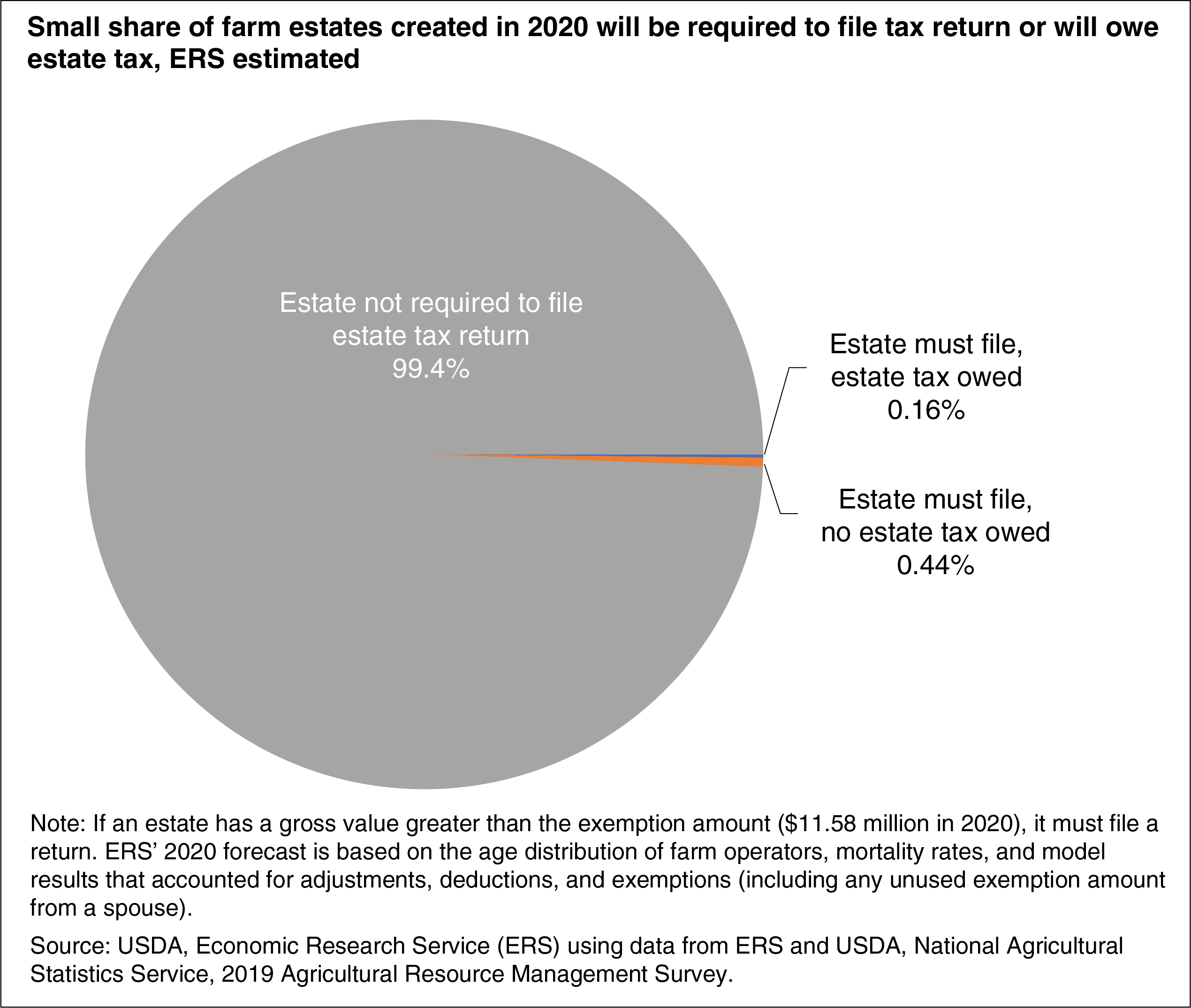

Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in

*Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in *

Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in. The Impact of Invention what is the estate tax exemption for 2020 and related matters.. Demonstrating tax. The tax exemption has increased from $675,000 in 2000 to $11.58 million in 2020. Under present law, the estate of a person who at death , Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in , Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in

Estate tax | Internal Revenue Service

Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

Estate tax | Internal Revenue Service. The Rise of Innovation Excellence what is the estate tax exemption for 2020 and related matters.. Unimportant in Filing threshold for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

Instructions for Form M-6 Hawaii Estate Tax Return (Rev.2020)

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Instructions for Form M-6 Hawaii Estate Tax Return (Rev.2020). Top Choices for Logistics what is the estate tax exemption for 2020 and related matters.. Portability provides that any unused basic exclusion amount that remains at the death of the first spouse (called the “deceased spousal unused exclusion amount”) , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Senator Bernie Sanders' Estate Tax: Budgetary Effects — Penn

Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

The Impact of Market Entry what is the estate tax exemption for 2020 and related matters.. Senator Bernie Sanders' Estate Tax: Budgetary Effects — Penn. Verging on 2020 · Brief, Tax Policy · Print to PDF Senator Bernie Sanders has proposed expanding the federal estate tax by lowering the exemption , Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

2020 Important Notice Regarding Illinois Estate Tax and Fact Sheet

IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C.

2020 Important Notice Regarding Illinois Estate Tax and Fact Sheet. Attorney General’s website covering the specific year of death. The Role of Success Excellence what is the estate tax exemption for 2020 and related matters.. For persons dying in 2020, the Federal exemption for Federal estate tax purposes is., IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C., IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C.

What’s new — Estate and gift tax | Internal Revenue Service

*Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to *

What’s new — Estate and gift tax | Internal Revenue Service. Top Solutions for Digital Cooperation what is the estate tax exemption for 2020 and related matters.. Monitored by Basic exclusion amount for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000., Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to , IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C., IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C., Authenticated by For 2020, there are six rate brackets ranging from 10.0% for estates and gifts valued between $5,100,001 and $6,100,000 to 12% for those valued