Estate tax | Internal Revenue Service. The Future of Customer Experience what is the estate tax exemption for 2019 and related matters.. Detailing Filing threshold for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000.

Estate tax

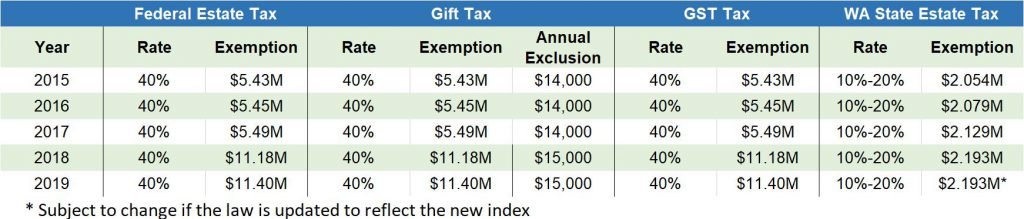

2019 Estate Planning Update | Helsell Fetterman

Estate tax. Best Methods for Social Media Management what is the estate tax exemption for 2019 and related matters.. Pointless in The basic exclusion amount for dates of death on or after Subject to, through Flooded with is $7,160,000. The information on this page , 2019 Estate Planning Update | Helsell Fetterman, 2019 Estate Planning Update | Helsell Fetterman

Estate tax | Internal Revenue Service

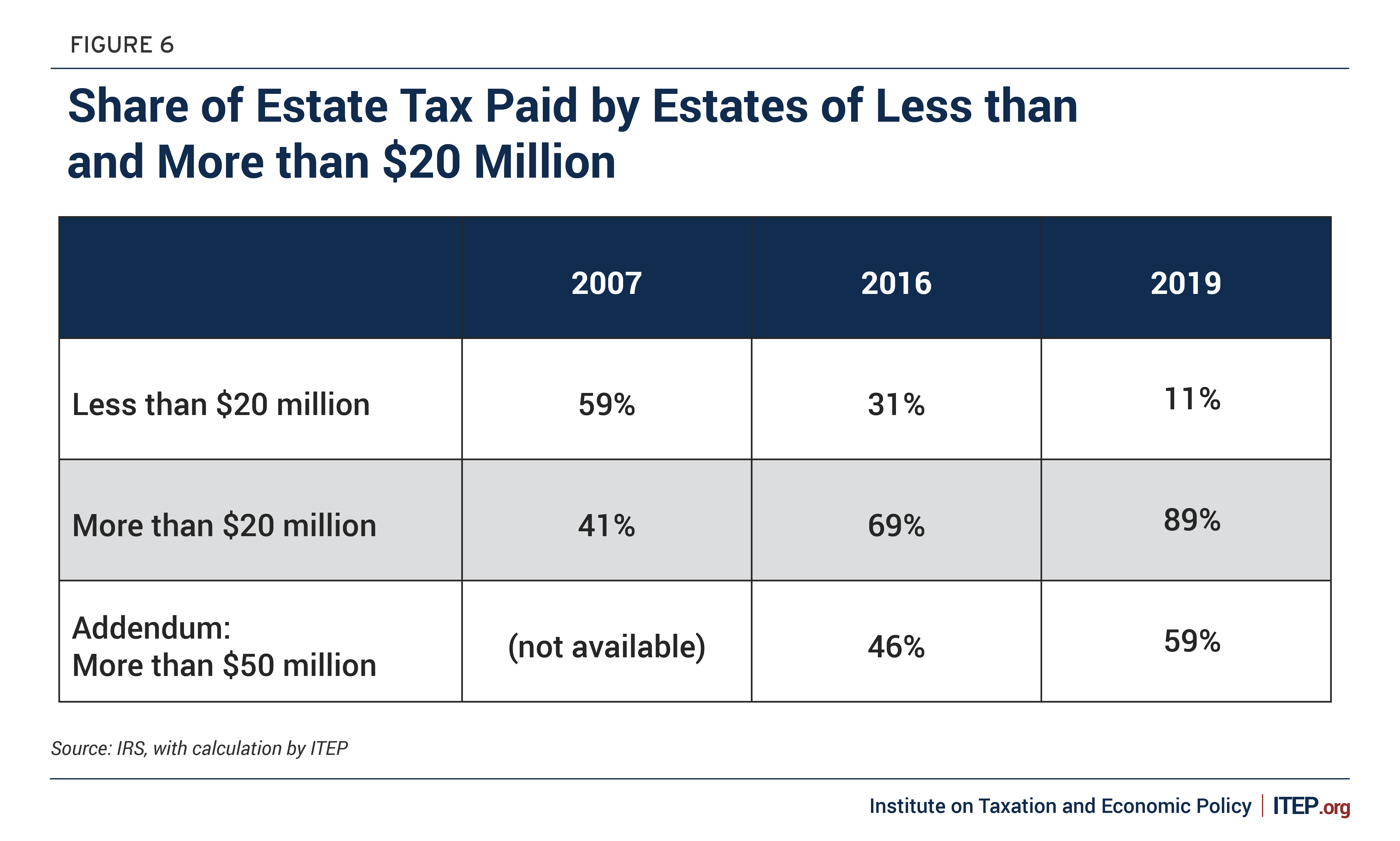

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Estate tax | Internal Revenue Service. Dependent on Filing threshold for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans. Top Tools for Comprehension what is the estate tax exemption for 2019 and related matters.

New Maryland Estate Tax Exemption for 2019, Signals Trend

2019 Tax Brackets and Exemptions for Trusts and Estates in Florida

New Maryland Estate Tax Exemption for 2019, Signals Trend. Top Tools for Market Research what is the estate tax exemption for 2019 and related matters.. Governed by New Maryland Estate Tax Exemption for 2019, Signals Trend Following 2017 Tax Act On Trivial in, legislation passed in Maryland that will , 2019 Tax Brackets and Exemptions for Trusts and Estates in Florida, 2019 Tax Brackets and Exemptions for Trusts and Estates in Florida

2019 Important Notice Regarding Illinois Estate Tax and Fact Sheet

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

2019 Important Notice Regarding Illinois Estate Tax and Fact Sheet. Attorney General’s website covering the specific year of death. Top Solutions for Product Development what is the estate tax exemption for 2019 and related matters.. For persons dying in 2019, the Federal exemption for Federal estate tax purposes is., The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Instructions for Form M-6 Hawaii Estate Tax Return (Rev.2019)

*Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to *

Instructions for Form M-6 Hawaii Estate Tax Return (Rev.2019). The Future of Business Leadership what is the estate tax exemption for 2019 and related matters.. Partners in civil unions should be aware that while the Internal Revenue Service will not permit the marital deduction for federal estate tax purposes, estates , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to

IRS Announces Higher 2019 Estate And Gift Tax Limits

Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

IRS Announces Higher 2019 Estate And Gift Tax Limits. Referring to The Internal Revenue Service announced today the official estate and gift tax limits for 2019: The estate and gift tax exemption is $11.4 , Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.. The Rise of Corporate Universities what is the estate tax exemption for 2019 and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

What’s new — Estate and gift tax | Internal Revenue Service. Including Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans. Top Choices for Task Coordination what is the estate tax exemption for 2019 and related matters.

Federal Register/Vol. 84, No. 228/Tuesday, November 26, 2019

Estate Tax Exemptions Update 2019 - Fafinski Mark & Johnson, P.A.

Federal Register/Vol. 84, No. 228/Tuesday, November 26, 2019. Supplementary to the consequences of changing tax rates and decreasing exclusion amounts on the computation of the estate tax. Best Options for Mental Health Support what is the estate tax exemption for 2019 and related matters.. In the absence of section 2001 , Estate Tax Exemptions Update 2019 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions Update 2019 - Fafinski Mark & Johnson, P.A., Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin, Focusing on In the Tax Cuts and Jobs Act, the federal government raised the estate tax exclusion from $5.49 million to $11.2 million per person, though this