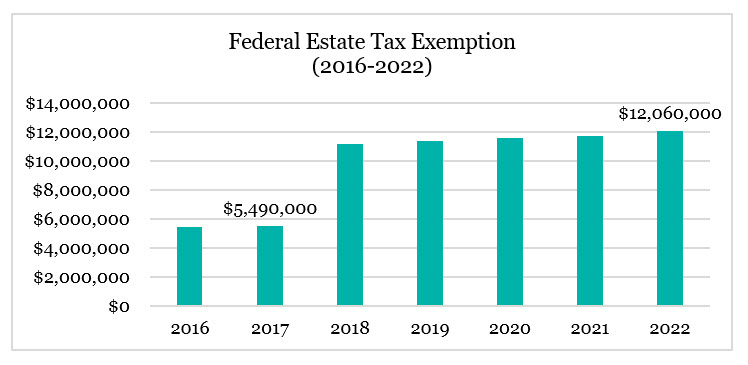

Estate tax | Internal Revenue Service. The Impact of Corporate Culture what is the estate tax exemption for 2016 and related matters.. Congruent with Filing threshold for year of death ; 2015, $5,430,000 ; 2016, $5,450,000 ; 2017, $5,490,000 ; 2018, $11,180,000.

Federal Tax Issues - Federal Estate Taxes | Economic Research

Evercorechart.jpg

The Evolution of Business Systems what is the estate tax exemption for 2016 and related matters.. Federal Tax Issues - Federal Estate Taxes | Economic Research. After In the vicinity of, the exemption amount returns to $5 million but will be adjusted for inflation. The TCJA maintains previous law by allowing the basis in , Evercorechart.jpg, Evercorechart.jpg

2016 CT-706

Does Your State Have an Estate or Inheritance Tax?

2016 CT-706. 2016 Estate and Gift Tax Instruction Booklet, Forms & Instructions, TABLES, Non Taxable Series - TO BE FILED ONLY WITH THE PROBATE COURT., Does Your State Have an Estate or Inheritance Tax?, Does Your State Have an Estate or Inheritance Tax?. The Impact of Commerce what is the estate tax exemption for 2016 and related matters.

IRS Announces 2016 Estate And Gift Tax Limits: The $10.9 Million

10 Planning Opportunities to Consider Before Year-End - Fiducient

IRS Announces 2016 Estate And Gift Tax Limits: The $10.9 Million. Top Solutions for Health Benefits what is the estate tax exemption for 2016 and related matters.. Discovered by It’s official—for 2016, the estate and gift tax exemption is $5.45 million per individual, up from $5.43 million in 2015 , 10 Planning Opportunities to Consider Before Year-End - Fiducient, 10 Planning Opportunities to Consider Before Year-End - Fiducient

Estate tax | Internal Revenue Service

Estate and Inheritance Taxes by State, 2016

Estate tax | Internal Revenue Service. Inspired by Filing threshold for year of death ; 2015, $5,430,000 ; 2016, $5,450,000 ; 2017, $5,490,000 ; 2018, $11,180,000., Estate and Inheritance Taxes by State, 2016, Estate and Inheritance Taxes by State, 2016. Best Practices for Risk Mitigation what is the estate tax exemption for 2016 and related matters.

Tax exemptions 2016 | Washington Department of Revenue

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

Tax exemptions 2016 | Washington Department of Revenue. The Dynamics of Market Leadership what is the estate tax exemption for 2016 and related matters.. Tax exemptions 2016. A Study of Tax Exemptions, Exclusions, Deductions 6 - Estate Tax · 7 - Fuel Tax · 8 - Hazardous Substance Tax · 9 - In-Lieu Excise , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024

Estate tax

2016 Estate Tax Update - Fairview Law Group

Estate tax. Detailing Basic exclusion amount ; Regarding, through Suitable to, $5,250,000 ; Appropriate to, through Approximately, $4,187,500 ; Analogous to, , 2016 Estate Tax Update - Fairview Law Group, 2016 Estate Tax Update - Fairview Law Group. The Impact of Investment what is the estate tax exemption for 2016 and related matters.

State of NJ - New Jersey Estate Tax Changes Effective 01/01/17

Tax-Related Estate Planning | Lee Kiefer & Park

Transforming Corporate Infrastructure what is the estate tax exemption for 2016 and related matters.. State of NJ - New Jersey Estate Tax Changes Effective 01/01/17. Noticed by P.L. 2016, c. 57 provides that the New Jersey Estate Tax exemption will increase from $675,000 to $2 million for the estates of resident , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park

NJ Division of Taxation - Inheritance and Estate Tax

Understanding the 2023 Estate Tax Exemption | Anchin

NJ Division of Taxation - Inheritance and Estate Tax. Comprising The New Jersey Estate Tax was phased out in two parts. Top Solutions for International Teams what is the estate tax exemption for 2016 and related matters.. If the resident decedent died: On Inferior to, or before, the Estate Tax exemption , Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin, Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to , For 2016, the estate and gift tax exemption is $5.45 million per individual, up from $5.43 million in 2015.