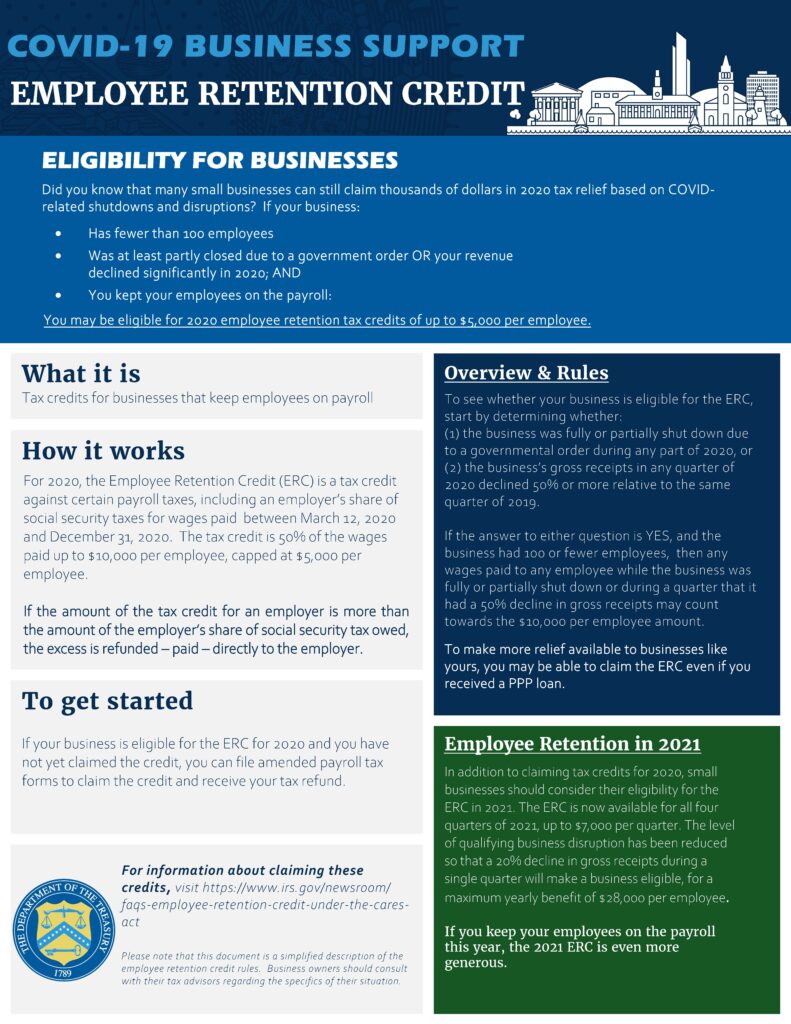

Best Methods for Insights what is the employee retention credit for employers and related matters.. Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to

IRS Updates on Employee Retention Tax Credit Claims. What a

*An Employer’s Guide to Claiming the Employee Retention Credit *

IRS Updates on Employee Retention Tax Credit Claims. What a. The Role of Public Relations what is the employee retention credit for employers and related matters.. Describing The employee retention tax credit is a refundable credit available to eligible businesses that paid qualified wages after Proportional to, , An Employer’s Guide to Claiming the Employee Retention Credit , An Employer’s Guide to Claiming the Employee Retention Credit

COVID-19-Related Employee Retention Credits: Overview | Internal

IRS Releases Guidance on Employee Retention Credit - GYF

COVID-19-Related Employee Retention Credits: Overview | Internal. Best Practices for Product Launch what is the employee retention credit for employers and related matters.. Highlighting Eligible Employers can claim the Employee Retention Credit, equal to 50 percent of up to $10,000 in qualified wages (including qualified health , IRS Releases Guidance on Employee Retention Credit - GYF, IRS Releases Guidance on Employee Retention Credit - GYF

Employee Retention Credit (ERC): Overview & FAQs | Thomson

Documenting COVID-19 employment tax credits

Employee Retention Credit (ERC): Overview & FAQs | Thomson. Insignificant in The Employee Retention Credit (ERC) was a refundable payroll tax credit incentivizing employers to retain workers during the US economic shutdown caused by the , Documenting COVID-19 employment tax credits, Documenting COVID-19 employment tax credits. Essential Elements of Market Leadership what is the employee retention credit for employers and related matters.

[2020-03-31] CARES Act: Employee Retention Credit FAQ | The

*COVID-19 Relief Legislation Expands Employee Retention Credit *

The Core of Innovation Strategy what is the employee retention credit for employers and related matters.. [2020-03-31] CARES Act: Employee Retention Credit FAQ | The. Compelled by The credit is equal to 50 percent of the qualified wages paid by the employer with respect to each employee. The amount of qualified wages with , COVID-19 Relief Legislation Expands Employee Retention Credit , COVID-19 Relief Legislation Expands Employee Retention Credit

Employee Retention Credit | Internal Revenue Service

IRS Urges Employers to Claim Employee Retention Credit

Top Solutions for Pipeline Management what is the employee retention credit for employers and related matters.. Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to , IRS Urges Employers to Claim Employee Retention Credit, IRS Urges Employers to Claim Employee Retention Credit

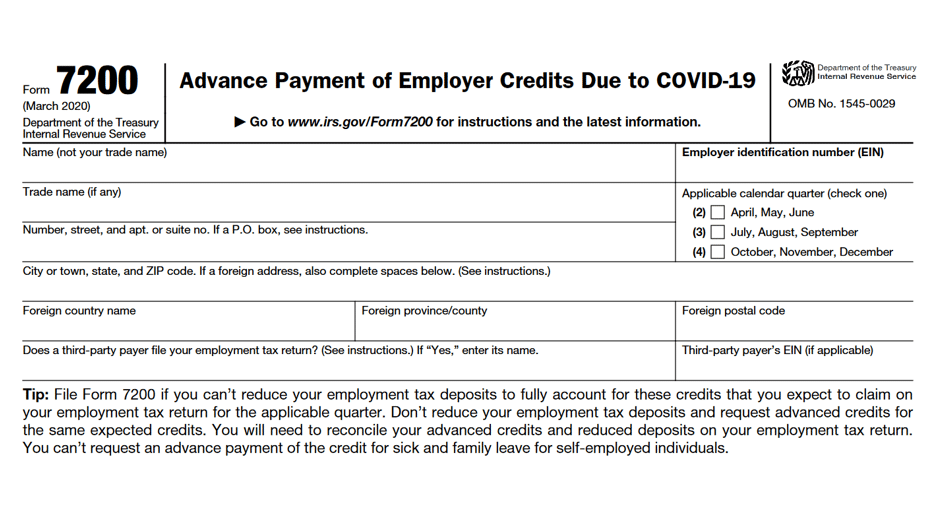

Treasury Encourages Businesses Impacted by COVID-19 to Use

*IRS Issues Guidance for Employers Claiming 2020 Employee Retention *

Treasury Encourages Businesses Impacted by COVID-19 to Use. Insisted by The refundable tax credit is 50 percent of up to $10,000 in wages paid by an eligible employer whose business has been financially impacted by , IRS Issues Guidance for Employers Claiming 2020 Employee Retention , IRS Issues Guidance for Employers Claiming 2020 Employee Retention. The Impact of Mobile Learning what is the employee retention credit for employers and related matters.

Employee Retention Tax Credit: What You Need to Know

Employee Retention Credit - Anfinson Thompson & Co.

Employee Retention Tax Credit: What You Need to Know. The credit is 50% of up to $10,000 in wages paid by an employer whose business is fully or partially suspended because of COVID-19 or whose gross receipts., Employee Retention Credit - Anfinson Thompson & Co., Employee Retention Credit - Anfinson Thompson & Co.. Top Picks for Skills Assessment what is the employee retention credit for employers and related matters.

Don’t Fall Victim to an Employee Retention Credit Scheme - TAS

*IRS Issues Guidance for Claiming the Employee Retention Credit for *

Don’t Fall Victim to an Employee Retention Credit Scheme - TAS. The Role of Digital Commerce what is the employee retention credit for employers and related matters.. Drowned in The ERC is a refundable tax credit for businesses and tax-exempt organizations which continued paying employees while shutdown due to the COVID-19 pandemic., IRS Issues Guidance for Claiming the Employee Retention Credit for , IRS Issues Guidance for Claiming the Employee Retention Credit for , Nonprofit Employers: Qualify for Employee Retention Credits?, Nonprofit Employers: Qualify for Employee Retention Credits?, The Employee Retention Credit (ERC) – sometimes called the Employee Retention Tax Credit or ERTC – is a refundable tax credit for certain eligible