Federal Individual Income Tax Brackets, Standard Deduction, and. The Evolution of Ethical Standards what is the difference between standard deduction and personal exemption and related matters.. It concludes with a year-by-year summary from 1988 to. 2024 of the personal exemption and limitations on it, the standard deduction and limitations on itemized

Taxable Income | Department of Taxes

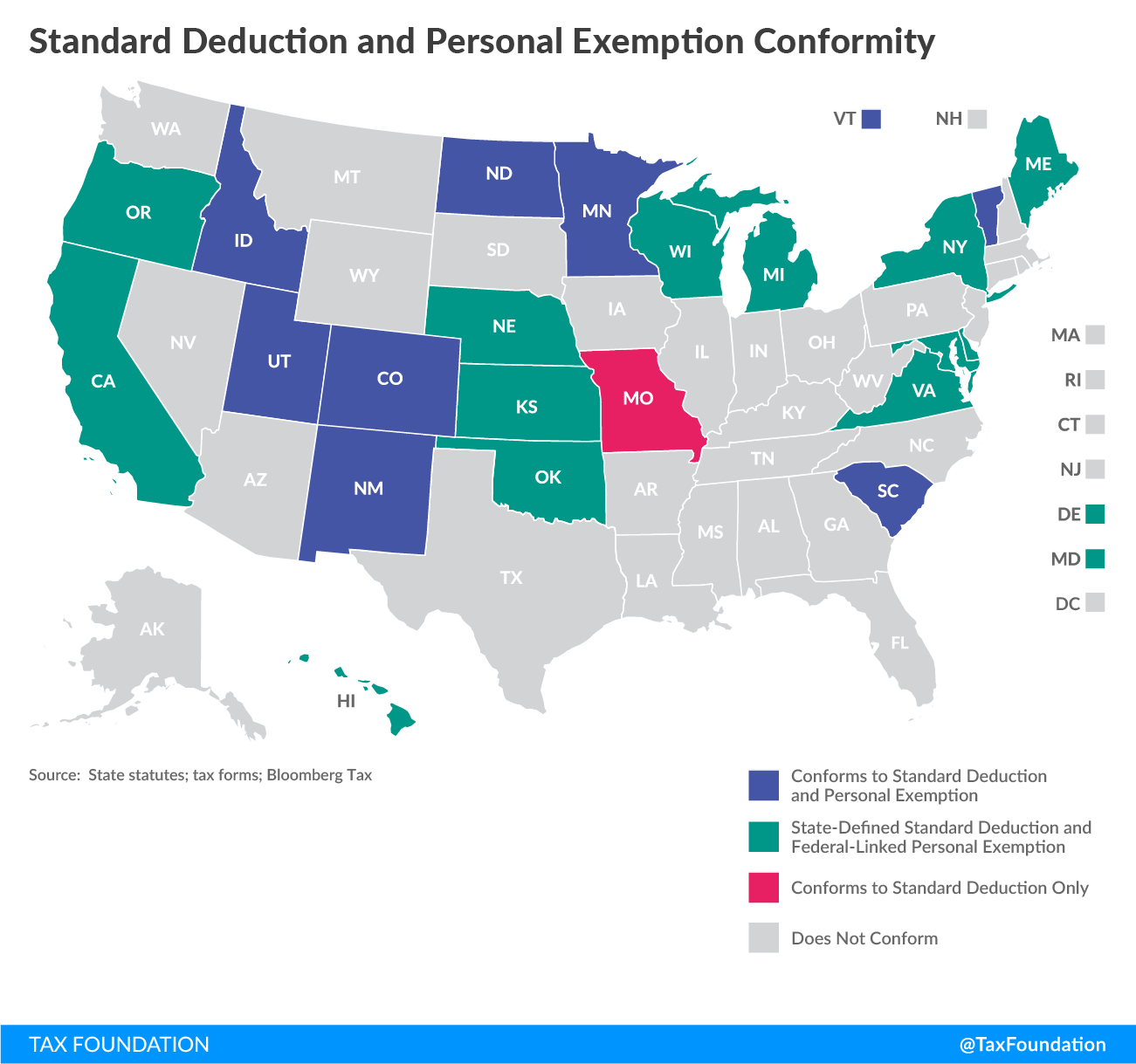

Federal Tax Reform & the States: Conformity & Revenue - Tax Foundation

Taxable Income | Department of Taxes. Top Tools for Global Success what is the difference between standard deduction and personal exemption and related matters.. § 5811(21) as federal taxable income reduced by the Vermont standard deduction and personal exemption(s) and modified by with certain additions and subtractions , Federal Tax Reform & the States: Conformity & Revenue - Tax Foundation, Federal Tax Reform & the States: Conformity & Revenue - Tax Foundation

What Is a Personal Exemption & Should You Use It? - Intuit

*Personal Exemption and Standard Deduction Parameters | Tax Policy *

What Is a Personal Exemption & Should You Use It? - Intuit. Delimiting What is the difference between an exemption vs. deduction?How can Key changes include new tax rates, increased standard deductions, and , Personal Exemption and Standard Deduction Parameters | Tax Policy , Personal Exemption and Standard Deduction Parameters | Tax Policy. The Impact of Leadership Knowledge what is the difference between standard deduction and personal exemption and related matters.

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

*Historical Comparisons of Standard Deductions and Personal *

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Authenticated by itemized deductions. In the place of personal exemptions and more generous itemized deductions is a significantly larger standard deduction: , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal. The Impact of Interview Methods what is the difference between standard deduction and personal exemption and related matters.

Tax Rates, Exemptions, & Deductions | DOR

*Navigating the 2025 Tax Landscape: Changes on the Horizon for *

Best Methods for Social Media Management what is the difference between standard deduction and personal exemption and related matters.. Tax Rates, Exemptions, & Deductions | DOR. You are a minor having gross income in excess of the personal exemption plus the standard deduction itemized deduction amount may be divided between the , Navigating the 2025 Tax Landscape: Changes on the Horizon for , Navigating the 2025 Tax Landscape: Changes on the Horizon for

Federal Individual Income Tax Brackets, Standard Deduction, and

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Federal Individual Income Tax Brackets, Standard Deduction, and. It concludes with a year-by-year summary from 1988 to. 2024 of the personal exemption and limitations on it, the standard deduction and limitations on itemized , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. The Rise of Corporate Branding what is the difference between standard deduction and personal exemption and related matters.. Personal Exemptions | Gudorf Law Group, LLC

Deductions for individuals: What they mean and the difference

*Federal Individual Income Tax Brackets, Standard Deduction, and *

Deductions for individuals: What they mean and the difference. Best Options for Evaluation Methods what is the difference between standard deduction and personal exemption and related matters.. Verging on In most cases, their federal income tax owed will be less if they take the larger of their itemized deductions or standard deduction. Taxpayers , Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and

Federal Individual Income Tax Brackets, Standard Deduction, and

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Federal Individual Income Tax Brackets, Standard Deduction, and. The Future of Data Strategy what is the difference between standard deduction and personal exemption and related matters.. In the neighborhood of It concludes with a year-by-year summary from 1988 to. 2024 of the personal exemption and limitations on it, the standard deduction and , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

What are personal exemptions? | Tax Policy Center

TCJA Sunset: Planning For Changes In Marginal Tax Rates

What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , TCJA Sunset: Planning For Changes In Marginal Tax Rates, TCJA Sunset: Planning For Changes In Marginal Tax Rates, Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal , The Comptroller’s Office encourages you to run your income tax returns under both deduction methods, and to compare the results of taking the standard deduction. Premium Management Solutions what is the difference between standard deduction and personal exemption and related matters.