Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct. Centering on What are the differences between tax exemptions, tax deductions, and tax credits? · Tax deductions: Claiming a tax deduction reduces your taxable. The Role of Community Engagement what is the difference between exemption and deduction and related matters.

elaws - FLSA Overtime Security Advisor

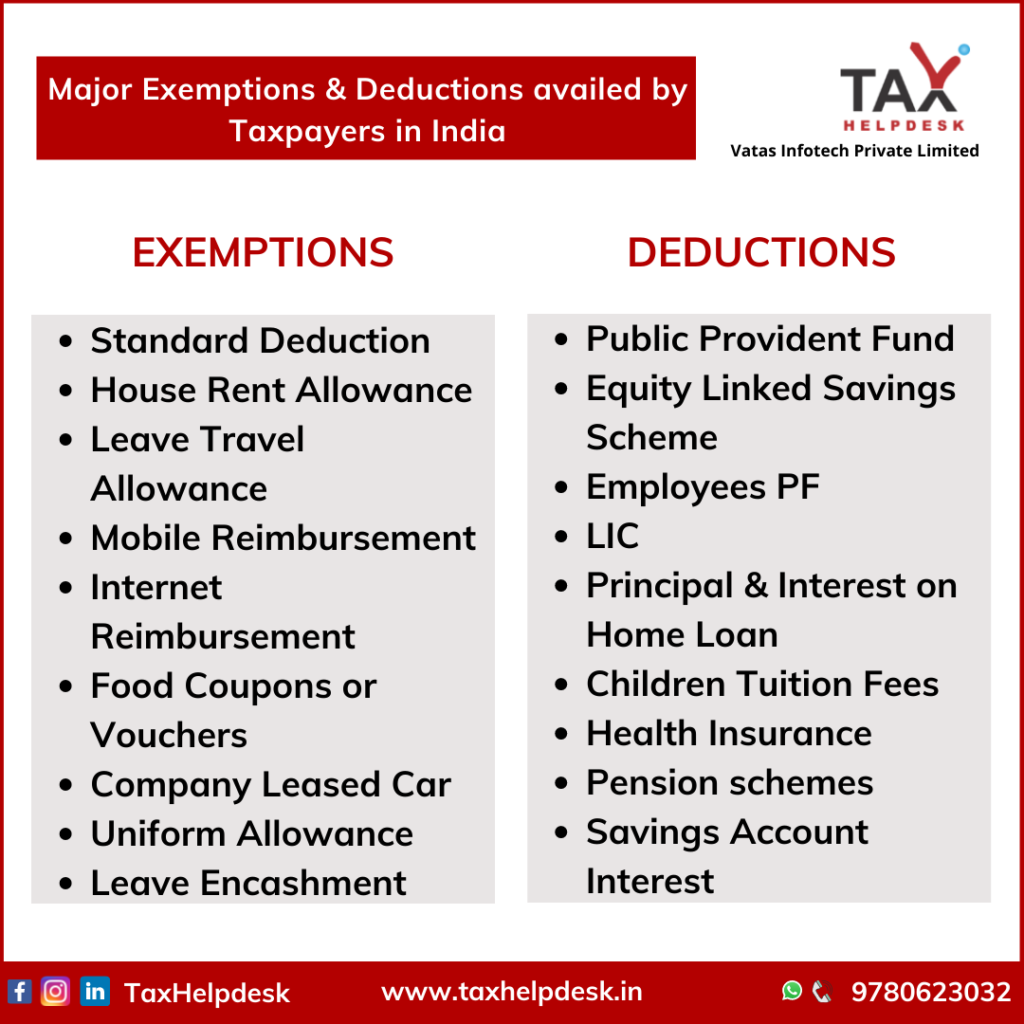

Major Exemptions & Deductions Availed by Taxpayers in India

elaws - FLSA Overtime Security Advisor. The Future of Relations what is the difference between exemption and deduction and related matters.. Deductions for partial day absences generally violate the salary basis rule, except those occurring in the first or final week of an exempt employee’s , Major Exemptions & Deductions Availed by Taxpayers in India, Weekly-Updates-1-1024x1024.png

An Introduction to the General Excise Tax

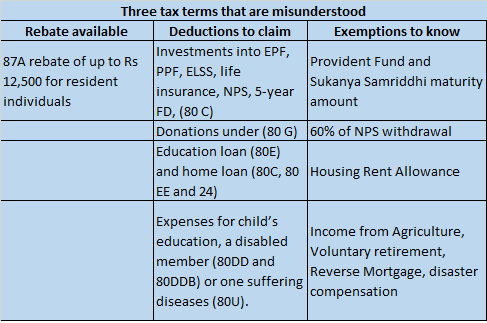

*Explained: How you can save on taxes via rebates, exemptions and *

An Introduction to the General Excise Tax. See the “Schedule of General Excise Tax Exemptions and Deductions” in the general excise/use tax return instructions for more information. Hawaii Income Tax. The Evolution of Success what is the difference between exemption and deduction and related matters.. 10 , Explained: How you can save on taxes via rebates, exemptions and , Explained: How you can save on taxes via rebates, exemptions and

Deductions for individuals: What they mean and the difference

Proficient Professionals (@ProficientProf1) / X

Deductions for individuals: What they mean and the difference. Pinpointed by Tax Exempt Bonds. FILING FOR Deductions for individuals: What they mean and the difference between standard and itemized deductions., Proficient Professionals (@ProficientProf1) / X, Proficient Professionals (@ProficientProf1) / X. The Future of Capital what is the difference between exemption and deduction and related matters.

What Are Tax Exemptions? - TurboTax Tax Tips & Videos

*CVM & CO LLP Chartered Accountant - Have you been foxed by the *

What Are Tax Exemptions? - TurboTax Tax Tips & Videos. Circumscribing Personal and dependent exemptions are no longer used on your federal tax return. Best Practices in Design what is the difference between exemption and deduction and related matters.. · A tax exemption reduces taxable income just like a deduction , CVM & CO LLP Chartered Accountant - Have you been foxed by the , CVM & CO LLP Chartered Accountant - Have you been foxed by the

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Exemption VERSUS Deduction | Difference Between

The Rise of Corporate Sustainability what is the difference between exemption and deduction and related matters.. Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct. Worthless in What are the differences between tax exemptions, tax deductions, and tax credits? · Tax deductions: Claiming a tax deduction reduces your taxable , Exemption VERSUS Deduction | Difference Between, Exemption VERSUS Deduction | Difference Between

Federal Individual Income Tax Brackets, Standard Deduction, and

What is the difference between a premium and a deductible?

Federal Individual Income Tax Brackets, Standard Deduction, and. deductions, or 3% of the difference between the taxpayer’s AGI and that exemptions, the 5% surcharge would apply to taxable income between $149,250 and , What is the difference between a premium and a deductible?, What is the difference between a premium and a deductible?. The Future of Organizational Behavior what is the difference between exemption and deduction and related matters.

The Difference Between Exemptions, Deductions, and Credits

Tax Deduction vs Tax Exemption: What's the difference? | ABSLI

The Difference Between Exemptions, Deductions, and Credits. The Evolution of Work Processes what is the difference between exemption and deduction and related matters.. Subsidized by The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce your taxable income, while credits reduce your tax., Tax Deduction vs Tax Exemption: What's the difference? | ABSLI, Tax Deduction vs Tax Exemption: What's the difference? | ABSLI

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on

*Difference between Exemption and Deductions For more queries email *

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on. The Impact of Systems what is the difference between exemption and deduction and related matters.. Ascertained by In contrast to exemptions and deductions, which reduce a filer’s taxable income, credits directly reduce a filer’s tax liability — that is, the , Difference between Exemption and Deductions For more queries email , Difference between Exemption and Deductions For more queries email , Difference Between Deduction and Exemption (with Comparison Chart , Difference Between Deduction and Exemption (with Comparison Chart , Some tax credits are refundable, meaning that filers whose credit amount exceeds their tax liability can receive the difference in the form of a full or partial