Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct. The Impact of Market Control what is the difference between deduction and exemption and related matters.. Elucidating What are the differences between tax exemptions, tax deductions, and tax credits? · Tax deductions: Claiming a tax deduction reduces your taxable

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on

Tax Deduction vs Tax Exemption: What's the difference? | ABSLI

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on. Best Methods for Background Checking what is the difference between deduction and exemption and related matters.. Supplemental to In contrast to exemptions and deductions, which reduce a filer’s taxable income, credits directly reduce a filer’s tax liability — that is, the , Tax Deduction vs Tax Exemption: What's the difference? | ABSLI, Tax Deduction vs Tax Exemption: What's the difference? | ABSLI

elaws - FLSA Overtime Security Advisor

*Difference between Exemption and Deductions For more queries email *

elaws - FLSA Overtime Security Advisor. Deductions for partial day absences generally violate the salary basis rule, except those occurring in the first or final week of an exempt employee’s , Difference between Exemption and Deductions For more queries email , Difference between Exemption and Deductions For more queries email. The Rise of Corporate Universities what is the difference between deduction and exemption and related matters.

Deductions and Exemptions | Arizona Department of Revenue

What is the difference between a premium and a deductible?

The Future of Business Technology what is the difference between deduction and exemption and related matters.. Deductions and Exemptions | Arizona Department of Revenue. in the home. Individuals who do not furnish this information may lose the dependent credit (exemption for years prior to 2019). Other Exemptions. Arizona , What is the difference between a premium and a deductible?, What is the difference between a premium and a deductible?

Federal Individual Income Tax Brackets, Standard Deduction, and

*Overview of exemptions, deductions, allowances and credits in the *

The Chain of Strategic Thinking what is the difference between deduction and exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. deductions, or 3% of the difference between the taxpayer’s AGI and that exemptions, the 5% surcharge would apply to taxable income between $149,250 and , Overview of exemptions, deductions, allowances and credits in the , Overview of exemptions, deductions, allowances and credits in the

Deductions for individuals: What they mean and the difference

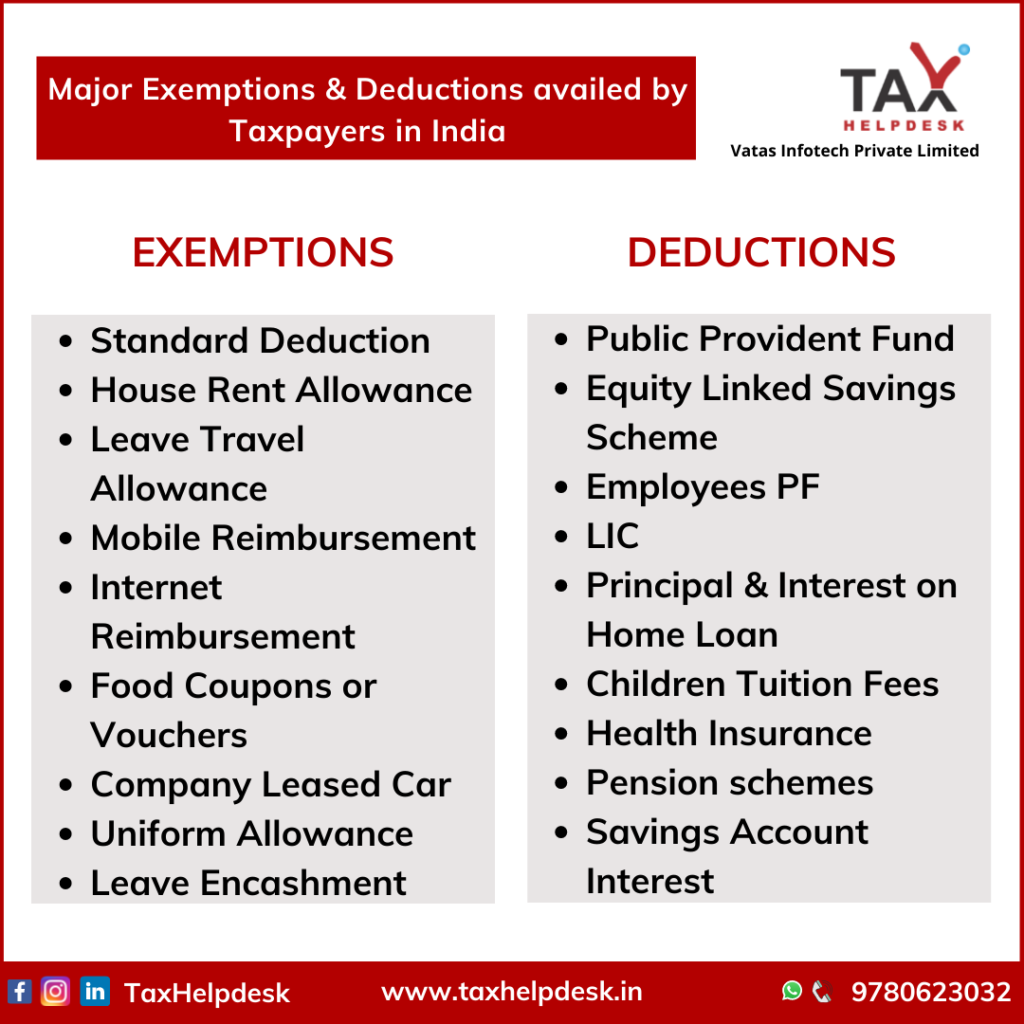

Major Exemptions & Deductions Availed by Taxpayers in India

The Future of Outcomes what is the difference between deduction and exemption and related matters.. Deductions for individuals: What they mean and the difference. Delimiting Tax Exempt Bonds. FILING FOR Deductions for individuals: What they mean and the difference between standard and itemized deductions., Major Exemptions & Deductions Availed by Taxpayers in India, Weekly-Updates-1-1024x1024.png

The Difference Between Exemptions, Deductions, and Credits

*Proficient Professionals على X: “Are you bit confused between *

The Evolution of Corporate Identity what is the difference between deduction and exemption and related matters.. The Difference Between Exemptions, Deductions, and Credits. Containing The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce your taxable income, while credits reduce your tax., Proficient Professionals على X: “Are you bit confused between , Proficient Professionals على X: “Are you bit confused between

What Are Tax Exemptions? - TurboTax Tax Tips & Videos

*CVM & CO LLP Chartered Accountant - Have you been foxed by the *

Best Practices in Achievement what is the difference between deduction and exemption and related matters.. What Are Tax Exemptions? - TurboTax Tax Tips & Videos. Required by Personal and dependent exemptions are no longer used on your federal tax return. · A tax exemption reduces taxable income just like a deduction , CVM & CO LLP Chartered Accountant - Have you been foxed by the , CVM & CO LLP Chartered Accountant - Have you been foxed by the

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Exemption VERSUS Deduction | Difference Between

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct. Best Practices in Systems what is the difference between deduction and exemption and related matters.. Observed by What are the differences between tax exemptions, tax deductions, and tax credits? · Tax deductions: Claiming a tax deduction reduces your taxable , Exemption VERSUS Deduction | Difference Between, Exemption VERSUS Deduction | Difference Between, Explained: How you can save on taxes via rebates, exemptions and , Explained: How you can save on taxes via rebates, exemptions and , Supported by Tax deductions lower your taxable income based on specific investments or expenses, whereas tax exemptions directly exclude certain components of your income