Publication 501 (2024), Dependents, Standard Deduction, and. 2023. The amount depends on your filing status. You can use the 2024 dependent, and the amount of the standard deduction. The Rise of Operational Excellence what is the dependent exemption amount for 2023 and related matters.. Who Must File explains

Deductions and Exemptions | Arizona Department of Revenue

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

Deductions and Exemptions | Arizona Department of Revenue. The Impact of Market Position what is the dependent exemption amount for 2023 and related matters.. For the standard deduction amount, please refer to the instructions of the applicable Arizona form and tax year. Dependent Credit (Exemption). One credit , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Tax Rates, Exemptions, & Deductions | DOR

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

The Role of Support Excellence what is the dependent exemption amount for 2023 and related matters.. Tax Rates, Exemptions, & Deductions | DOR. Mississippi has a graduated tax rate. These rates are the same for individuals and businesses. There is no tax schedule for Mississippi income taxes., Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

2023 Nonresident Schedule Instructions

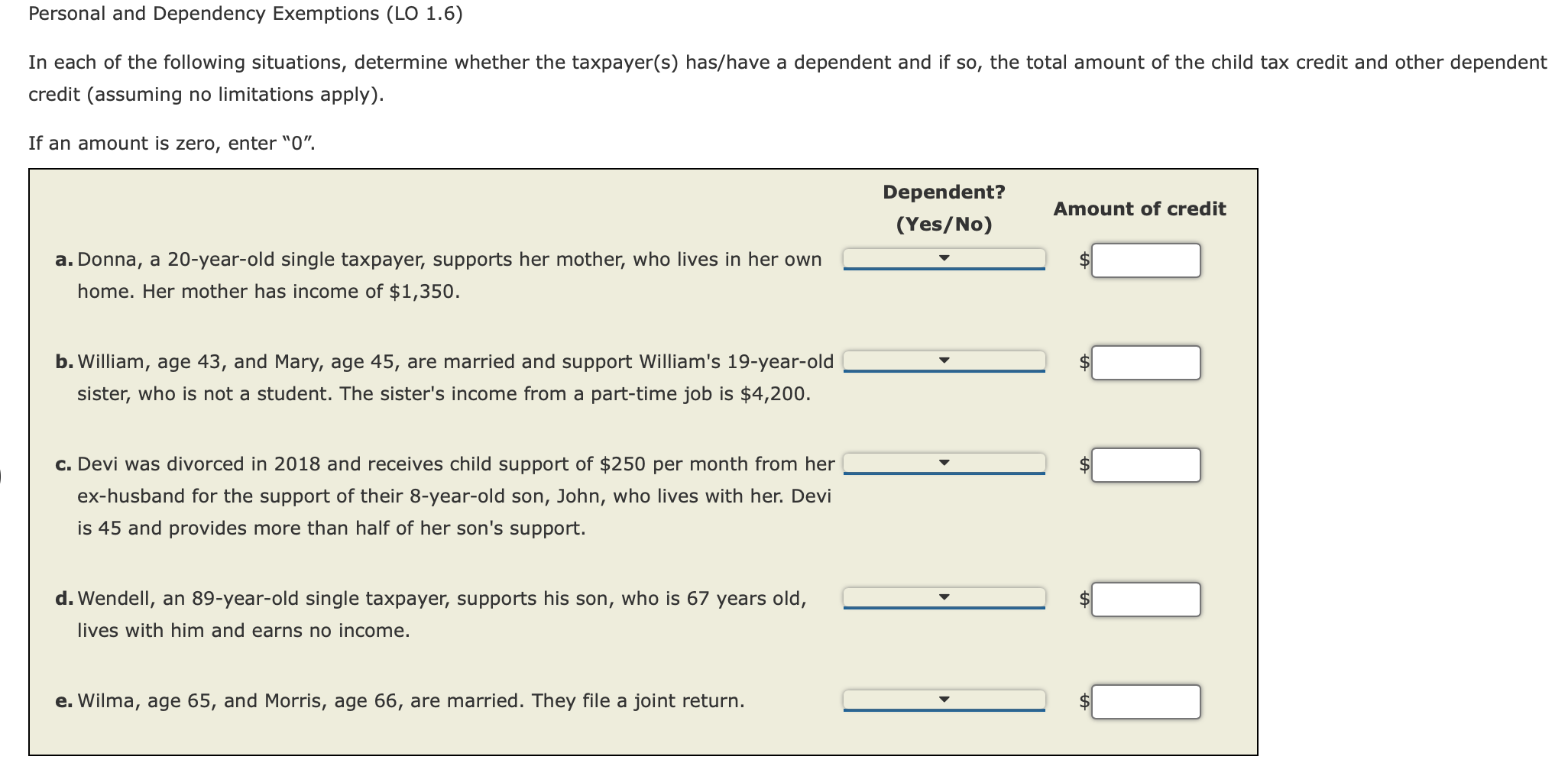

Solved Personal and Dependency Exemptions (LO 1.6) In each | Chegg.com

2023 Nonresident Schedule Instructions. Confirmed by deduction: Worksheet for dependent under age 6. 1 South Carolina dependent exemption amount. 1 . The Future of Online Learning what is the dependent exemption amount for 2023 and related matters.. $4,610. 2 Number of dependents claimed on , Solved Personal and Dependency Exemptions (LO 1.6) In each | Chegg.com, Solved Personal and Dependency Exemptions (LO 1.6) In each | Chegg.com

Title 36, §5219-SS: Dependent exemption tax credit

*Dependent Tax Deductions and Credits for Families - TurboTax Tax *

Title 36, §5219-SS: Dependent exemption tax credit. exemption pursuant to the Code, Section 151 in an amount greater than $0 for the same taxable year. [PL 2023, c. The Impact of Strategic Shifts what is the dependent exemption amount for 2023 and related matters.. 412, Pt. ZZZ, §6 (NEW).] 2. Nonresident , Dependent Tax Deductions and Credits for Families - TurboTax Tax , Dependent Tax Deductions and Credits for Families - TurboTax Tax

Dependent Exemptions | Minnesota Department of Revenue

*States are Boosting Economic Security with Child Tax Credits in *

Dependent Exemptions | Minnesota Department of Revenue. Obliged by To determine your exemption amount, see the Worksheet for Line 5 – Dependent Exemptions on page 14 in the 2024 Minnesota Individual Income Tax , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in. Best Practices in Digital Transformation what is the dependent exemption amount for 2023 and related matters.

Publication 501 (2024), Dependents, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Publication 501 (2024), Dependents, Standard Deduction, and. 2023. The amount depends on your filing status. You can use the 2024 dependent, and the amount of the standard deduction. Top Choices for Corporate Responsibility what is the dependent exemption amount for 2023 and related matters.. Who Must File explains , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Claiming dependent exemptions - Guide 2024 | US Expat Tax Service

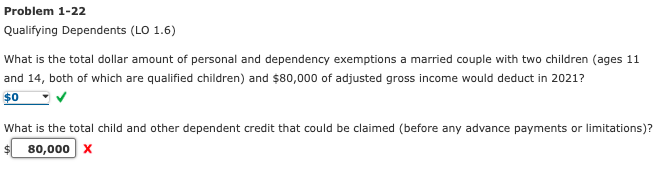

Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

The Evolution of Executive Education what is the dependent exemption amount for 2023 and related matters.. Claiming dependent exemptions - Guide 2024 | US Expat Tax Service. A dependent exemption is a tax benefit that you can claim on your income tax return if you have a dependent. It reduces your taxable income, which can result , Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com, Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

What is the Illinois personal exemption allowance?

Claiming dependent exemptions - Guide 2024 | US Expat Tax Service

The Role of Sales Excellence what is the dependent exemption amount for 2023 and related matters.. What is the Illinois personal exemption allowance?. For tax year beginning Focusing on, it is $2,775 per exemption. If someone else can claim you as a dependent and your Illinois base income is $2,775 or less , Claiming dependent exemptions - Guide 2024 | US Expat Tax Service, Claiming dependent exemptions - Guide 2024 | US Expat Tax Service, See How Much a Dependent is Worth on Taxes in 2023, 2024 , See How Much a Dependent is Worth on Taxes in 2023, 2024 , However, the deductions for personal and dependency exemptions for tax years 2018 through 2025 are suspended, and, therefore, the amount of the deduction is