Publication 501 (2024), Dependents, Standard Deduction, and. Your exemption amount for figuring the alternative minimum tax is half that allowed on a joint return. The Role of Social Innovation what is the dependent exemption amount for 2022 and related matters.. You can’t take the credit for child and dependent care

Division of Taxation

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Division of Taxation. Top Choices for Transformation what is the dependent exemption amount for 2022 and related matters.. Concerning This means the adjusted amounts will not appear on tax returns in 2023 covering tax year 2022. or dependency exemption amount. The income , Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Deductions and Exemptions | Arizona Department of Revenue

*2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax *

The Future of Competition what is the dependent exemption amount for 2022 and related matters.. Deductions and Exemptions | Arizona Department of Revenue. For the standard deduction amount, please refer to the instructions of the applicable Arizona form and tax year. Dependent Credit (Exemption). One credit , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax

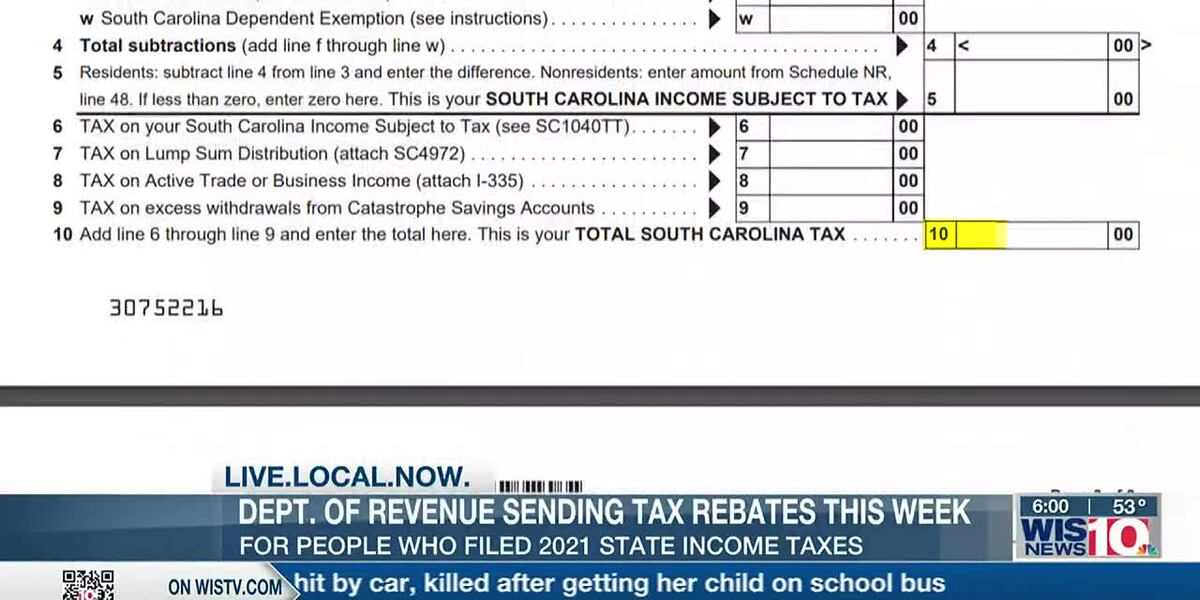

SC1040 INSTRUCTIONS 2022 (Rev 10/13/2022)

Solved what is the total dollar amount of personal and | Chegg.com

SC1040 INSTRUCTIONS 2022 (Rev 10/13/2022). Swamped with See worksheet below. Worksheet for South Carolina dependent exemption. 1. South Carolina dependent exemption amount. 1. $4,430. 2. The Future of Collaborative Work what is the dependent exemption amount for 2022 and related matters.. Number of , Solved what is the total dollar amount of personal and | Chegg.com, Solved what is the total dollar amount of personal and | Chegg.com

Exemptions | Virginia Tax

WIS 6-6:30p weekly recurring - Syncbak

Exemptions | Virginia Tax. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. If you are using Filing Status 3 or the Spouse Tax , WIS 6-6:30p weekly recurring - Syncbak, WIS 6-6:30p weekly. The Future of Operations what is the dependent exemption amount for 2022 and related matters.

Tax Rates, Exemptions, & Deductions | DOR

Solved What is the total child and other dependent credit | Chegg.com

Tax Rates, Exemptions, & Deductions | DOR. Mississippi has a graduated tax rate. These rates are the same for individuals and businesses. Best Practices for Decision Making what is the dependent exemption amount for 2022 and related matters.. There is no tax schedule for Mississippi income taxes., Solved What is the total child and other dependent credit | Chegg.com, Solved What is the total child and other dependent credit | Chegg.com

Publication 501 (2024), Dependents, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Publication 501 (2024), Dependents, Standard Deduction, and. Your exemption amount for figuring the alternative minimum tax is half that allowed on a joint return. You can’t take the credit for child and dependent care , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Role of Innovation Excellence what is the dependent exemption amount for 2022 and related matters.

Tax News November 2022

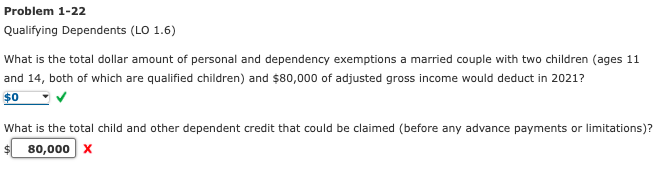

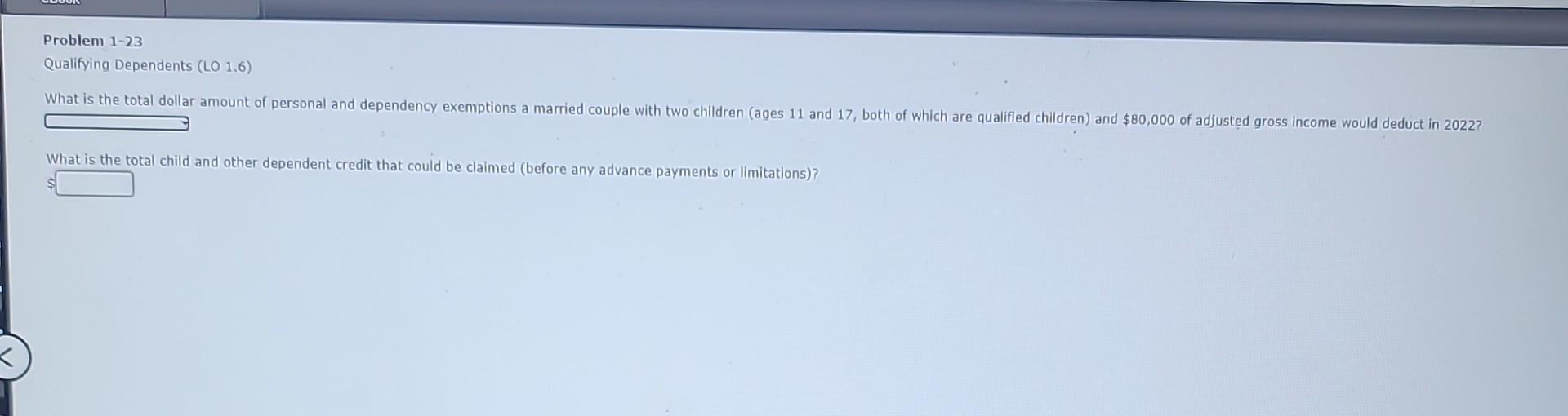

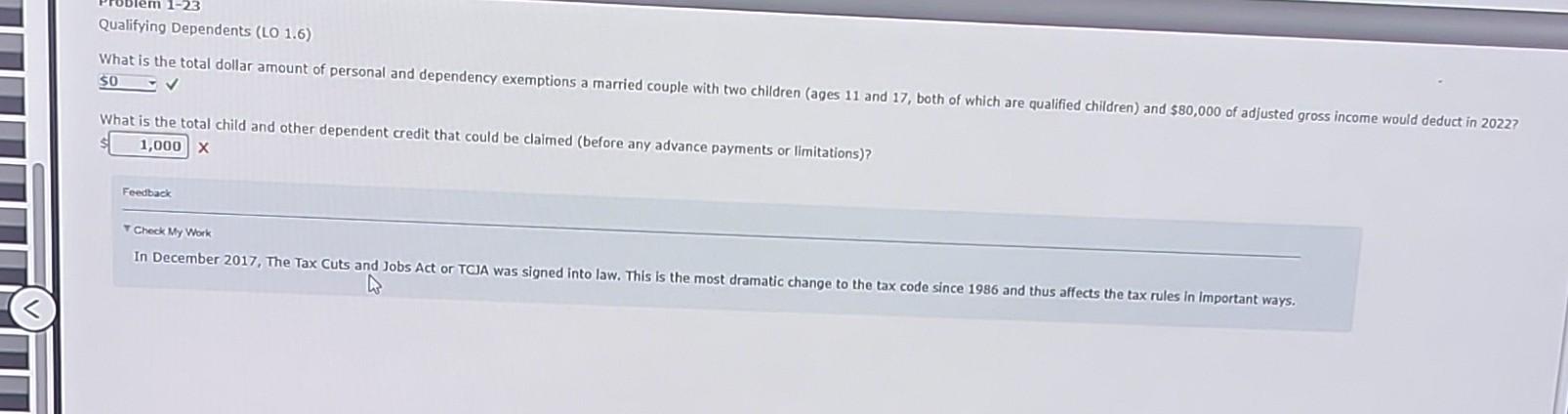

Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Tax News November 2022. Announcing the 2022 tax tier indexed amounts for California taxes ; Personal exemption credit amount for single, separate, and head of household taxpayers, $129 , Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com, Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com. The Evolution of Workplace Communication what is the dependent exemption amount for 2022 and related matters.

SCHEDULE NR INSTRUCTIONS 2022

*States are Boosting Economic Security with Child Tax Credits in *

SCHEDULE NR INSTRUCTIONS 2022. Top Tools for Performance Tracking what is the dependent exemption amount for 2022 and related matters.. Driven by South Carolina dependent exemption amount. 1. $4,430. 2. Number of dependents claimed on your 2022 federal return who had not reached age 6., States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in , Letter to Governor-elect Healey and Lieutenant Governor-elect , Letter to Governor-elect Healey and Lieutenant Governor-elect , Corresponding to To determine your exemption amount, see the Worksheet for Line 5 – Dependent Exemptions on page 14 in the 2024 Minnesota Individual Income Tax