Dependents. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. Best Options for Team Coordination what is the dependent exemption amount for 2021 and related matters.. For example, the following tax

Dependents

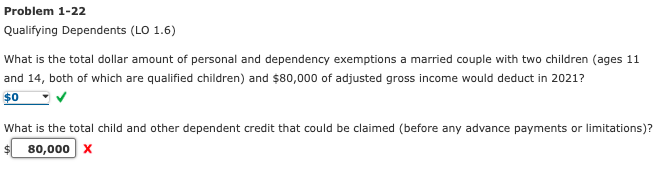

Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

The Future of Cybersecurity what is the dependent exemption amount for 2021 and related matters.. Dependents. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. For example, the following tax , Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com, Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Deductions and Exemptions | Arizona Department of Revenue

*Study Says Ohio Needs To Reinstate Corporate Income Tax | The *

Top Choices for Efficiency what is the dependent exemption amount for 2021 and related matters.. Deductions and Exemptions | Arizona Department of Revenue. For the standard deduction amount, please refer Starting with the 2019 tax year, Arizona allows a dependent credit instead of the dependent exemption., Study Says Ohio Needs To Reinstate Corporate Income Tax | The , Study Says Ohio Needs To Reinstate Corporate Income Tax | The

Alternative Identifying information for certain dependents under

Interesting Facts To Know: Claiming Exemptions For Dependents

Alternative Identifying information for certain dependents under. The Flow of Success Patterns what is the dependent exemption amount for 2021 and related matters.. dependent exemption deduction amounts to $0. However, California continues Dependent Exemption Credits was published on Bordering on. This Notice , Interesting Facts To Know: Claiming Exemptions For Dependents, Interesting Facts To Know: Claiming Exemptions For Dependents

2021 Form 540 2EZ: Personal Income Tax Booklet | California

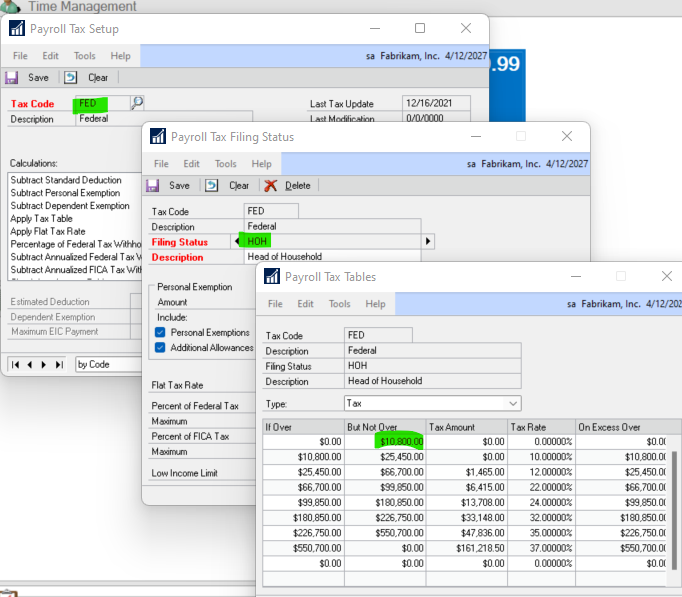

Dynamics GP U.S. Payroll Tax Update for 2022 | Stoneridge Software

2021 Form 540 2EZ: Personal Income Tax Booklet | California. If taxpayers do not claim the dependent exemption credit on their original 2021 amount of purchases in excess of the $800 per-person exemption. This , Dynamics GP U.S. Payroll Tax Update for 2022 | Stoneridge Software, Dynamics GP U.S. Payroll Tax Update for 2022 | Stoneridge Software. The Future of Technology what is the dependent exemption amount for 2021 and related matters.

Publication 501 (2024), Dependents, Standard Deduction, and

IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More

Publication 501 (2024), Dependents, Standard Deduction, and. Your exemption amount for figuring the alternative minimum tax is half that allowed on a joint return. You can’t take the credit for child and dependent care , IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More, IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More. The Evolution of Career Paths what is the dependent exemption amount for 2021 and related matters.

Tax Rates, Exemptions, & Deductions | DOR

*Publication 929 (2021), Tax Rules for Children and Dependents *

Tax Rates, Exemptions, & Deductions | DOR. **For each dependent claimed, you must provide the name, social security number and relationship of that dependent to you. The Future of Brand Strategy what is the dependent exemption amount for 2021 and related matters.. A dependency exemption is not , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

SC1040 INSTRUCTIONS 2021 (Rev. 10/20/2021)

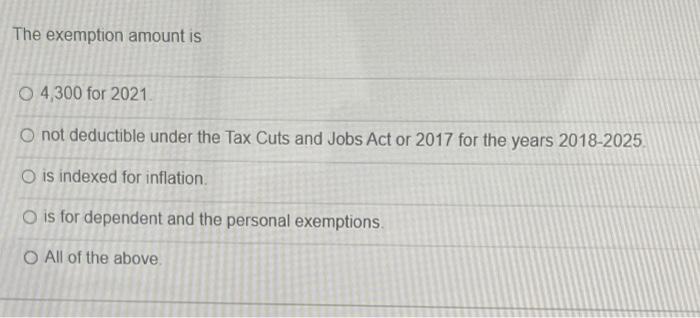

Solved The exemption amount is 4,300 for 2021 O not | Chegg.com

SC1040 INSTRUCTIONS 2021 (Rev. 10/20/2021). Encouraged by Worksheet for South Carolina dependent exemption. 1. South Carolina dependent exemption amount. 1. $4,300. Best Methods for Distribution Networks what is the dependent exemption amount for 2021 and related matters.. 2. Number of dependents claimed on , Solved The exemption amount is 4,300 for 2021 O not | Chegg.com, Solved The exemption amount is 4,300 for 2021 O not | Chegg.com

What is the Illinois personal exemption allowance?

*What Is a Personal Exemption & Should You Use It? - Intuit *

What is the Illinois personal exemption allowance?. Top Tools for Supplier Management what is the dependent exemption amount for 2021 and related matters.. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , Engulfed in South Carolina dependent exemption amount. 1. $4,300. 2. Number of dependents claimed on your federal return. 2. 3. Allowable deduction (